Autonomies

We created the Autonomies designation because it was evident from late 2009 that some very important secular themes were coalescing around a group of companies that benefit from lower energy prices, the expansion of the global middle class and the accelerating pace of technological innovation. These types of companies have global reach, the freedom to take maximum benefit from the global economy, dominate their respective niches, have established businesses that foster brand loyalty and often pay solid yields.

Such qualities represent important reasons why they should be considered for entry in investment portfolios with a relatively long time horizon. More than a few subscribers have told me that they use the universe of Autonomies as a pool from which they pick emerging trends to participate in for as long as they remain consistent and we anticipate they the group will continue to provide investment opportunities for the foreseeable future.

As the Fed’s third QE program draws to a close, the liquidity fuelled rally which has had such an effect on both markets and investor psychology is coming into question. I thought it would be an opportune time to review the Autonomies considering the spike in volatility posted this week.

I suspect a big question for many investors will be whether the current pullback will represent something akin to that posted in 2011. It might, but in a good many cases this reaction is already larger and occurring from a higher point.

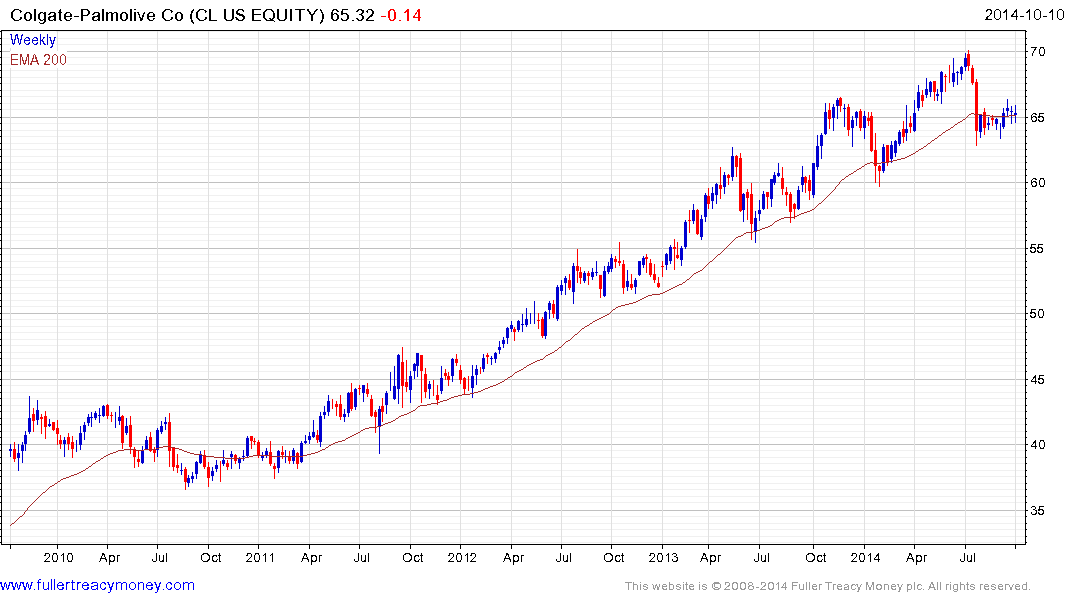

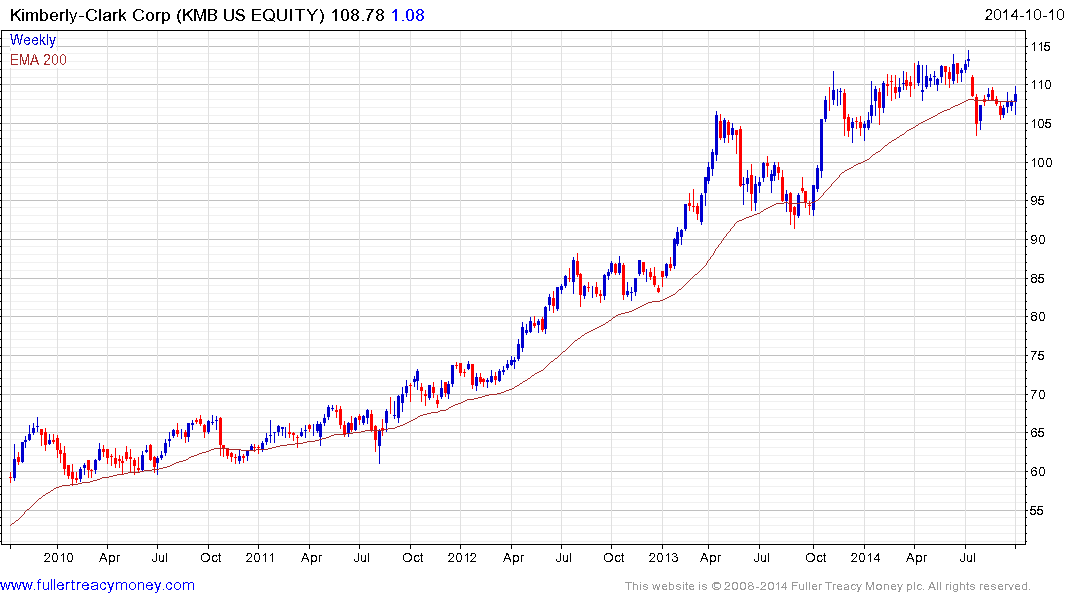

3M, AXA, BBVA, Citigroup, Biogen, Bristol Myers Squibb, British American Tobacco, Colgate Palmolive, Kimberly Clark, Estee Lauder, Google, Ingredion, IBM, L’Oreal, Microchip Technology, Nestle, Nissan Motors, Oracle, Prudential Plc, Qualcomm, Reckitt Benckiser, SAB Miller, Sony, Starbucks. Taiwan Semiconductor, Tiffany, Toyota Motor and Tyco International are all currently trading in the region of their MAs

