China Stocks Still Adored Abroad as Losses Mount for Locals

This article by Sofia Horta e Costa for Bloomberg may be of interest to subscribers. Here is a section:

Mainland markets have struggled under the government’s campaign to trim risk in the financial sector, making stocks the least linked to the offshore index since 2006. With history showing sentiment can flip quarter to quarter, international traders are riding on a bet that solid corporate and economic data will continue to support the divergence.

“These investors don’t believe that any of this will lead to a crisis,” said Caroline Yu Maurer, the Hong Kong-based head of Greater China equities at BNP Paribas Investment Partners.

“For stocks, people are buying earnings growth rather than macro stories. The market is quite resilient as long as that holds.”For a gauge that is rarely this expensive relative to the rest of the world, improving earnings are emerging as a key line of defense against worsening sentiment. While profit estimates are being upgraded at the fastest pace since 2010, they’re failing to keep pace with the index’s rally, which has pushed valuations toward the highest levels since 2015. The gauge gained another 0.4 percent on Wednesday, while the Shanghai Composite slumped 0.9 percent to its lowest level since October.

The mainland Shanghai Composite is heavily weighted by state owned enterprises like banks and infrastructure companies which are the primary focus of the clamp down on the shadow banking sector and financial leverage in “private lending clubs”. Privately owned companies, many of which are listed in Hong Kong or the USA continue to perform not least because they are not overly impacted by the financial sector tightening currently underway.

Nevertheless, the banking sector still needs to be monitored because a run on the banks, which we might regard as a worst case scenario, would have inevitable knock-on effects for the whole economy.

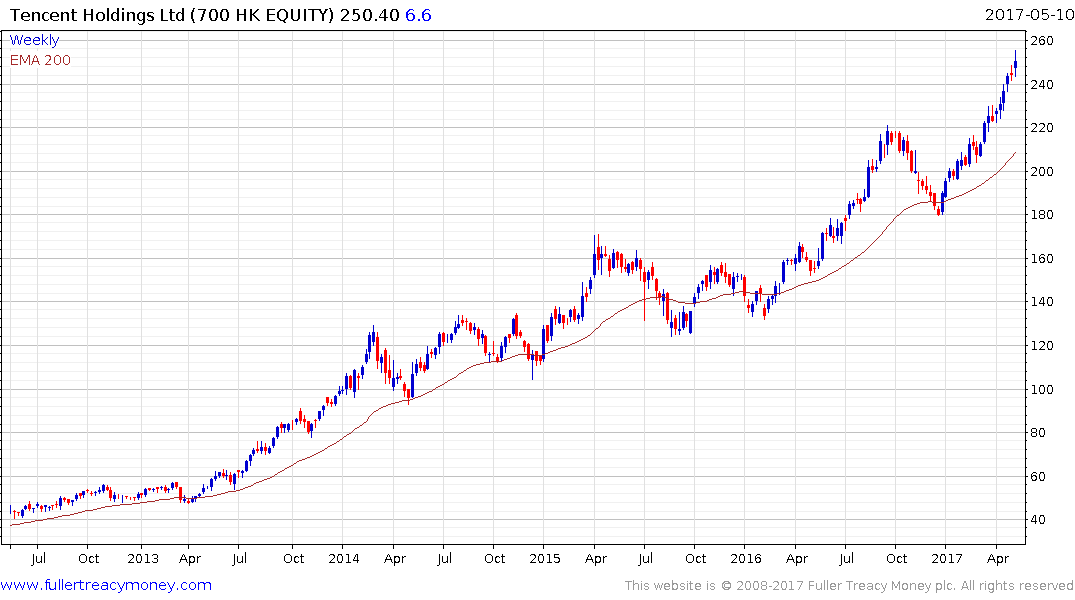

Tencent Holdings has paused in the region of HK$250 and some consolidation of what has been a very impressive advance is looking more likely than not.

