Coffee Lovers Set for Price Pain as Vietnam Reserves Shrink

This article from Bloomberg may be of interest to subscribers. Here is a section:

The slump in Vietnamese inventories pushed domestic robusta prices in Dak Lak province, which accounts for about one-third of the country’s harvest, to a record high of 49,100 dong ($2.10) a kilogram last week.

Carryover stockpiles are seen at 200,000 tons at the start of the new season on Oct. 1, compared with an estimated 400,000 tons a year earlier, according to the survey. Output may fall 6% to 1.72 million tons in 2022-23, the survey showed. The robusta variety accounts for about 90% of Vietnam’s coffee output.

A drop in the planting area for “profitable” fruit trees and a rise in fertilizer prices will probably affect production in 2022-23, said Do Ha Nam, Intimex Group’s chairman, and the Vietnam Coffee and Cocoa Association’s deputy head.

Citigroup Inc. has trimmed its projection for coffee production in Vietnam this year and the next as local crop surveys indicated cherry development had suffered from the lack of fertilizer usage this year. “This poses substantial risk to the prospect for the upcoming planting season,” it said in a report earlier this month.

This is a stark example of how the rising cost of fertiliser has eaten into the ability of farmers to boost yields and improve the quality of their crops. There is no easy way out of this conundrum.

Prices for the commodity will need to rise enough to provide farmers with the resources to purchase fertilisers. Alternatively, energy prices have to collapse during a global recession which would greatly reduce the cost of producing agricultural products. The typical cycle is prices rise, farmers invest in additional new supply and the market crashes at exactly the same time as yields improve.

The reality everyone has to face today is we eat natural gas, and right now that is not cheap.

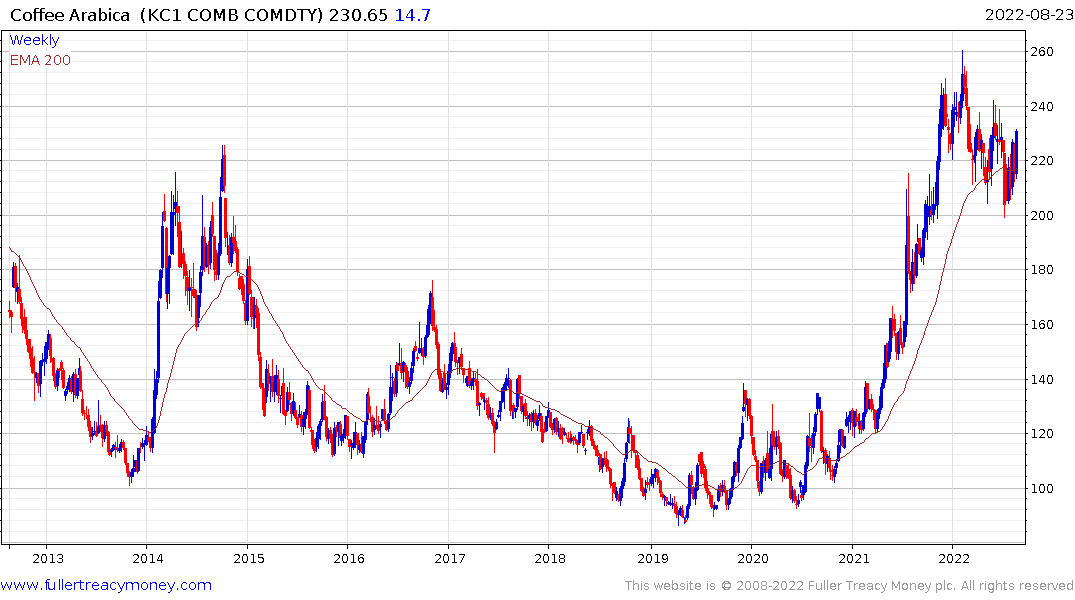

Robusta coffee has been ranging mostly below $2200 since 2012. It popped above that level at the end of 2021 and rebounded strongly over the last month.

Robusta coffee has been ranging mostly below $2200 since 2012. It popped above that level at the end of 2021 and rebounded strongly over the last month.

Arabica jumped this week to test the sequence of lower rally highs. The failed break below 200