Stretching Thin

Thanks to a subscriber for this heavyweight 114-page emerging market fixed income focused for report from Deutsche Bank which may be of interest. Here is a section on Saudi Arabia:

Large FX buffers buy time despite high fiscal breakeven KSA also has a high fiscal breakeven, expected to reach USD84 in 2017 according to the IMF and somewhat lower according to our estimates at USD72. As such fiscal reform is a priority, but over USD500 billion of SAMA reserves and the potential for part-sale of oil assets give flexibility of timing. However, arguably, the size and conservative nature of the Kingdom makes early reform a necessity.

Saudi Arabia’s approach to breaking its hydrocarbon habit has been to undertake something akin to a revolution in the country, as outlined in the Vision 2030 document and the shorter-term National Transformation Program 2020. The challenges are significant, given the elevated fiscal breakevens, delivering 11% budget deficit in 2017. Ambitions for achieving a balanced budget by 2020 (“Fiscal Balance Program 2020”), suggests the bulk of the social and economic overhaul should be front-loaded.

The National Project Management Office (NPMO), announced in September 2015 and tasked with moving projects forward in a coordinated fashion, has stalled. Furthermore, headline projects such as the Makkah Metro or the North-South rail line have been pushed out. Of the USD1 trillion pipeline, the only actual new project awards have been limited to Aramco investments. Until the NPMO is fully in place, any major project awards will be exceptions.

By contrast the establishment of the Bureau of Capital and Operational Spending Rationalization – an entity aimed at reviewing the feasibility of projects less than 25 per cent complete has moved forward with a review of some of the SAR1.4 trillion of projects in development. On the first round, approximately SAR100 billion of costs have been cut. Some projects will be cancelled, others retendered or converted to self-financing PPP-style contracts, but the certainty is that these cannot continue to be financed substantially from the public purse. There has also been additional controls on current spending with cuts in civil service allowances. The switch from an Islamic contract year to a slightly longer Gregorian one amounts to a 3% pay cut.

Here is a link to the full report.

With significant reserves Saudi Arabia has time to deal with a relatively low oil price environment and the effect that is having on its fiscal condition. Rolling back spending commitments would leave the country in a much healthier position to compete considering its abundant resources and low cost of production. The new administration has embraced the need for change both in terms of domestic reform and investing in sectors outside of energy. The soon to launch $100 billion Softbank Technology Fund is a case in point.

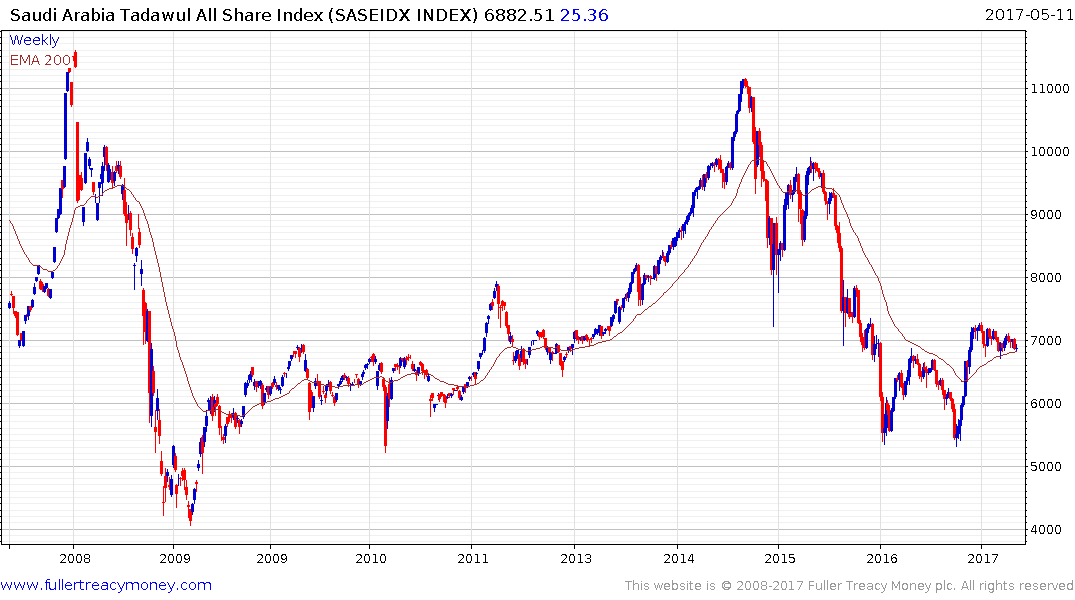

The domestic stock market surged higher late last year to break a two-year progression of lower rally highs and has been ranging mostly above the trend mean since. A sustained move below it would be required to question medium-term scope for additional upside.

How successfully Saudi Arabia transitions away from its almost total dependence on oil will likely have a major impact on how likely the kingdom will be to support additional supply cuts.

Back to top