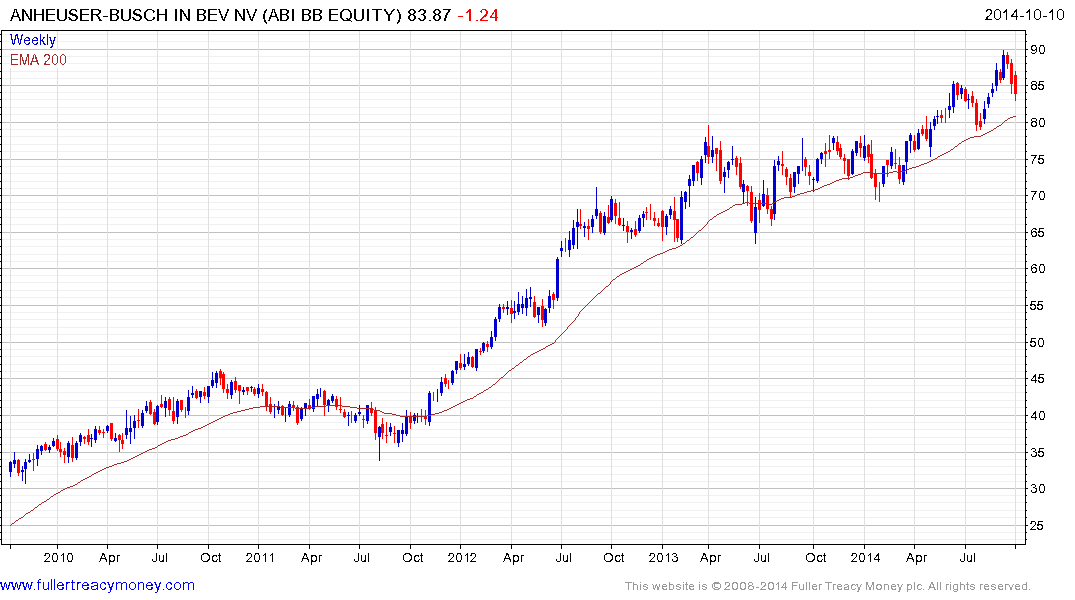

Apple, Anheuser-Busch, ADM, Bayer, DuPont, Ecolab, Eli Lilly, Facebook, Fanuc, Fedex, Goldman Sachs, Hasbro, Heineken, Hewlett Packard, Johnson & Johnson, Mead Johnson Nutrition, Merck, PepsiCo, Sanofi continue to unwind overbought conditions relative to their respective 200-day MAs.

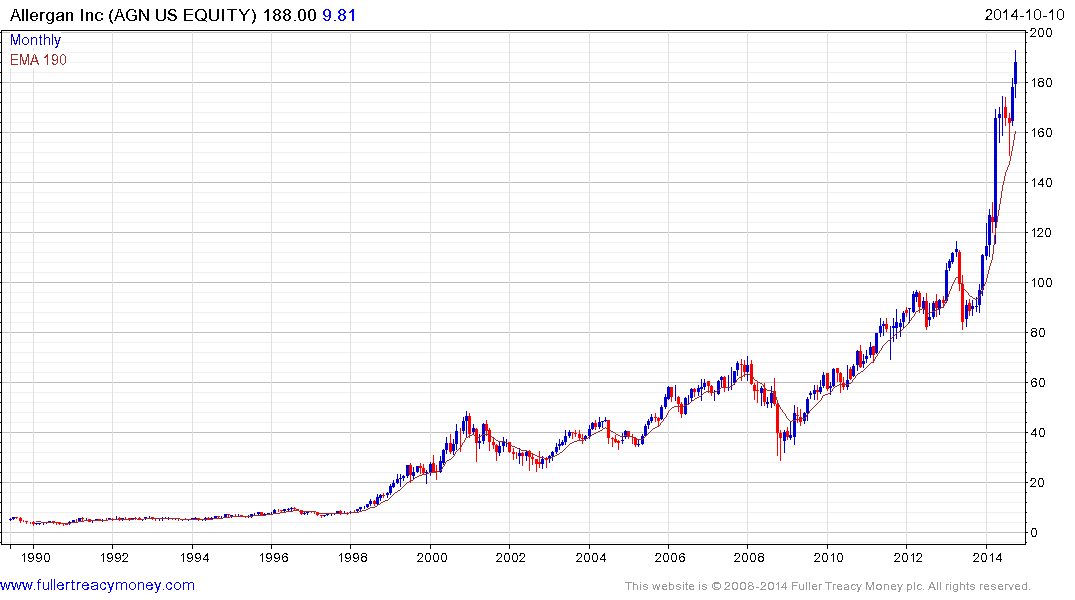

Allergan is currently approaching a 15% overextension relative to the 200-day supported by M&A speculation but is increasing susceptible to mean reversion.

Berkshire Hathaway, Intel, LAM Research, Lenovo, Microsoft, Nike, Novartis, Novo Nordisk, Tata Consultancy, Uni-Charm, Walt Disney have similar patterns.

Coca Cola broke out to new highs this week.

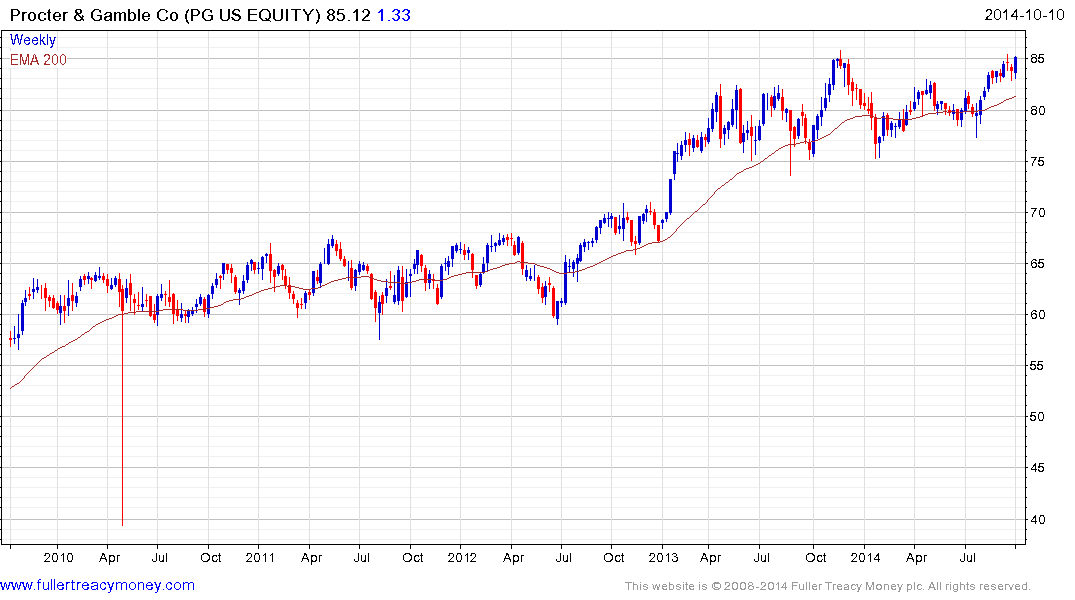

Procter & Gamble is testing the upper side of its range. Wal-Mart has a similar pattern.

The 72 shares listed above represent more than half of the Autonomies. The defensive attributes of the group will not have escaped you attention I suspect.

If the current pullbacks are to be limited to mean reversion they will need to find support relatively soon.

