Cryptocurrencies Stem Losses on Binance's Recovery Fund Plan

This article from Bloomberg may be of interest to subscribers. Here is a section:

Even though markets gained on Zhao’s tweet, such a fund may not be best for the industry, said Quantum Economics founder and Chief Executive Officer Mati Greenspan. Binance already has too much control in a decentralized market, he said.

“That sort of concentration of power makes me uncomfortable,” said Greenspan. “It’s the kind of thing crypto was designed to avoid and one of the lessons we should have learned from last week.”

Meanwhile, Elon Musk’s tweet that Bitcoin “will make it” also gave crypto markets a boost, said Greenspan. Dogecoin, a token the Tesla CEO has touted in the past, gained as much as 7.9%.

This is yet another example of the paradox of decentralized finance. It’s appealing in theory but the benefits of centralized control become evident during crises. A truly decentralized system does not have a buffer against bank runs. It is looking likely Binance will come through this crisis with a dominant position in the “decentralized” finance market.

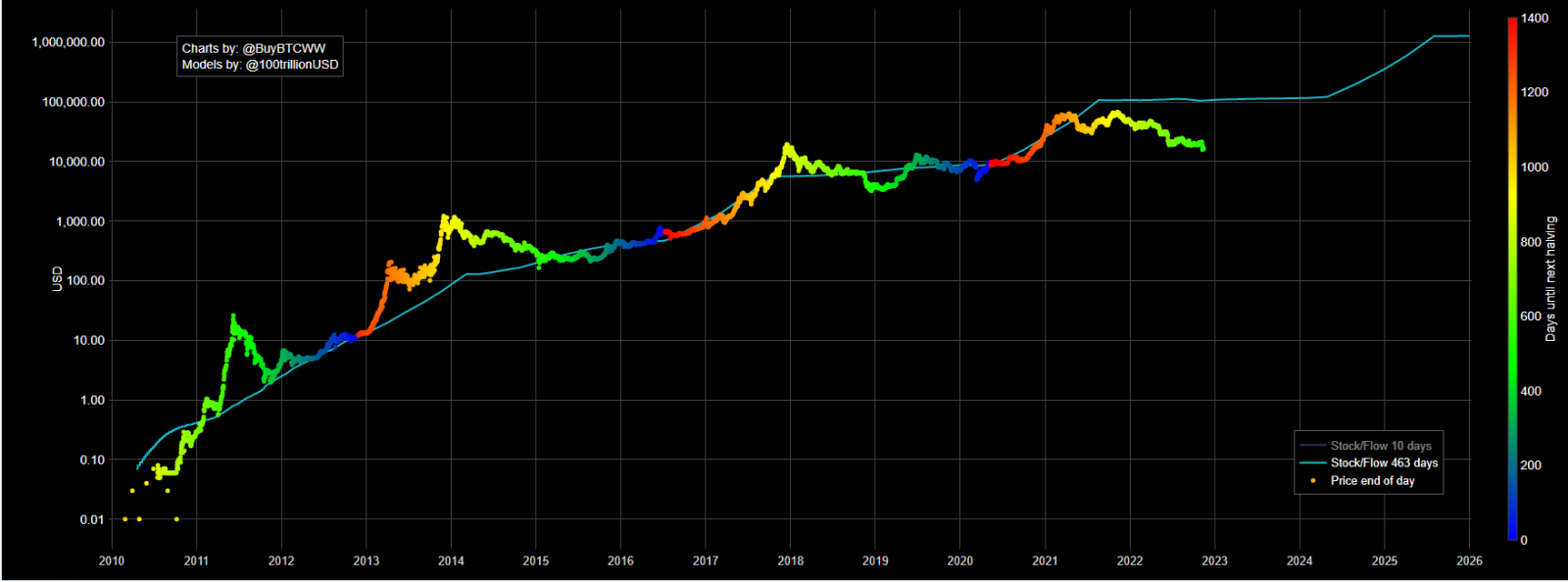

Investors always tend to highlight stock to flow charts during crypto market upswings but the time to pay particular attention is when we are about a year out from the next halvening. At present, the estimated date for the next bitcoin halvening is April 24th 2024.

Investors always tend to highlight stock to flow charts during crypto market upswings but the time to pay particular attention is when we are about a year out from the next halvening. At present, the estimated date for the next bitcoin halvening is April 24th 2024.

It is exactly at the current point in the cycle that we can expect a winnowing of the field in terms of crypto projects. The excesses of the recent boom are being unwound and the biggest risk takers at the peak are being punished. Nevertheless, the bear market lows tend to occur at this point in the cycle and the actual halvening usually corresponds with a higher reaction low.

Bitcoin’s trend has lost almost all of its primary consistency characteristics. The one thing that long-term bulls hold on to is no one who has owned bitcoin for four years (longer than a halvening cycle) has ever lost money.

The simple way of thinking about the bullish cycle in bitcoin is that at some point in 2024 there is going to be a massive money printing event that will refloat risk assets on an epic scale. The tendency of central banks to multiply the size of their balance sheets, following periods of quantitative tightening supports that view. However, between now and then there would need to be a sufficiently large scare to prompt money supply growth on a scale big enough to achieve the price goals of six-digit bitcoin bulls.

If the world has changed and we are in a new higher interest rate, lower liquidity environment where value and substance are the dominant themes then the money to flow chart pattern will not justify prices for bitcoin in the six figures, let alone seven figures. If the pattern of the post GFC market prevails then bitcoin will continue to reflect the liquidity splurges initiated by central banks to quell market panic.

Back to top