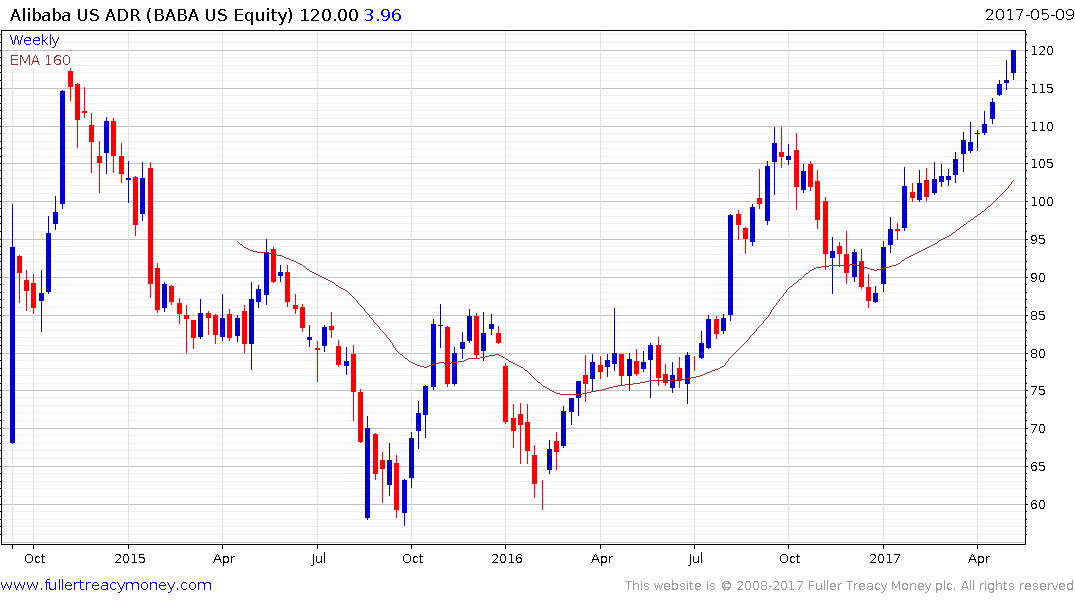

Alibaba continues to perform and took out its post IPO peak this week. It has now advanced for 12 consecutive weeks so some consolidation is inevitable at some stage, but a clear downward dynamic will be required to signal it is beginning.

JD.com announced it turned a profit this week and also moved to a new high. It is equally overextended and susceptible to some consolidation.