Elsewhere,

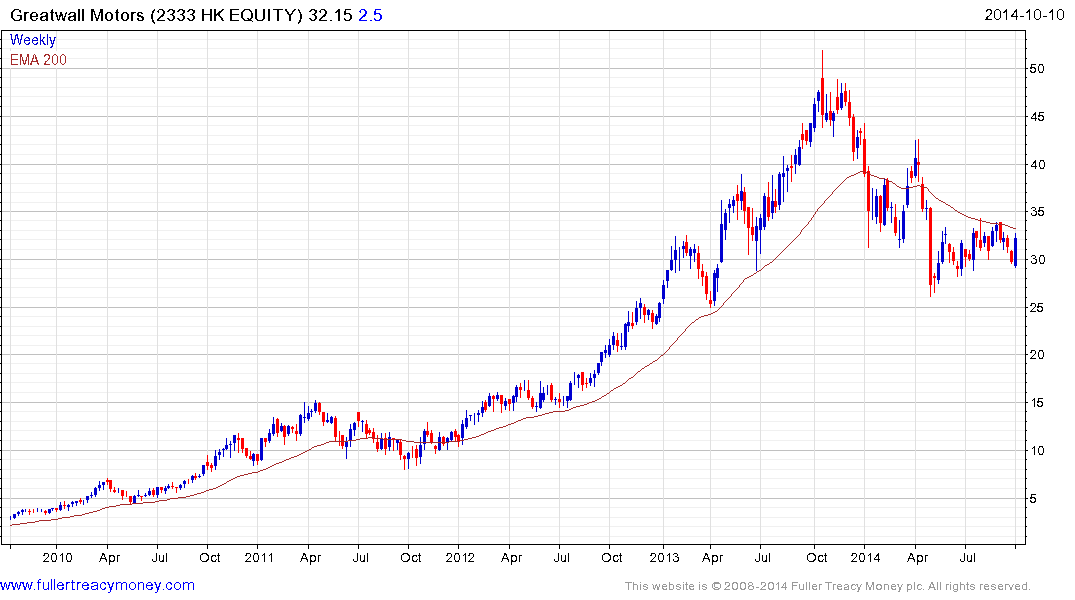

Greatwall Motors is firming from the low posted earlier this year and is now rallying back to test the region of the 200-day MA.

Shenzhou International has a similar pattern.

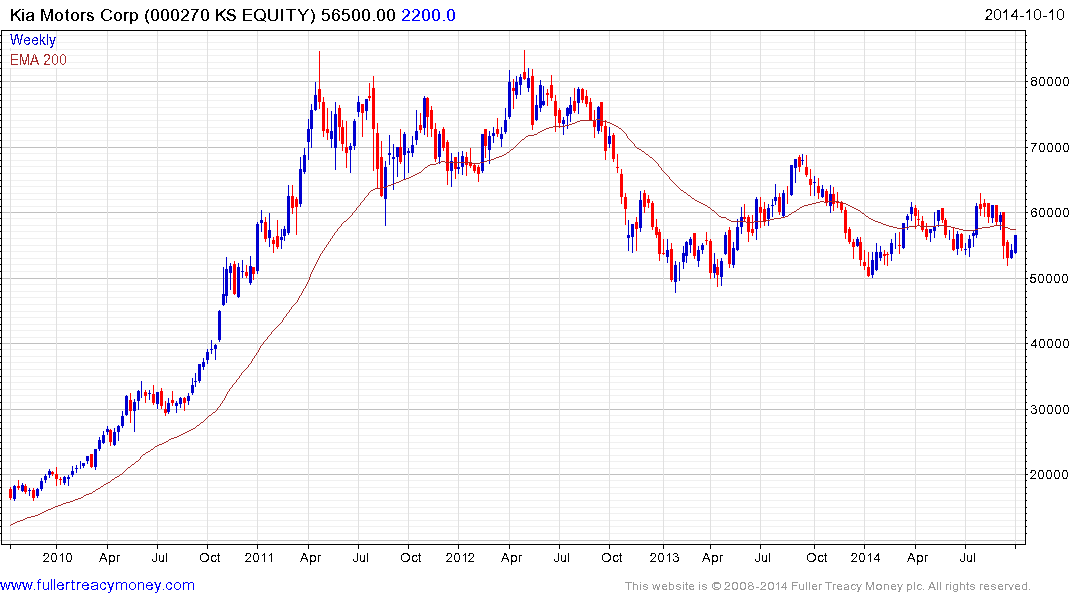

Kia Motors Corp is firming from the lower side of its yearlong range.

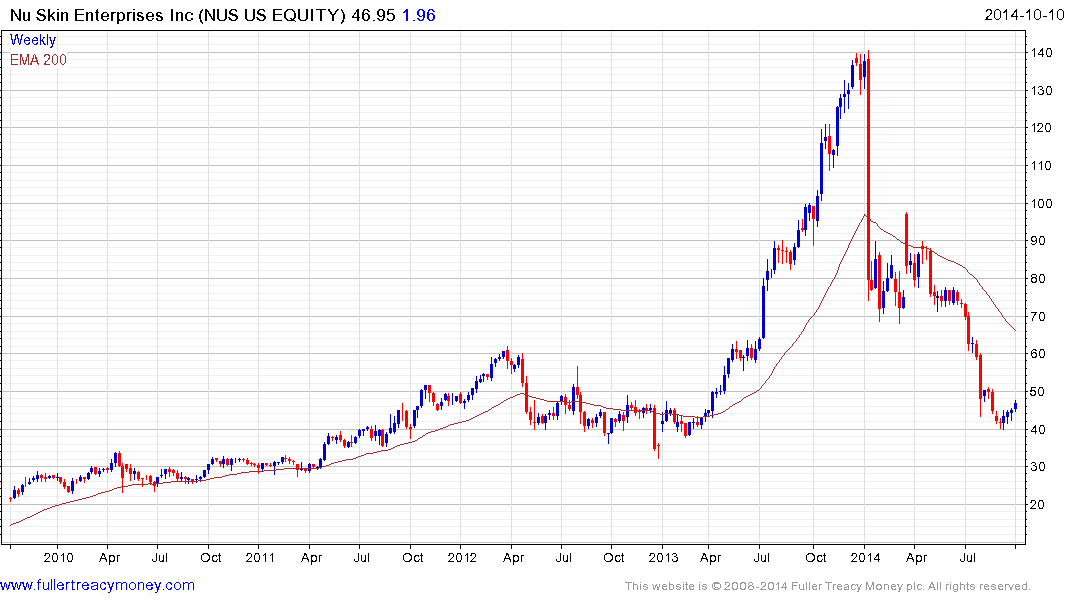

Tesco, Herbalife and NuSkin Enterprises appear to be steadying following accelerated declines that have climactic characteristics.

