China Deposit Insurance Plan Seen as Risk for Small Banks

This article from Bloomberg News may be of interest to subscribers. Here is a section:

While the move could limit systemic risks, it may fuel competition for deposits and drive up lenders’ borrowing costs as savers divert money to stronger banks or those that offer higher interest rates, according to Jim Antos, a Hong Kong-based analyst at Mizuho Securities Asia Ltd.

China may offer customers deposit protection as soon as the start of 2015, the official Xinhua News Agency reported, citing unidentified sources. The insurance would help to prepare China’s financial system for bank failures as the economy slows and authorities allow banks to pay higher interest on deposits.“Competition for large deposits will clearly increase, with pricing and the perceived financial strength of the banks being the key factors for consumers,” Antos wrote in an e-mail.

“We expect to see a shift of large deposits to the megabanks which, being government-owned, are viewed as stronger institutions.”The government may cap coverage at 500,000 yuan ($81,000) and set different premium levels based on a bank’s regulatory rating under the plan, Economic Information Daily reported today, citing a person close to regulators.

Multiple government departments, including the People’s Bank of China and the China Banking Regulatory Commission, are preparing the program, Xinhua said.

One of the challenges with assessing the outlook for the Chinese market is that there has been so much bearish commentary over the last few years that it is difficult to decipher which arguments hold water. What appears clear is there is an impending issue with bad loans coming down the pipe. As the economy slows and state investment priorities evolve it is reasonable to assume that not all loans taken out in the last decade are going to be paid back in full.

The more important consideration at the present time is that measures are being put in place to deal with this eventuality. The creation of the deposit insurance program is a positive initiative and suggests the Chinese government is not willing to continue to engage in blanket bailouts of troubled institutions.

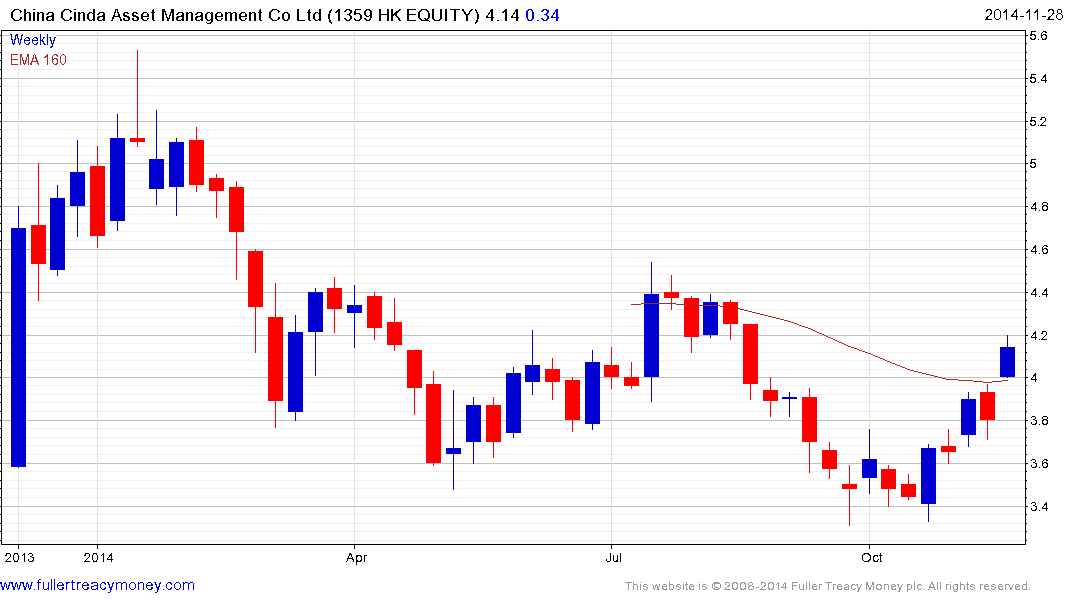

Cinda Asset Management IPOed in Hong Kong last year. It is the legacy bad bank left over from the bailouts that followed the banking crisis of the 1990s. Considering China’s experience with such structures and the recent pressure absorbing private sector banking debt has represented for Europe, China has obvious incentives to introduce a deposit insurance corporation structure which will allow for an orderly wind down of troubled institutions.

The FTSE/Xinhua China A600 Bank Index has posted a bigger rally this week than at any time since 2007. We can conclude that the five-year base has been completed provided it holds the move above the psychological 10,000.

Back to top