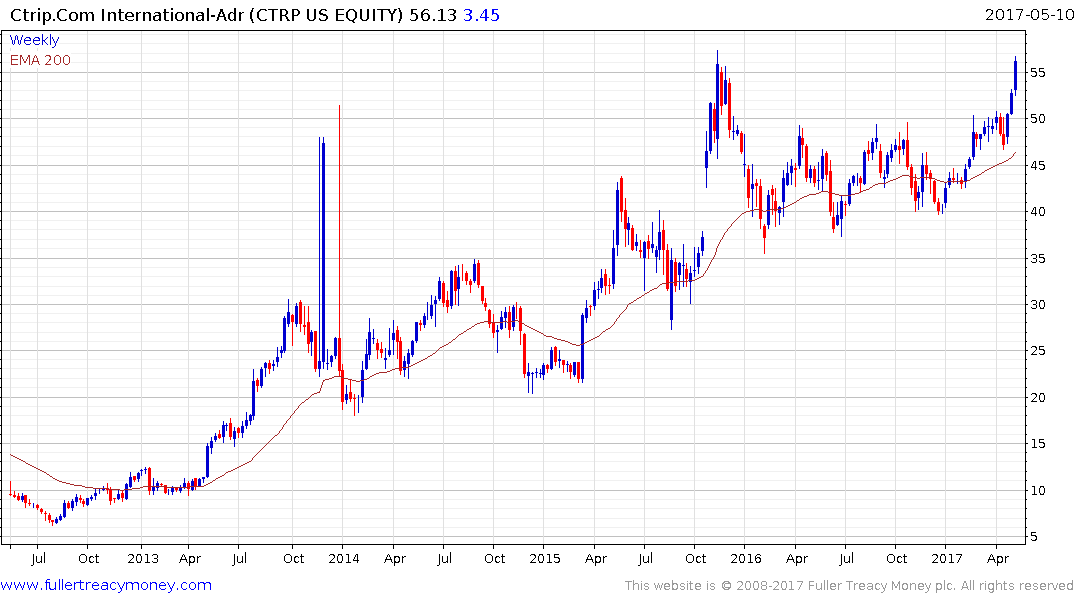

Ctrip broke out of a yearlong range last week and is now testing its 2015 peak. A clear downward dynamic would be required to question potential for additional upside.

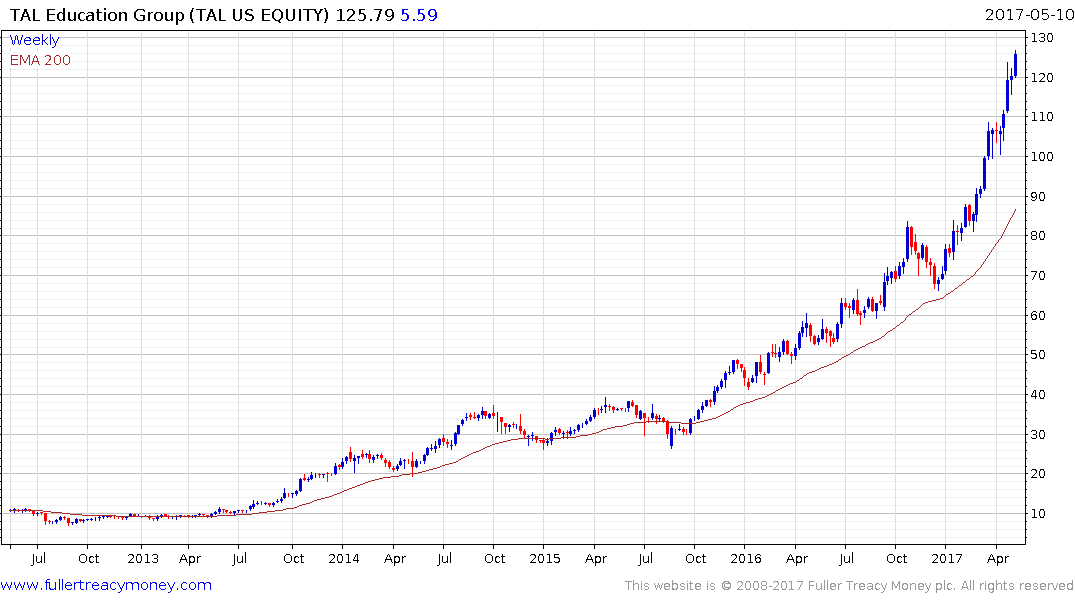

TAL Education may exhibit one of the clearest accelerations of any share but it continues to hold a consistent progression of higher reaction lows.

