Ebola and iron ore price put London Mining on life support

This article by Lawrence Williams for Mineweb may be of interest to subscribers. Here is a section:

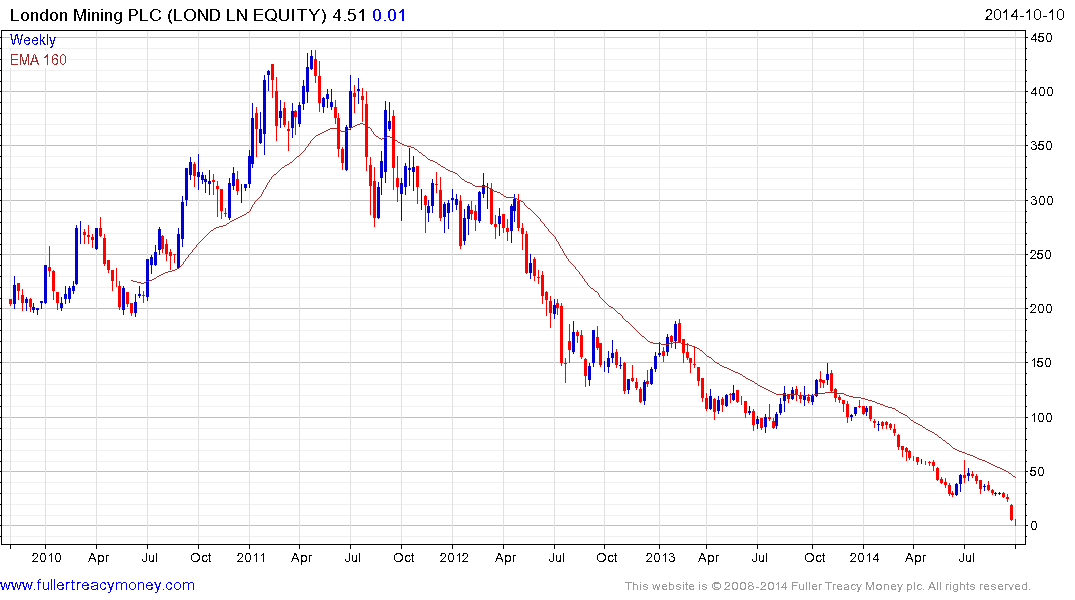

But London Mining was already on the downward path before the ebola outbreak struck its host country and exacerbated the situation, although no-one at the mine site appears to have fallen victim to the disease. Mining and upgrading 31% tenor iron ore to compete with those like Rio Tinto, Vale and BHP who can dig the stuff out of the ground at around 60% just became less and less economic as iron ore prices slumped. The company’s share price on London’s AIM market fell from comfortably over £4 in April 2011, down to around 4 pence and now trading is suspended.

?The company had been trying to find an investor to plug a financing gap which meant it had been running out of money to maintain operations. Indeed only a week ago the company’s CEO, Graeme Hossie commented that there was little or no value remaining in the company’s shares.

Now it is down to the PwC administrators to try and salvage something from the wreckage. According to an announcement confirming the appointment of administrators, Russel Downs, joint administrator and PwC partner said "The collapse in iron ore prices and the resulting impacts on this business have been very dramatic and our focus is to ensure that a buyer is found for the Marampa Mine operations given it is such an important part of the Sierra Leone economy. We are liaising with key stakeholders and asking for a short window of forbearance as we look to conclude a transaction."

This is exactly the kind of news the major iron-ore miners were looking for when they decided to flood the market with supply in order to overcome competition from higher cost producers. Cliffs Natural Resources announcing a $6 billion write down today on its iron-ore assets is an additional sign that their strategy is having the desired effect. They will now be waiting for similar news from Chinese iron-ore miners before attempting to stabilise the market.

Despite the fact that the ebola scare has little to do with London Mining’s demise, the emotionality of the debate on how best to deal with the disease represents an additional impediment to securing an additional line of credit.

This article from the Wall Street Journal, kindly forwarded by a subscriber, highlights how political correctness appears to be overcoming common sense in terms of the USA’s response to containing the disease in West Africa. I’ve even seen news commentary to the effect that it is racist to suggest a travel ban from the countries most badly affected. As this article from The Economist highlights, the disease has nothing to do with race and everything to do with limiting new exposures.

The Blackrock World Mining Trust made a bad decision when it decided to invest heavily in London Mining. The share’s decline weighted on the trust and the decision to purchase it in the first place points to a lack of good governance and/or oversight for the trust’s managers. The Trust accelerated lower last week but stabilised in the last couple of days. Potential for a reversionary rally back up towards the still declining trend mean has increased.

Back to top