Heard on the Street: Tesla Rival Finds Its Lane

This article from the Wall Street Journal may be of interest to subscribers. Here is a section:

BYD is scouting lithium mines to protect itself from surging prices of the essential battery metal. Despite rapid sales growth, BYD's margins were hammered last year due to high raw material prices. Net margins fell to 1.4% in 2021 from 2.6% a year earlier, according to FactSet. That compares with Tesla's 10.3%.

There is some hope of that reversing however, as commodity prices retreat again and new, pricier models hit showroom floors: The models in BYD's launch pipeline are twice as expensive as prior ones, according to Goldman Sachs. The bank expects BYD's net margin to expand to 2.2% this year and 2.5% in 2023.

BYD has paid down debt rapidly in recent years and as of December had more cash and short-term investments on hand than debt according to FactSet -- a reverse of the situation as recently as June last year.

In the downside scenario of a nasty Chinese recession, that could prove to be an important cushion.

One obvious challenge at home will be getting buyers to pony up for pricier cars with China's economy, potentially at least, deep in the doldrums. But for now at least, the company seems confident. BYD, which reports on Aug. 29, said in July that first-half net income could climb as much as 207% to 3.6 billion yuan, equivalent to about $528 million.

Sustaining such heady numbers will be a challenge but with strong, cost-effective technology, an integrated supply chain and Beijing's determination to dominate the sector, it would be a mistake to count BYD out.

Chinese lithium carbonate prices are still close to CNY500,000 a tonne. Significant investment and political will are being devoted to boosting supply of the metal but that is a medium-term objective. Meanwhile, nickel, copper, cobalt and manganese have all retraced much of their initial price spikes. That’s more about less demand than a sudden increase in supply.

The challenge in the short-term is vehicles are getting more expensive. Consumers were capable of absorbing higher costs during the inflationary boom period. That’s going to be more difficult as we head into the inflationary bust period when liquidity tightens to the point where spending focuses on necessities.

BYD has lost uptrend consistency. The share failed to sustain the breakout to new highs in July and is now trading back below the 200-day MA. A clear upward dynamic will be required to question potential for a further test of underlying trading. The deteriorating outlook for hydro power in China may also be responsible for recent weakness since it impacts production momentum.

BYD has lost uptrend consistency. The share failed to sustain the breakout to new highs in July and is now trading back below the 200-day MA. A clear upward dynamic will be required to question potential for a further test of underlying trading. The deteriorating outlook for hydro power in China may also be responsible for recent weakness since it impacts production momentum.

Tesla steadied today ahead of its 3:1 split aimed at making the stock and associated options more accessible to retail traders.

Tesla steadied today ahead of its 3:1 split aimed at making the stock and associated options more accessible to retail traders.

Lucid Group is attempting to steady in the region of the lower side of its evolving four-month range.

Lucid Group is attempting to steady in the region of the lower side of its evolving four-month range.

Rivian has held a mild sequence of higher reaction lows since May and is steadying from the most recent at present.

Rivian has held a mild sequence of higher reaction lows since May and is steadying from the most recent at present.

Ford has abandoned manufacturing sedans and intends to meet is emissions requirements with EVs. That frees up capacity to make pickups which are proven money makers. The share has rebounded emphatically since bottoming in July.

Ford has abandoned manufacturing sedans and intends to meet is emissions requirements with EVs. That frees up capacity to make pickups which are proven money makers. The share has rebounded emphatically since bottoming in July.

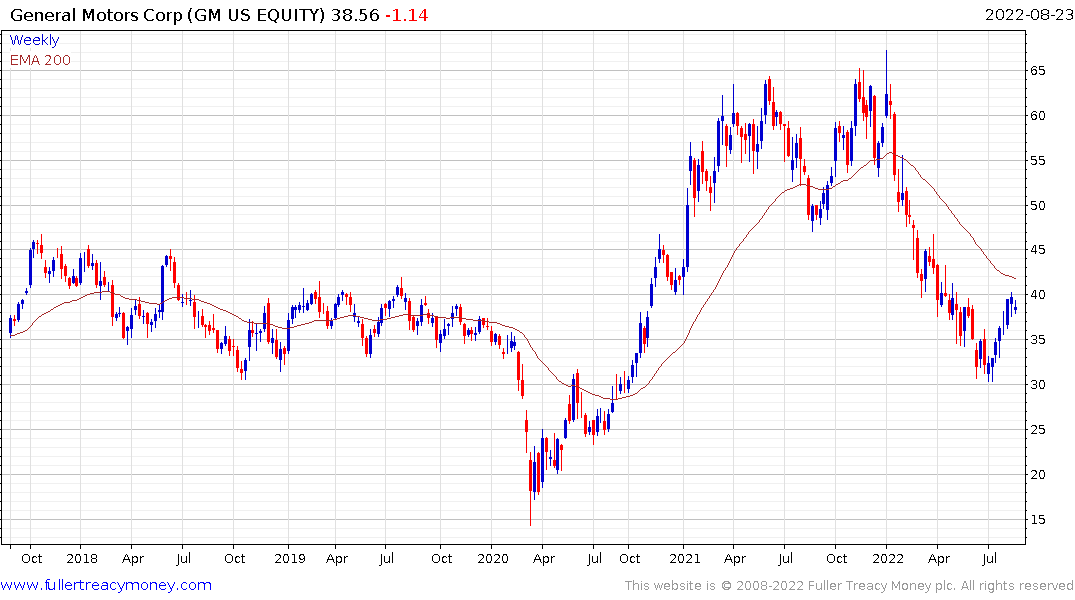

GM is following a similar strategy and has also rebounded impressively.

GM is following a similar strategy and has also rebounded impressively.