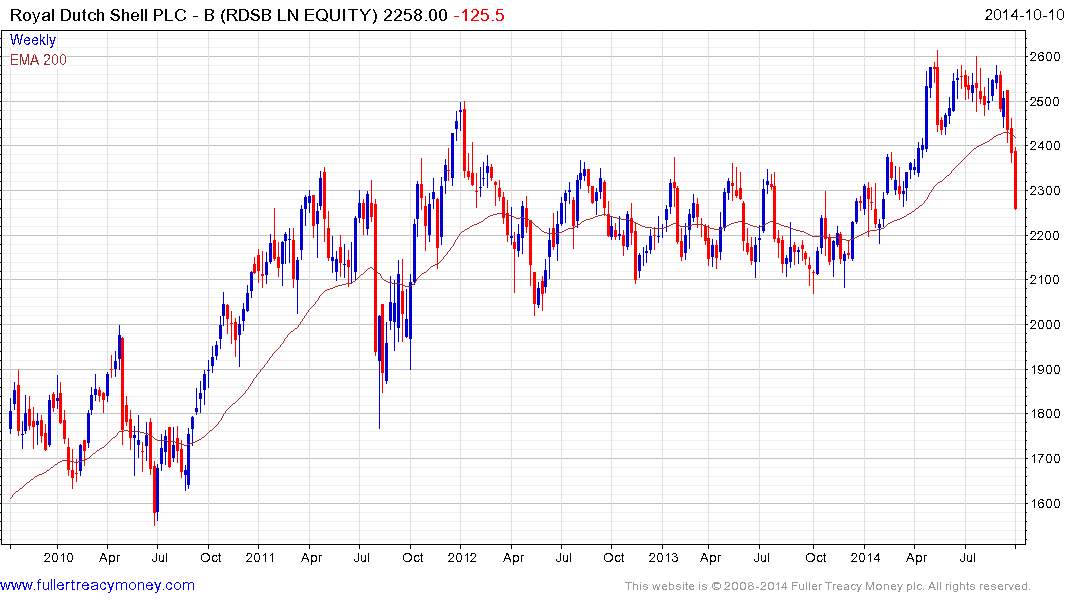

Royal Dutch Shell failed to sustain its breakout.

Chubb has lost momentum but continues to hold its progression of higher reaction lows.

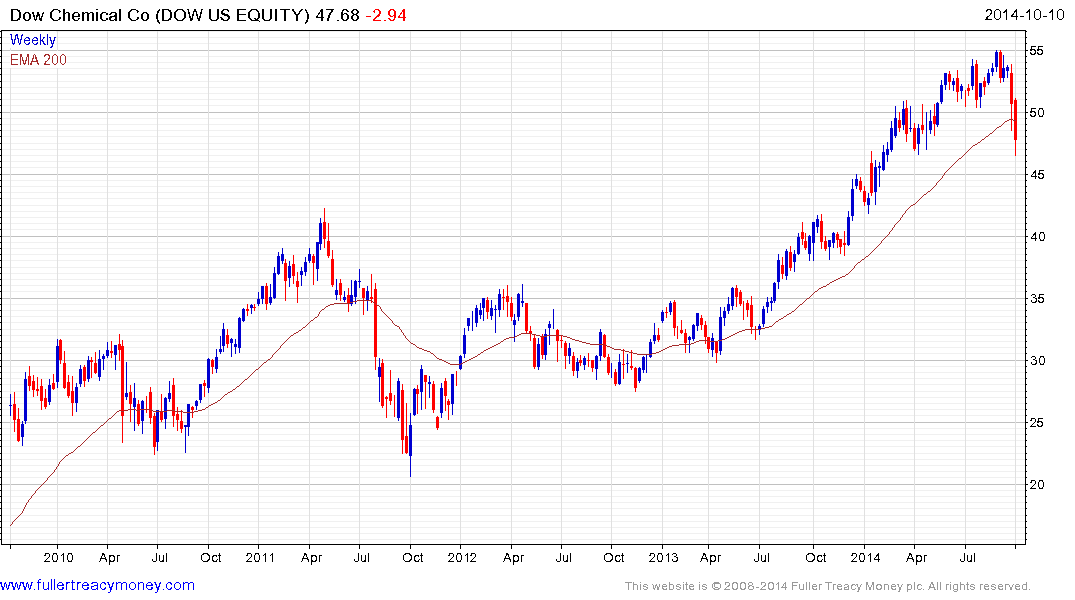

Dow Chemical has broken its progression of higher reaction lows and is currently testing the region of its 200-day MA.

ABB has been confined to a volatile range for almost six years and is currently trending downwards from the most recent test of the upper side late last year.

Cisco Systems is pulled back from upper side of its range.

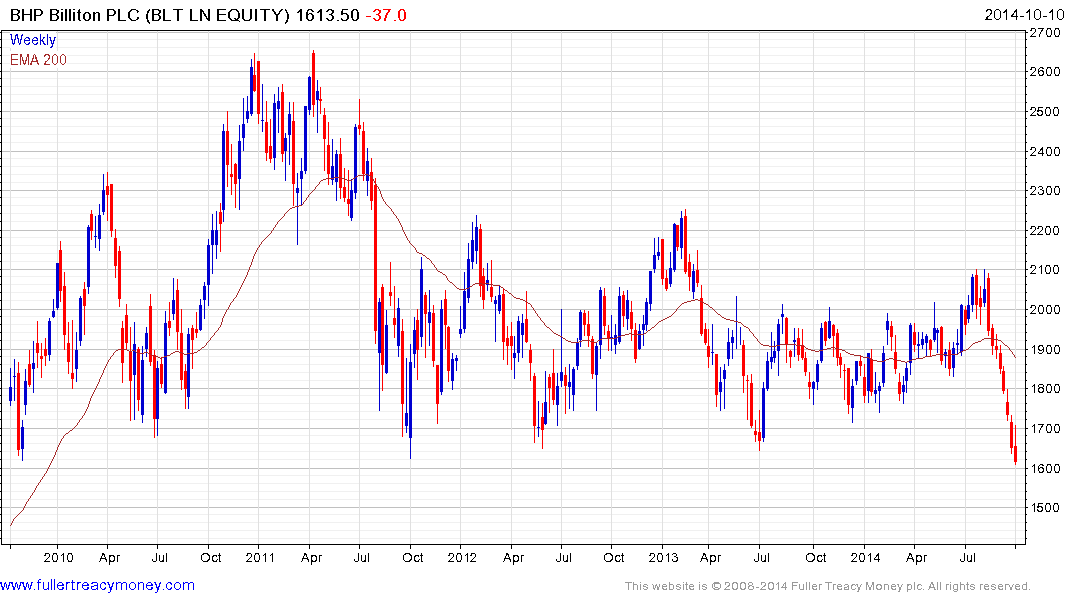

BHP Billiton is testing he lower side its range.

Rio Tinto is mid-range.

Australian listed Amcor and Brambles both continue to range.

Broadening following a previously consistent advance is rarely a reliable continuation pattern. ARM Holdings, SAP and Kerry Group have developing Type-3 top formation characteristics.

Boeing has lost form following its accelerated advance late last year.

