Goldman Sees No Crude Glut as Price Slump Deemed Excessive

This article by Ben Sharples for Bloomberg may be of interest to subscribers. Here is a section:

Oil’s collapse into a bear market is excessive because there’s no oversupply to justify the selloff, according to Goldman Sachs Group Inc.

The bank is “near-term constructive about prices” after they fell too much, too soon, analysts including Jeffrey Currie, the head of commodities research in New York, wrote in a report e-mailed today. While expectations of a glut have driven down crude, the risk of a near-term shortage may increase as forward prices of benchmarks including West Texas Intermediate and Dubai crude discourage stockpiling, it said.

Oil futures slumped to the lowest in four years in London amid the highest U.S. output in almost 30 years and weakening global demand growth. Members of the Organization of Petroleum Exporting Countries are responding by cutting prices, prompting speculation that they will compete for market share rather than reduce production.

“The ‘supply glut’ is not yet here today, it exists in expectations,” the Goldman analysts wrote. “Prices have likely overshot to the downside.”

West Texas Intermediate posted an upside key day reversal yesterday and held the advance today. Following such an accelerated decline there is scope for some steadying but market participants will continue to watch Saudi Arabia for signs of a change to their policy of pricing out competitors from their major growth markets.

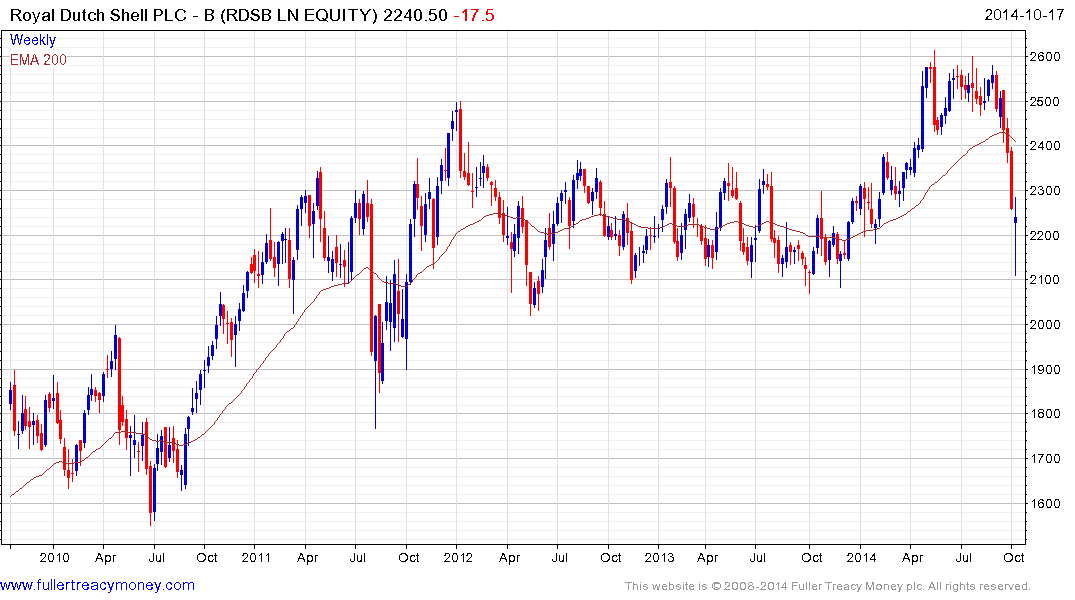

The oil production sector has fallen even more aggressively that crude oil futures contracts and valuations have returned to competitive levels. For example Exxon Mobil (Est P/E 12.35, DY 3.03%), Chevron (Est P/E 10,98, DY 3.83%), Conoco Philips (Est P/E 11.02, DY 4.29%), Royal Dutch Shell (Est P/E 9.5, DY 4.98%), Total Fina (Est P/E 9.74, DY 5.48%) and Statoil (Est P/E 10.2, DY 4.71%) among others experienced sharp declines and found at least short-term support over the last two days.

In an uncertain environment, if oil prices continue to steady the relative attraction of defensive sectors such as high yielding oil companies may prove attractive for investors.

Back to top