Container shipping: rising tide

Thanks to a subscriber for this article by Richard Milne for the Financial Times may be of interest to subscribers. Here is a section:

Soren Skou, chief executive of Danish conglomerate AP Moller Maersk said global demand for containers — a proxy for trade growth — was at its highest level in years in the first quarter.

“It’s a very strong quarter for global trade. Five per cent is significantly above global [gross domestic product] growth. It’s driven by strong growth in Europe, and continued strong growth in the US,” he told the Financial Times.

Global trade growth has been sluggish ever since the 2008/09 financial crisis. That has hurt container shipping lines — of which the Danish group’s Maersk Line is the largest — with annual growth falling from more than 10 per cent before the crisis to 1 to 3 per cent in recent years. Maersk recorded only its second ever loss since the second world war in 2016.

Maersk Line still made a loss of $66m in the first quarter of 2017 as a rise in freight rates from record lows last year was offset by an 80 per cent jump in fuel costs. But the group stuck to its full year forecast of a profit of more than $616m at Maersk Line as a sign of its confidence in improving shipping markets.

Here is a link to the full article.

It’s an understatement to say that the Baltic Dry Index is prone to wild swings. It rallied from a low of 290 in early 2016 to a March peak of 1338 and yet there is still significant stress evident across the shipping sector. The Index is currently testing the region of the trend mean which reflects a potential area of support.

With the shipping sector some companies have been liquidated, there has been a string of mergers and new rules about the way ballast is managed and what kind of fuel oil can be used are being implemented this year. That suggests there is likely to continue to be a clear delineation between sector’s winners and losers.

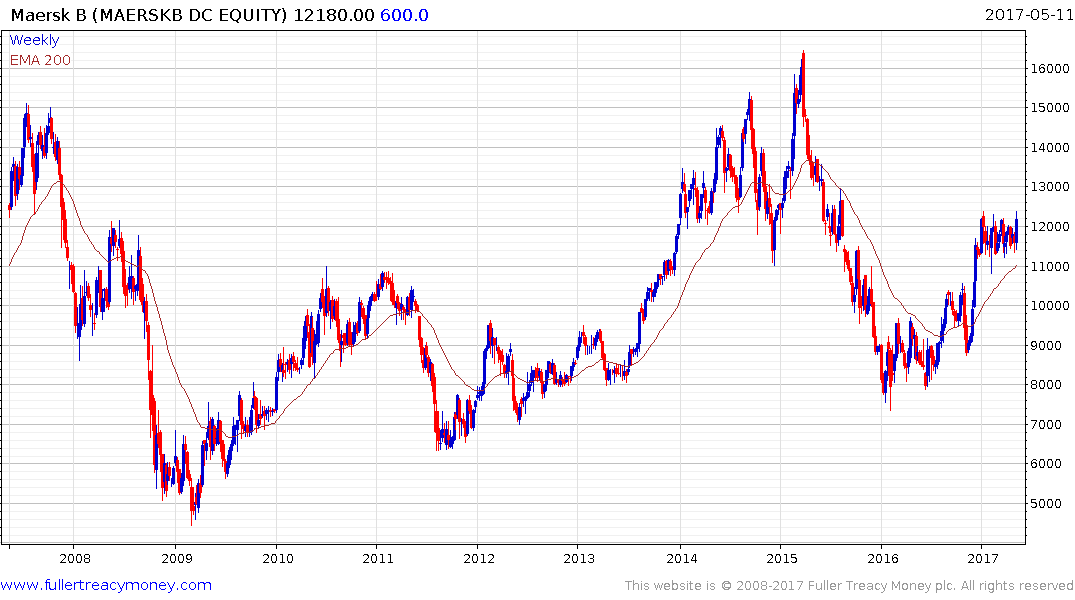

Maersk has been largely rangebound since the beginning of the year but is pressuring the upper boundary and a sustained move below the trend mean, currently near DKK11,000 would be required to question medium-term scope for additional upside.

Among shipping companies that experienced explosive breakouts earlier this year a number of pulled back sharply. Diana Shipping is representative; falling from an early April peak of $6.20 to today’s low of $3.66. This area represents the region of the trend mean and the 17-month progression of higher reaction lows and therefore represents a potential region where demand could be reasserted.