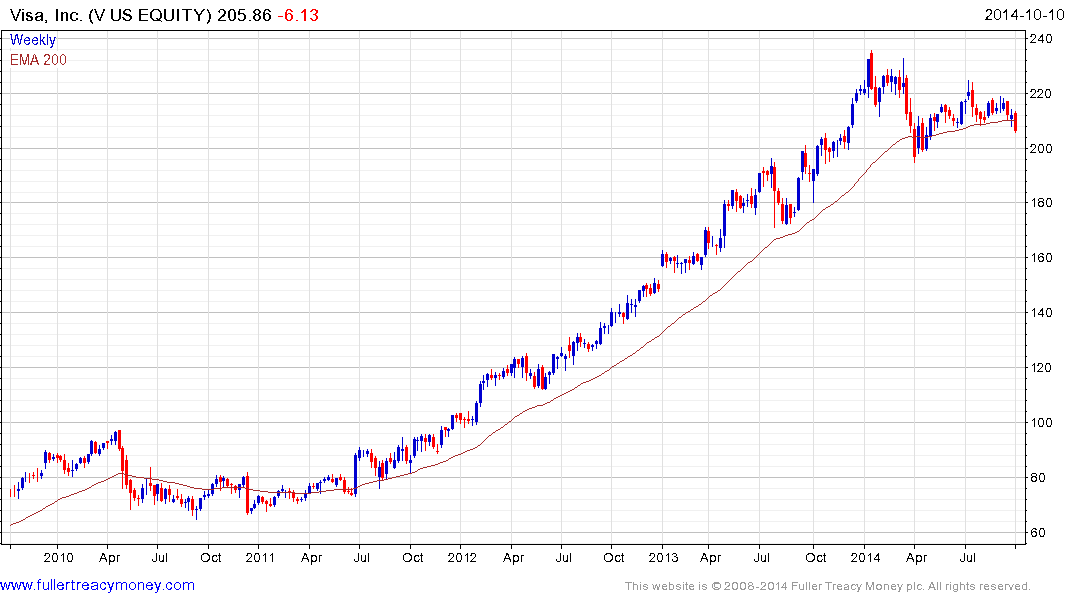

MasterCard, Visa, Christian Dior, Twenty-First Century Fox share a similar pattern.

General Electric, Danaher, Honeywell, Illinois Toolworks, McCormick, McDonalds, Inditex, Luxottica Group, Unilever and UPS have lost momentum.

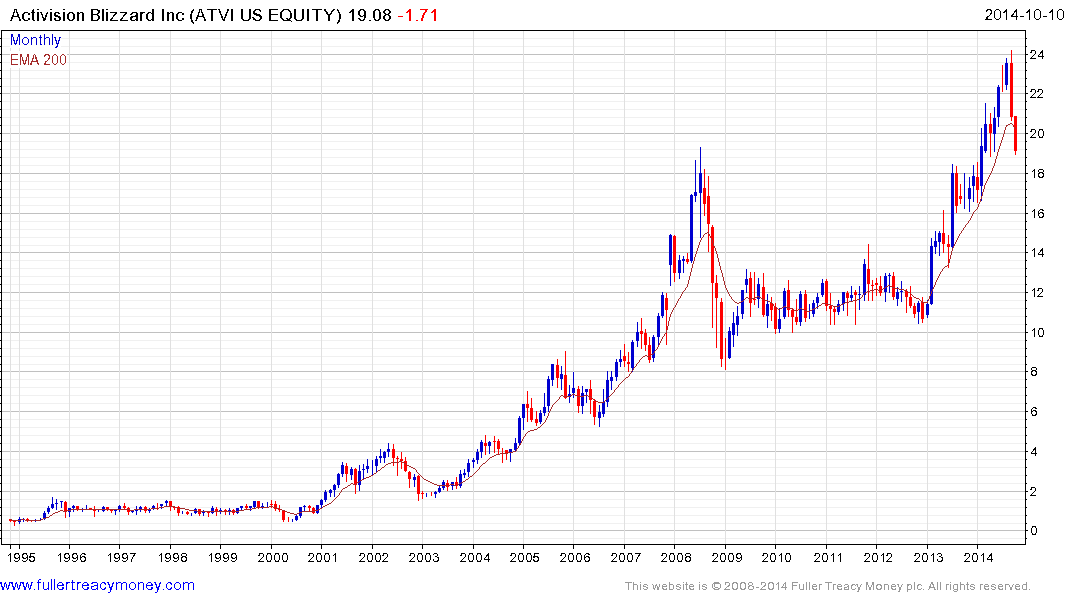

Activision Blizzard’s 20% pullback in the last month represents a major trend inconsistency for what has been an orderly step sequence advance since early 2013.

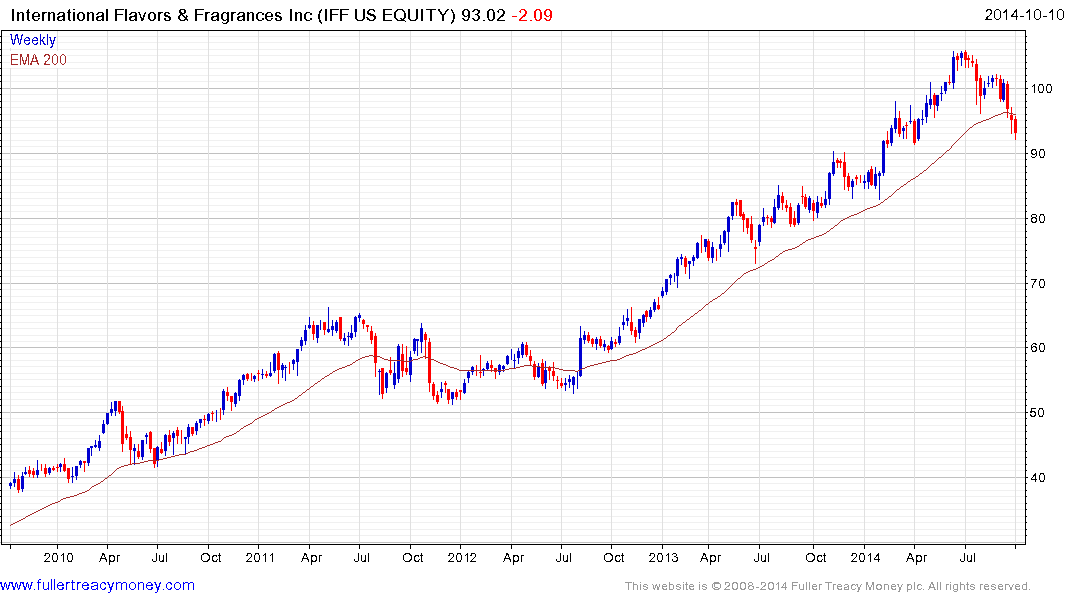

International Flavors & Fragrances, MediaTek, Mondelez International, Monsanto, Omnicom, PPG Industries, Schlumberger have similar patterns.

