Copper Posts Two-Year High, Miners Surge as China Brightens

This article by Mark Burton and Susanne Barton for Bloomberg may be of interest to subscribers. Here it is in full:

Copper posted its highest close in more than two years and shares in producers of the metal rallied amid a weaker dollar and expectations demand will increase in China, the world’s top user of industrial metals.

Copper surged as much as 4.2 percent, leading gains on the London Metal Exchange. Freeport-McMoRan Inc. paced gains by mining stocks as Jefferies LLC recommended buying the biggest publicly traded producer. Caterpillar Inc. is strengthening its forecast for a first annual sales increase in five years after construction demand surged last quarter in China.

Base metals have rallied in the past month as a gauge of the dollar trades around a one-year low, making materials priced in greenbacks more attractive. In addition, economists have become more upbeat about China’s economy and concerns about a tightening of liquidity in the nation have eased.

All main industrial metals climbed Tuesday, while steel and iron ore contracts also advanced as the People’s Bank of China said it will pursue stable monetary policies. The announcement came after economists raised their forecasts for China’s economic output after first-half growth beat estimates.

“The weaker dollar has had quite a positive effect on base metals markets, but we’re seeing some sector-specific elements helping too,” Casper Burgering, senior sector economist at ABN Amro Bank NV, said by phone from Amsterdam. Freer credit availability in China should boost demand in key end-use industries like construction, he said.Copper for three-month delivery rose 3.3 percent to settle at $6,225 a metric ton by 6:15 p.m. on the LME. That’s the highest since May 2015. Lead, nickel and zinc all gained more than 1.7 percent.

A rebound in China’s construction sector will be particularly beneficial for zinc, which is used to galvanize steel, while nickel has also benefited from signs of a rebound in stainless-steel demand, Burgering said.

Nickel reached the highest in three months after Philippine President Rodrigo Duterte on Monday threatened to impose higher taxes on mining firms unless they take steps to protect the environment, renewing concerns about supply from the world’s top producer of mined nickel.

The commodity complex when through a painful process of rationalisation from the 2011 peak and by the beginning of 2016 a lot of the excess capacity in the sector has been eroded. With economic growth picking up the potential for prices to rally remains intact because so many miners have been scarred by the experience of the crash and will be slow to invest in boosting supply.

The industrial metals offer a clear example of this trend while oil have been much more volatile because a war is going on between supply and demand that is contributing to volatility.

Copper broke out to new recovery highs yesterday; responding both to improving global economic figures and the continued supply disruption in Chile.

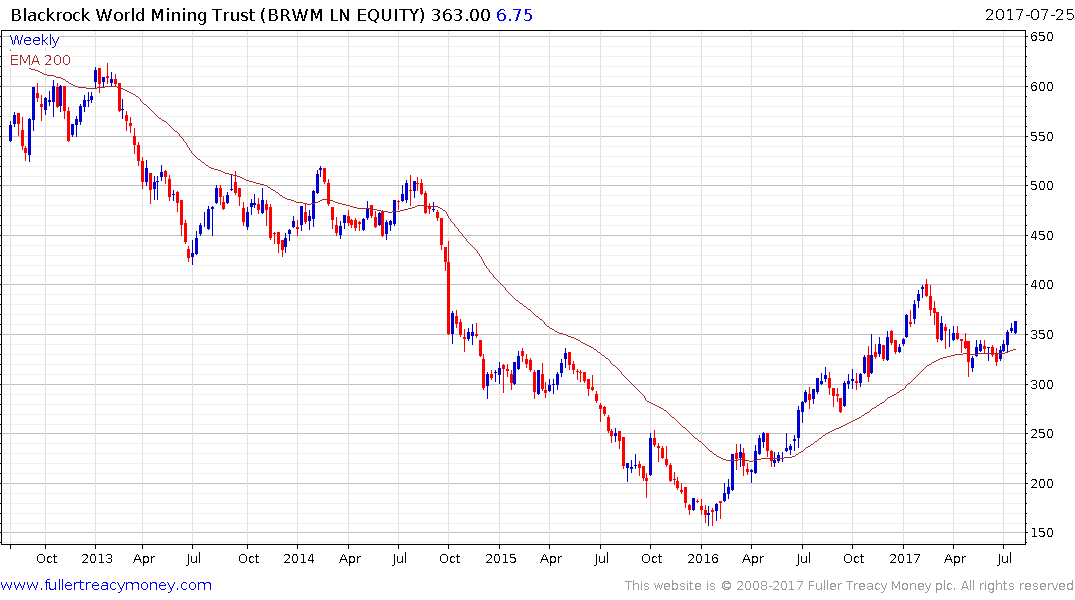

The Blackrock World Mining Trust is trading on a discount to NAV of 7.28% and is firming from the region of the trend mean in line with the performance of the FTSE-350 Mining Index.

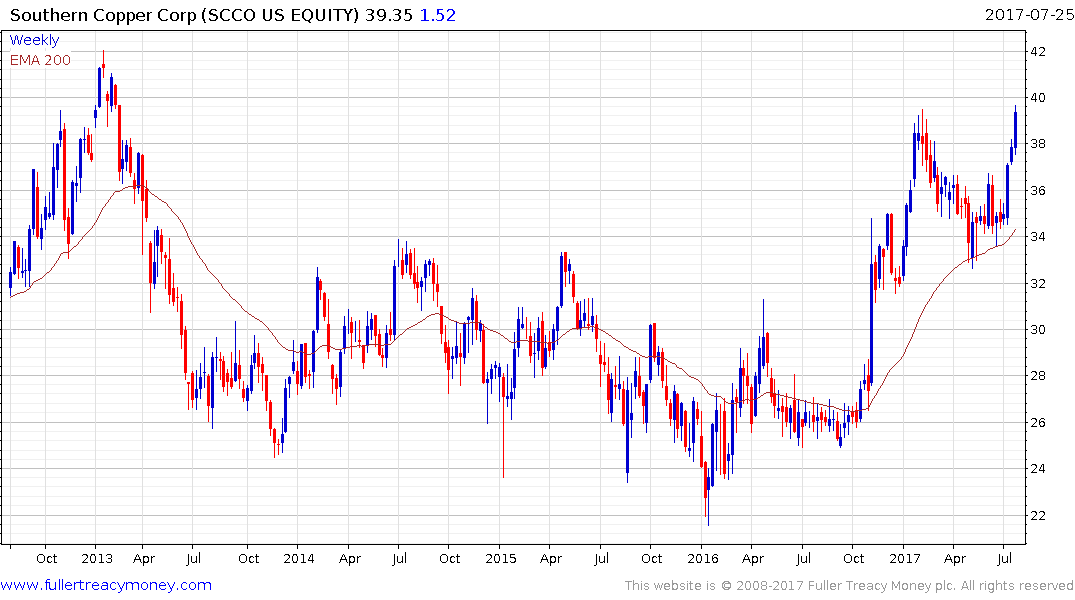

Among the major copper producers Antofagasta and Southern Copper share similar patterns with the metal while Kazakhmys might be considered a high beta play.

Among iron-ore miners Ferrexpo has experienced an impressive rally, but is increasingly overextended relative to the trend mean.