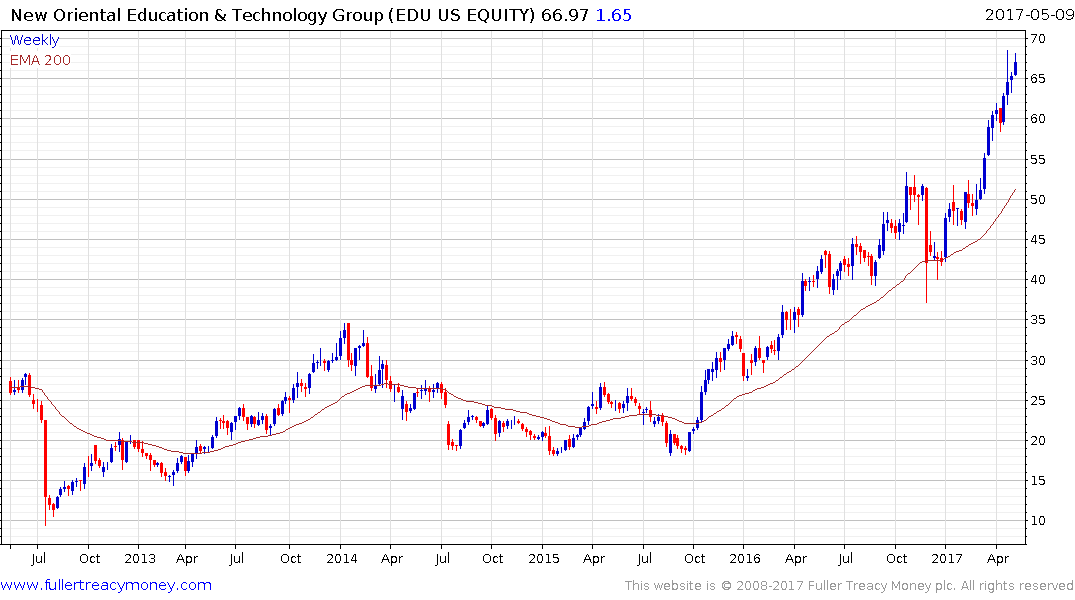

New Oriental Education has a similar pattern.

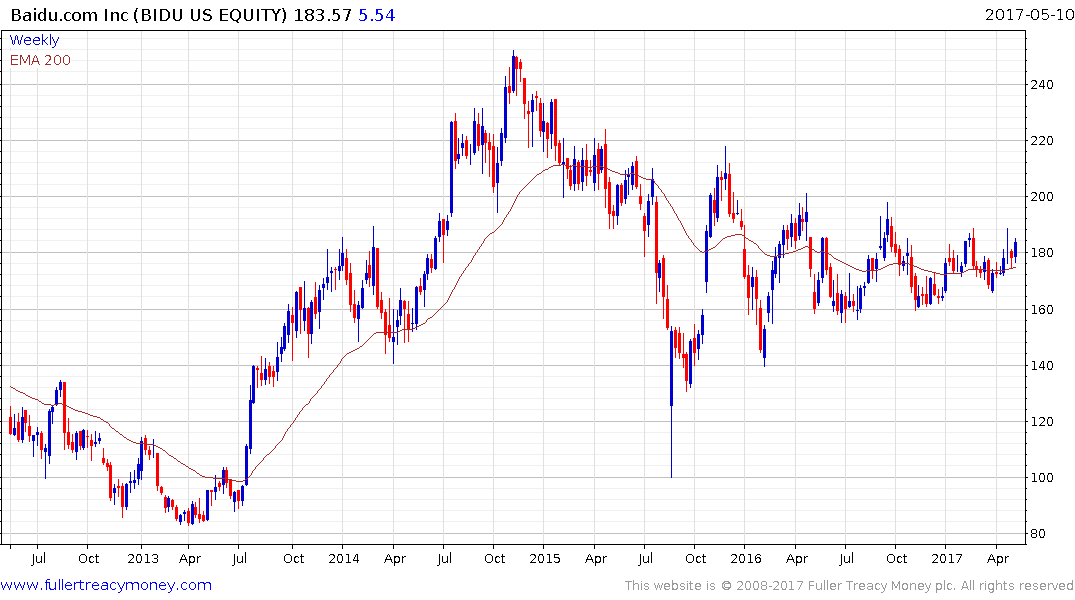

Baidu has been confined to a triangular pattern for almost two years and is rallying back up towards the most recent lower high. A break the tightening band of trading could result in a breakout in either direction.

Netease.com has returned to test the region of the trend mean and steadied this week from above the $250 area.

YY Inc. rallied this week to break a two and half year progression of lower rally highs.

Back to top