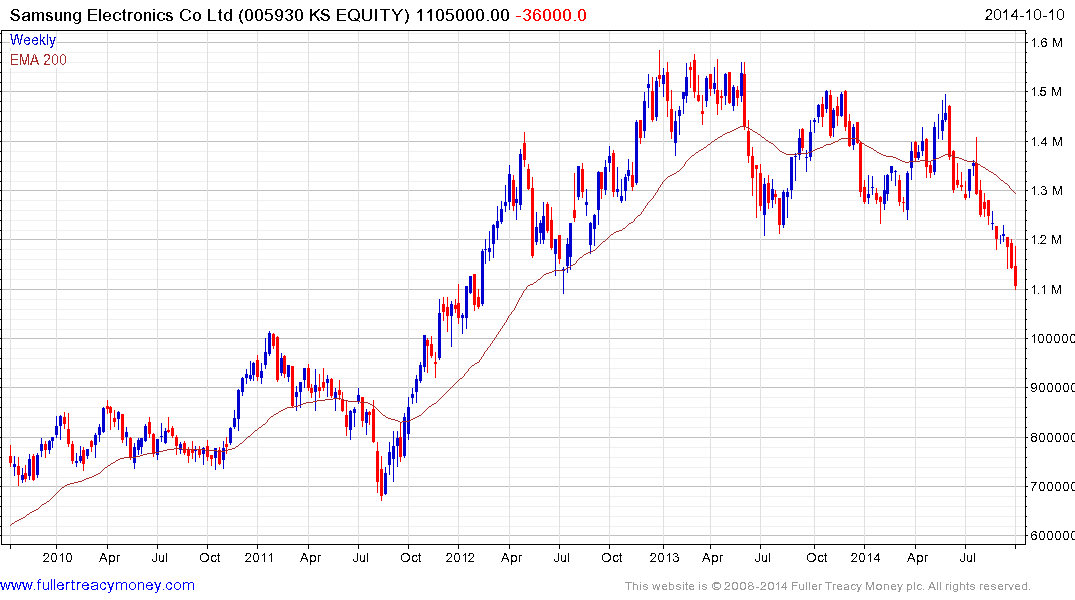

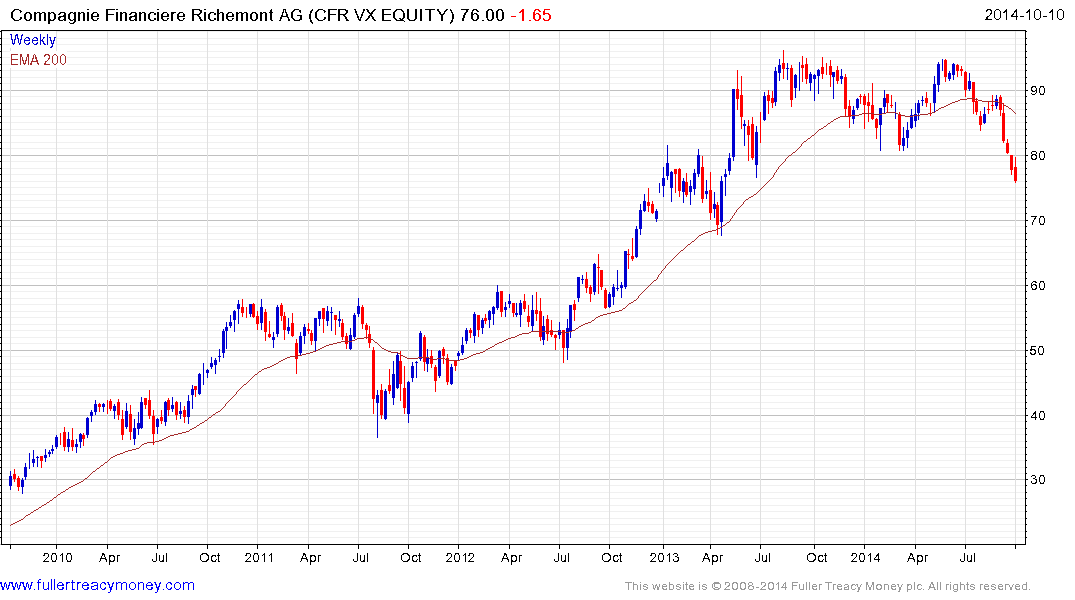

Praxair and Rexam, Samsung Electronics, Siemens, United Technologies and Compagnie Financiere Richemont are breaking down.

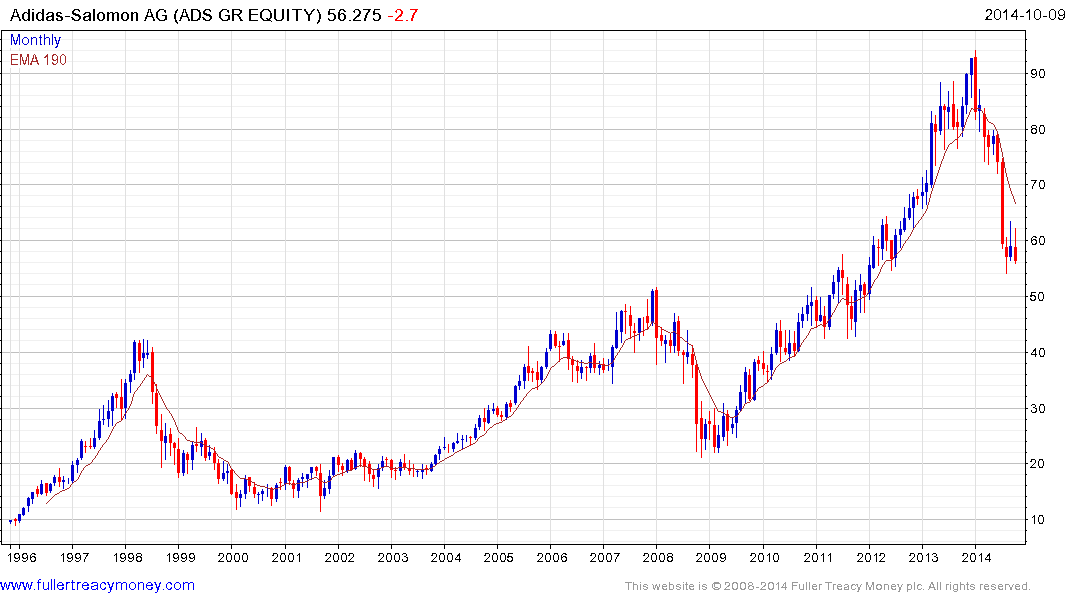

Adidas Salomon has been trending lower all year and while the decline has paused, it will need to find support above the September low to begin to suggest demand is returning to dominance.

