Deutsche Bank Said Near Full Takeup for $8.5 Billion Share Sale

This article by Ruth David and Steven Arons for Bloomberg may be of interest to subscribers. Here is a section:

Deutsche Bank AG is poised to receive orders for almost all of the 8 billion euros ($8.5 billion) of stock on offer to investors as the sale draws to a close, according to people familiar with the matter.

Investors have pledged to buy more than 95 percent of the stock on sale in the rights offer, which ends Thursday, said the people, asking not to be identified because the details aren’t public. About 80 percent of existing investors decided to participate in the capital increase, with some opting to boost their exposure and new investors buying the rest, said one person.

The shares are trading well above their offer price, a key factor in attracting demand.

The capital increase -- the bank’s fourth since 2010 -- is the centerpiece in Chief Executive Officer John Cryan’s new turnaround plan, which he announced in early March after Deutsche Bank failed to sell its Postbank unit to bolster capital. The company’s key Qatari shareholders are buying shares to maintain their stake, according to people familiar with the matter. Chinese investor HNA Group Co. has built up its stake to 4.76 percent, and that number may increase, said one person with knowledge of the firm’s strategy.

The German banking sector has been largely nationalised with only a handful still listed. Deutsche Bank represents the nation’s only truly international bank and every effort has been made to turn it around following what has been a very difficult decade.

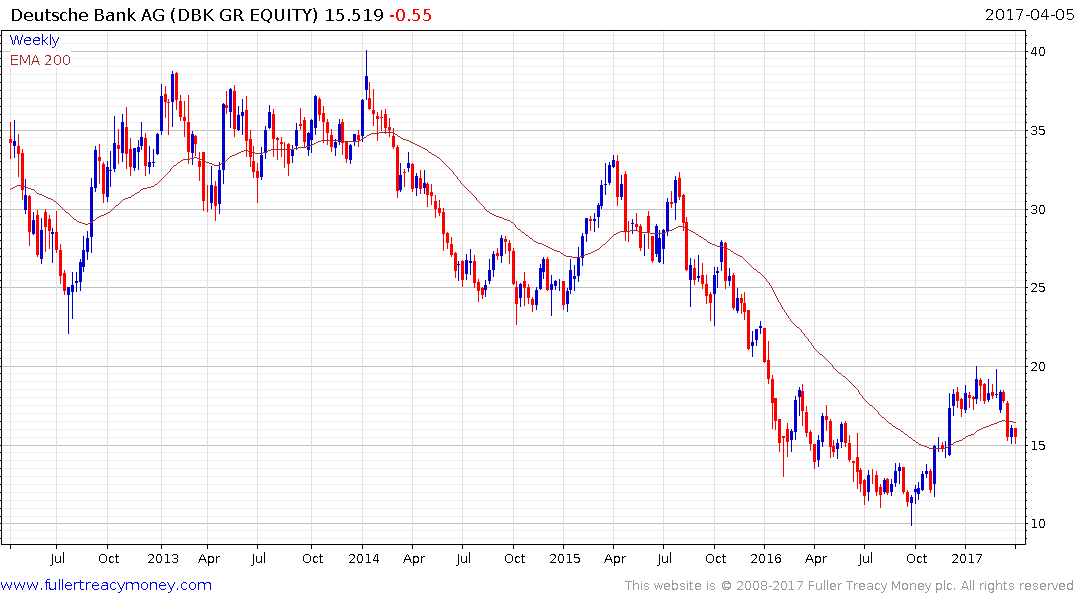

The share has bounced from the region of the 2008 low since November and is now testing the region of the trend mean. A sustained move below it would be required to question medium-term scope for additional higher to lateral ranging.

Commerzbank, which has had even more questions raised about it sustainability is trading well below its 2008 lows and exceeded even the 2013 low in August last year. It is has since rebounded and is now trading above its trend mean for the first time since early 2015.

The broader Euro STOXX Banks Index has been ranging with a mild downward bias for the better part of a decade but is also rebounding from the lower boundary and a sustained move below 113 would be required to question medium-term scope for continued higher to lateral ranging.