As VIX Plumbs Depths of Torpor, Betting on Its Future Gets Brisk

This article by Elena Popina and Lu Wang for Bloomberg may be of interest to subscribers. Here is a section:

“The market is being overly optimistic, and the doldrums of summer could have driven the volatility to current levels,”

Katie Stockton, managing director and chief technical strategist at BTIG LLC, said by phone.Yet a low VIX also means cheap options prices, leading to more bets. More than 551,000 VIX calls changed hands each day on average this month, almost three times more than puts. The last time options volume was close to being this busy in July was just before a market rout that sent the index to an almost four- year high in August 2015 on concerns that China’s economic growth was slowing. It took the VIX about a year to erase its gains.

On the S&P 500, hedging costs appear particularly low. One- month implied volatility on the measure has been below realized price swings for most of the time since mid-May. In July, it reached its lowest level since October relative to historical volatility.“When options prices are low, options traders will step in to own them,” Amy Wu Silverman, managing director and equity derivatives strategist at RBC Capital Markets LLC, said by phone from New York. “The risk-reward is so attractive, they can’t miss it. It’s like you go to Las Vegas and you play the odds. Now that the options are so cheap you have even better odds.”

The trend of lower rally highs in the volatility of both bonds and equities is a significant input when quantitative strategies calculate the size of their positions. It allows them to have larger position sizes and to buy the dips with more confidence which has been a contributory factor in the consistency of the stock market this year.

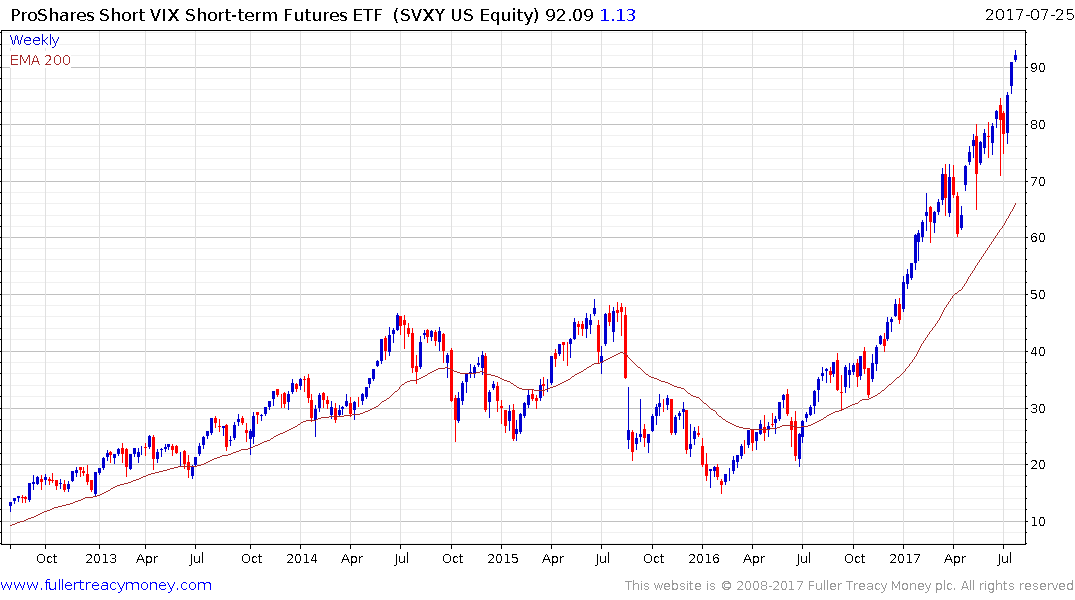

The ProShares Short VIX Short-term Futures ETF (SVXY) has rallied spectacularly since early 2016 and despite two stabs to the downside, in May and June, has continued to set new highs. A break in the fund’s progression of higher reaction lows would be required to check the advance.