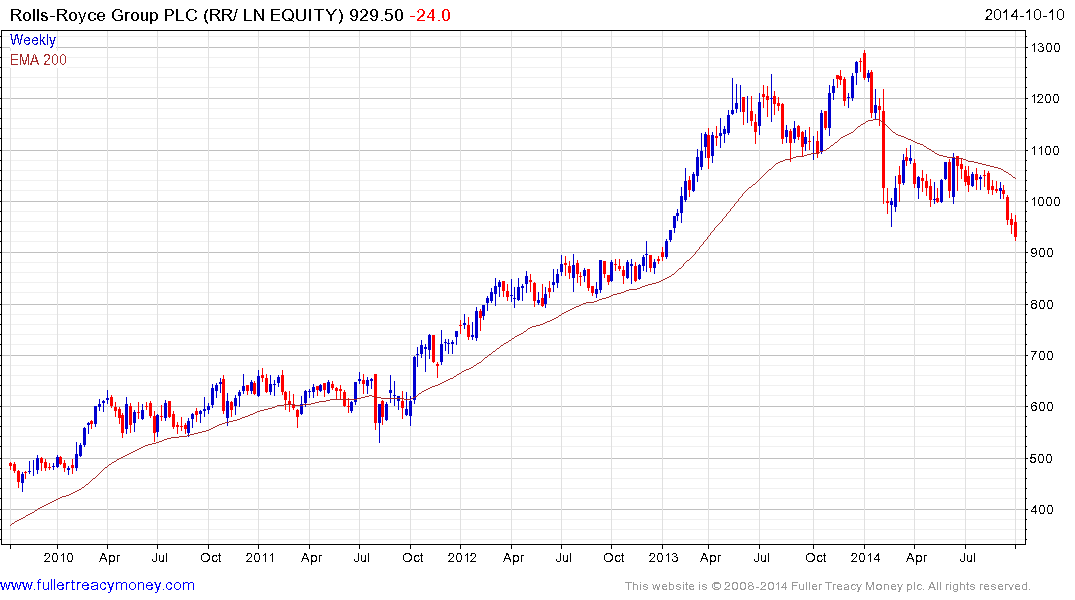

Mattel, Publicis. Remy Cointreau and Rolls Royce share a similar pattern.

Air Liquide remains in a choppy advance and is pulling back to test the progression of higher reaction lows.

Linde, Casino Guichard, Chevron, Danone, Hengan International and H&M have similar patterns.

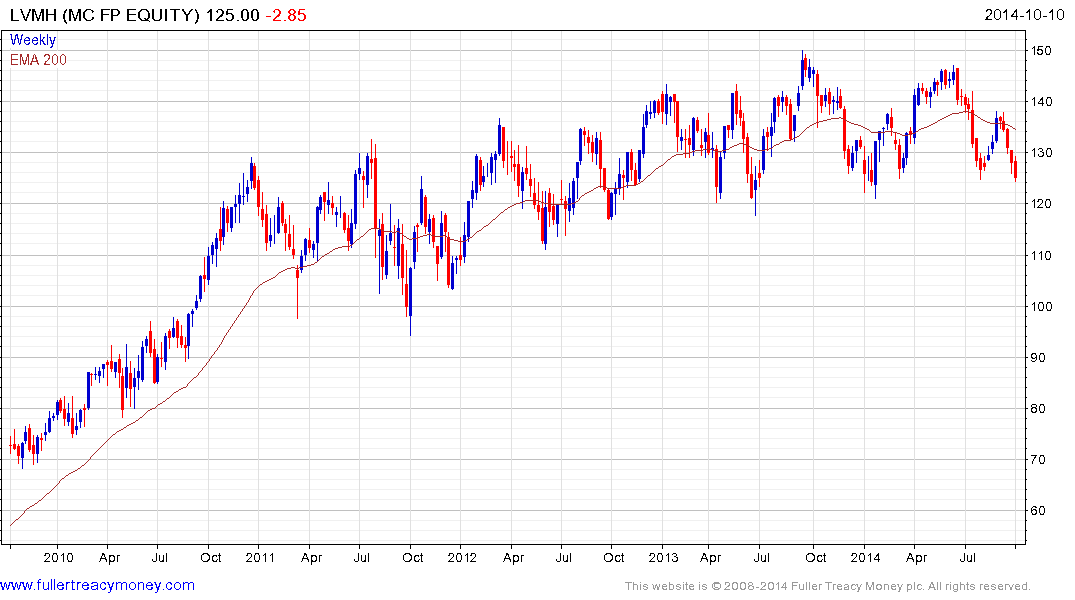

LVMH has Type-3 top formation characteristics and is currently testing the progression of higher reaction lows.

Yum Brands has a similar pattern.

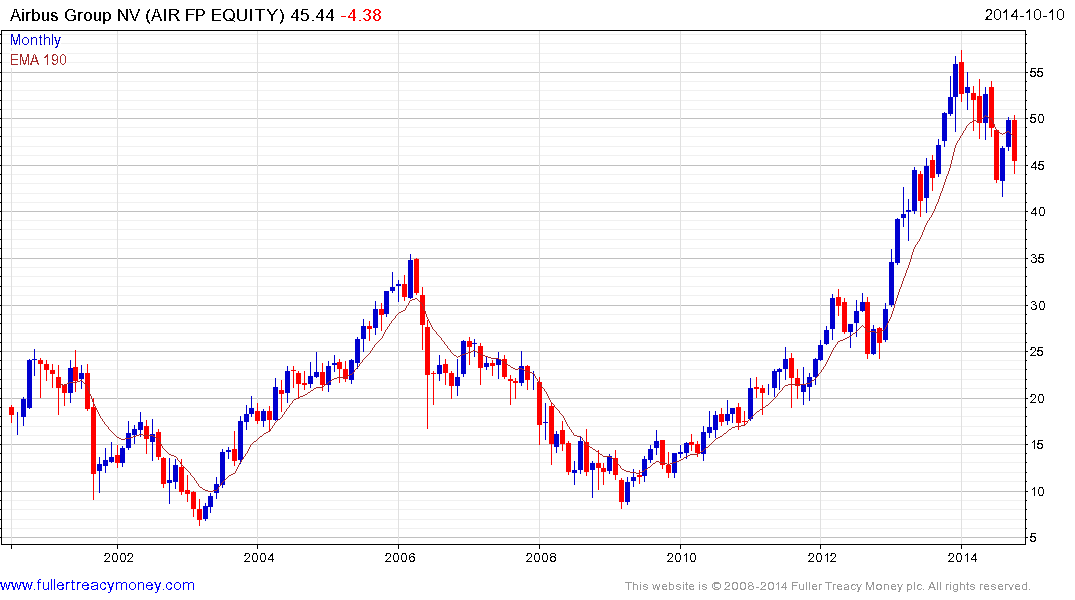

Airbus encountered resistance in the region of the 200-day MA following its earlier decline in the summer. Amazon, DSM NV, Pernod Ricard. Pfizer, Philip Morris and Potash Corp fall into the same category.

