Biotechnology Sector update

Thanks to a subscriber for this report from Oppenheimer dated in April which may be of interest. Here is a section:

Industry’s sales/earnings growth and margin structure are enviable, M&A on-tap

1. With increases in sales and earnings power and improving product approval rates, large-cap biotech has stuck to its knitting, i.e., developing products for smaller, more focused disease areas with high unmet needs.

2. 2015 was a banner year for worldwide biopharma M&A. After downturns, such as seen in 2016, M&A typically picks up as valuations become realistic.

3. Drug pricing, recent slowdown in large-cap sales/earnings momentum, many companies between product cycles and some clinical disappointments, are all still overhangs.

And

1. Sales/earnings growth deceleration following peak sales/earnings in 2014 for the large-cap companies.

2. Has led to generalist and momentum money reducing exposure/abandoning the sector.

3. This deceleration in sales/earnings growth to trough in 2017, then rapidly start accelerating again.

4. Currently GILD is the laggard in its peer group for expected sales/earnings growth over the next three years.

Here is a link to the full report.

R&D is expensive, riddled with uncertainty and big bureaucracies tend to stifle the creativity necessary for the kind of out of the box thinking which leads to breakthroughs. The result is that large pharmaceuticals companies often buy promising biotechnology companies, usually at a premium, rather than invest in the uncertainty of in-house development.

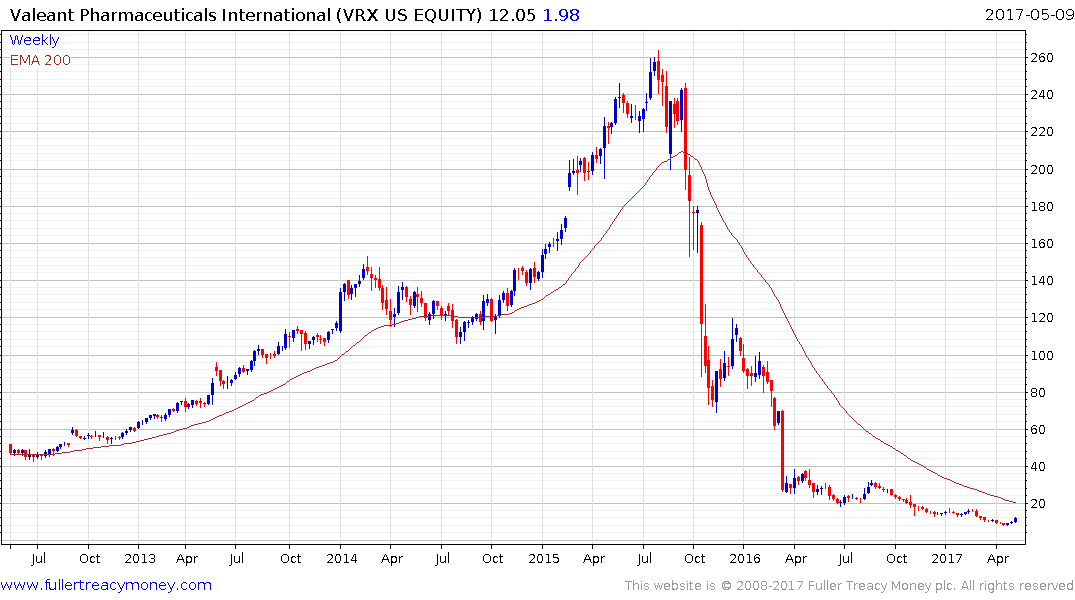

The Nasdaq Biotech Index has stabilised above the 2016 lows and is now trading above the 200-day MA. There has been considerable rotation within the Index with previous high fliers like Gilead Sciences and notorious Valeant Pharmaceuticals having led declines over the last 18 months.

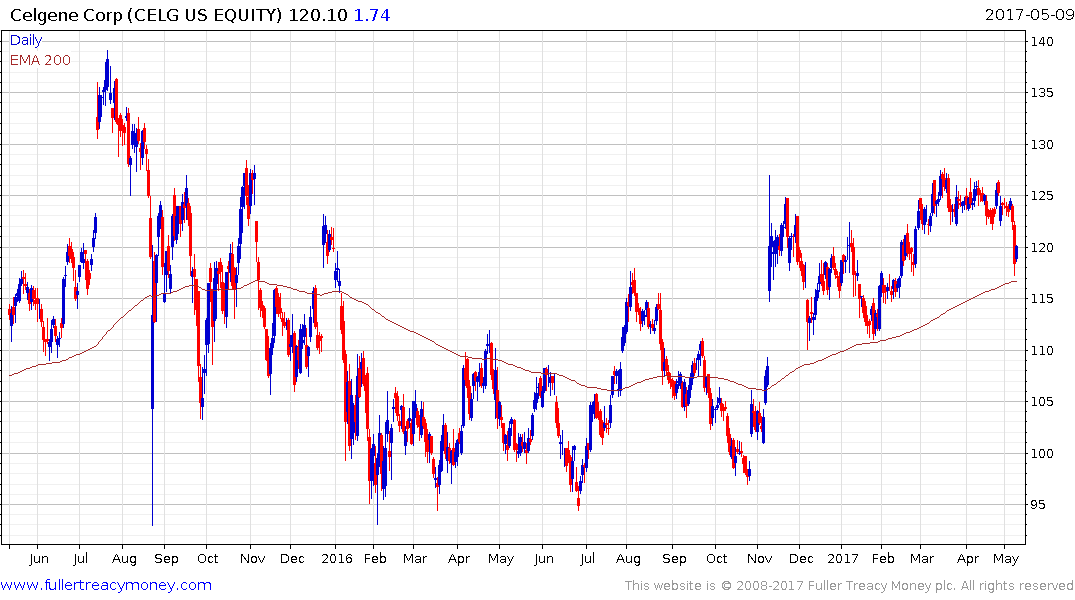

Celgene by comparison has held up better,

Meanwhile Biogen is something of a bellwether for the sector since it peaked ahead of the wider Index and subsequently stabilised before other shares. It is currently falling back from the $300 for the fourth time since July and will need to continue to hold the $250 if near-term potential for additional higher to lateral ranging is to be given the benefit of the doubt.