Don't Trade a Bear Like a Bull; Reality Check for Earnings is Good

Thanks to a subscriber for this report from Micheal Wilson for Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report.

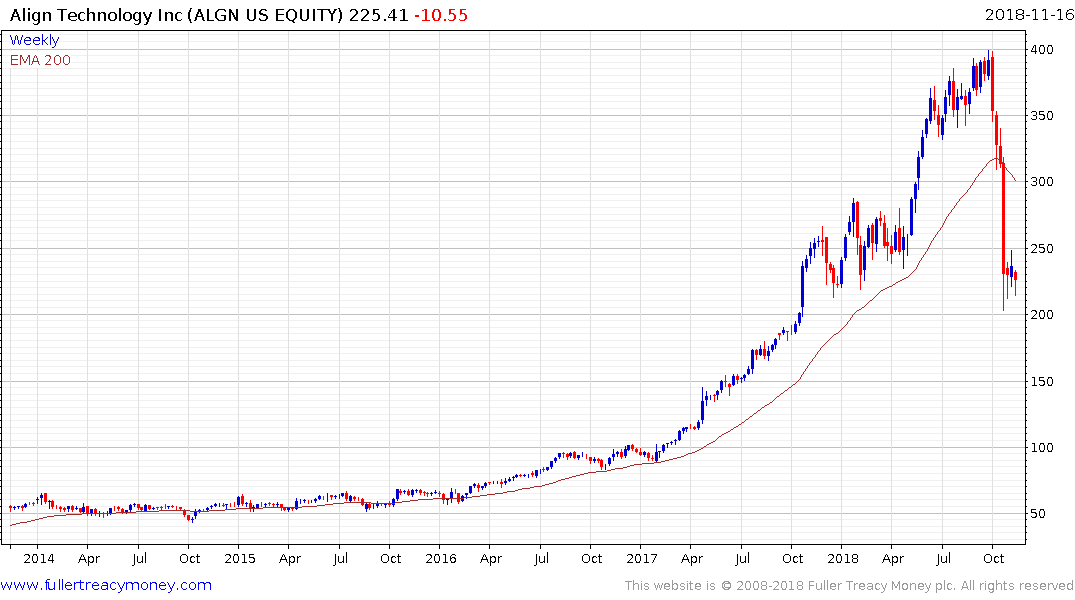

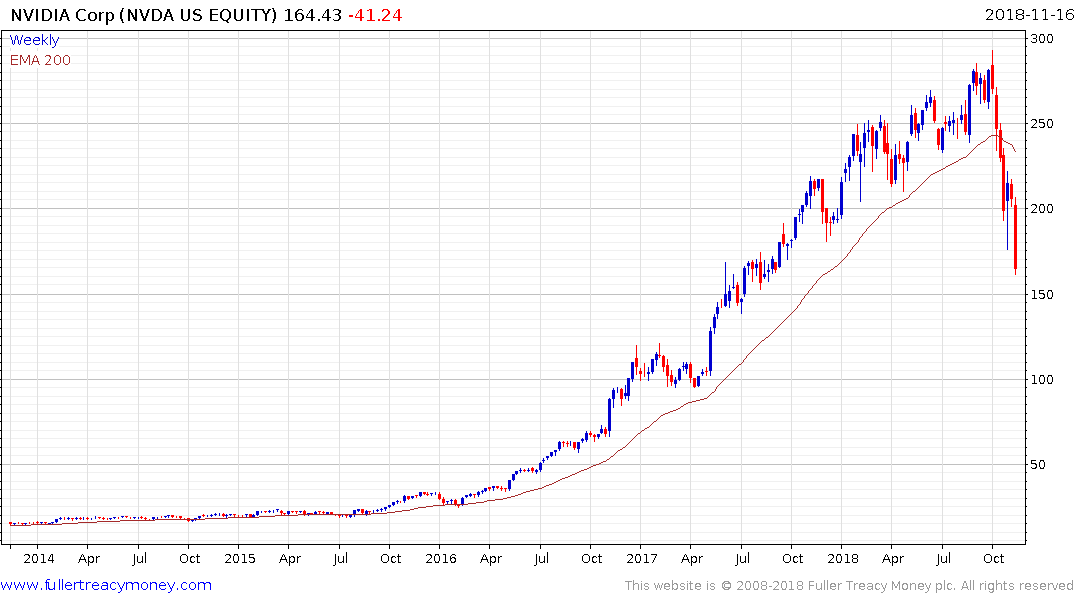

Leverage is quickly being squeezed out of the “new economy” shares which were among the best performers over the last 18 months. That is certainly going to lead to earnings revisions for the companies like Nvidia, Align Technologies and Netflix.

It also holds out the prospect of a lengthier period of underperformance for the segment of the technology sector which has been most aggressively bought by investors over the last few years.

Meanwhile the outperformance of highly defensive sectors points to a rotation out of highly interest rate sensitive sectors.

This spreadsheet of the Nasdaq-100’s constituents ranked by their overextension relative to the trend mean highlights how focused selling pressure has been on the tech and semiconductors sector while consumer sectors are outperforming.

From a broader perspective the Federal Reserve’s balance sheet reduction program coincides with the expiry of bonds held on its account which occurs on the 15th and 30th of the month. There is evidence of the market falling into those days and rallying subsequently. Therefore, it is worth considering that there was a major expiry on Thursday and the market rallied immediately afterwards. Outside of the most heavily leveraged sectors, a lot of selling pressure has already taken place and a short-term oversold condition is evident.

Back to top