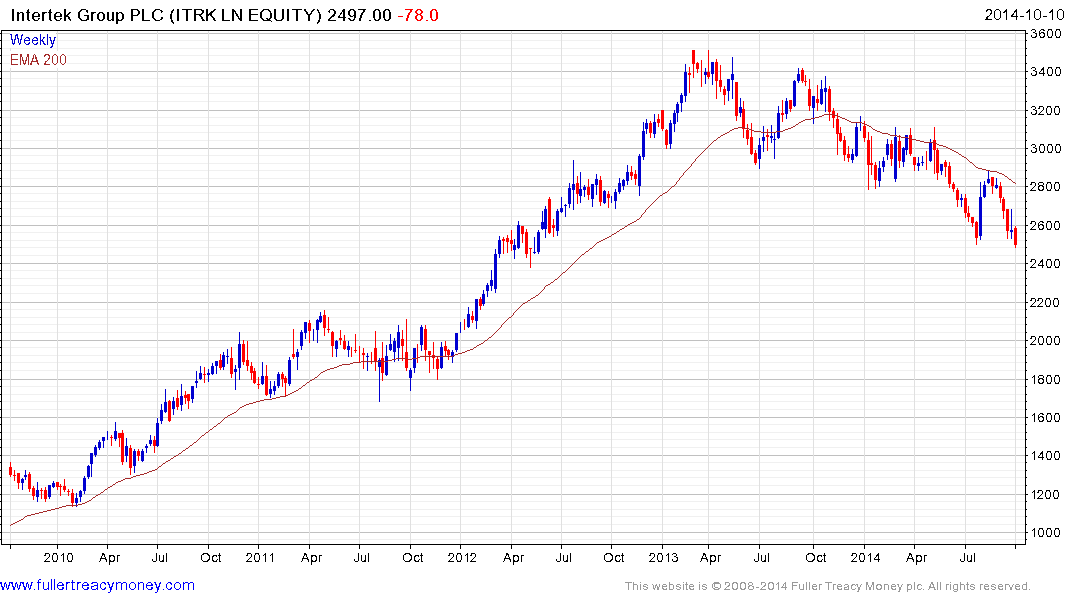

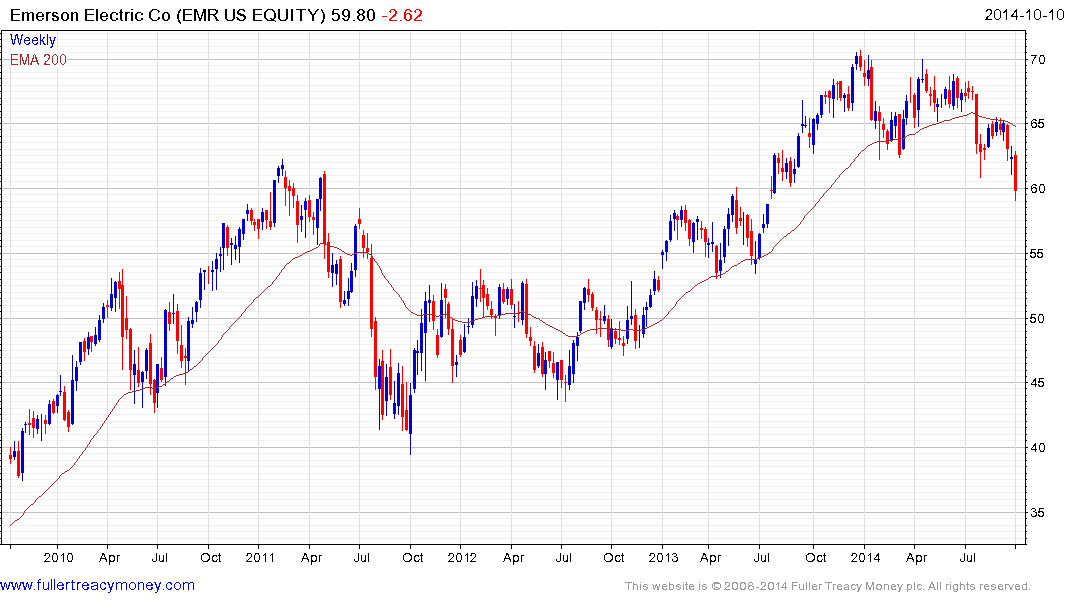

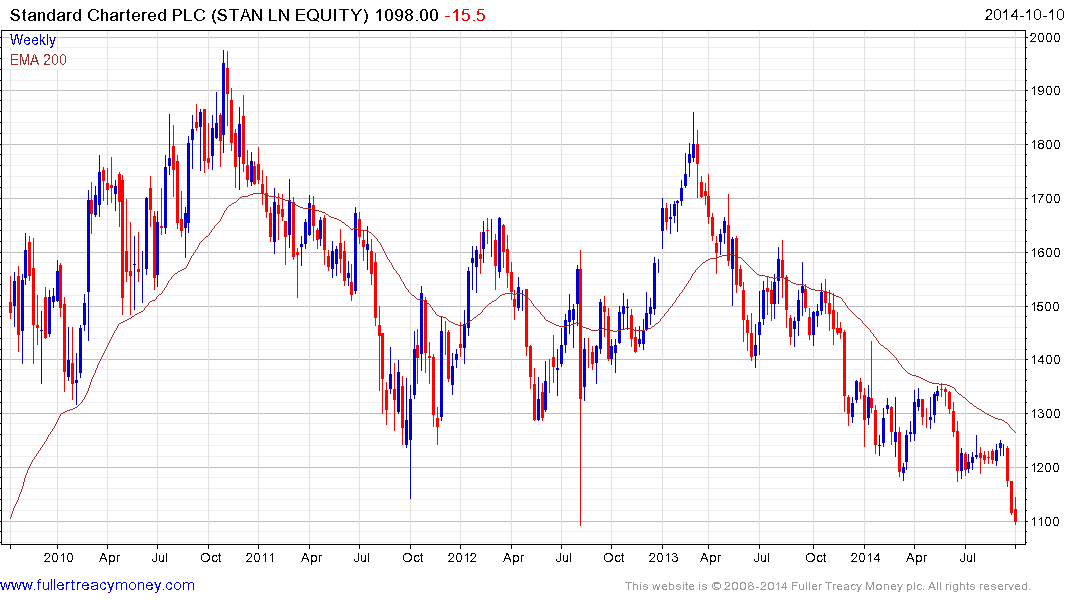

Intertek Group and Dairy Farm International, BASF, Akzo Nobel, Emerson Electric, Standard Chartered, Swatch Group, Volkswagen, WPP have similar patterns and extended their declines this week.

BMW broke below its 200-day MA for the first time in more than a year last week.

Barclays has held a progression of lower rally highs for 18 months.

Prada, Diageo, HSBC and Experian have similar trajectories.

Varying degrees of uptrend degradation, emerging downtrends and accelerating downtrends are evident in the above charts. Energy and resources companies are being affected by the falling price of their respective commodities while China’s anti-corruption drive is weighing on luxury goods companies. More broadly a slowing global economy is a headwind and the withdrawal of QE is pressuring leveraged traders. As valuations improve, some of the above companies will provide attractive entry points so it will be time well spent monitoring their charts for signs of support buidling. Here is a link to the Autonomies section of the Chart Library.