StanChart Rating Cut by S&P for First Time in 20 Years

This article by Stephen Morris for Bloomberg may be of interest to subscribers. Here is a section:

S&P cut the group’s credit grade one level to A from A+, with a negative outlook, according to a statement today. The lender reported falling revenue, increasing operating expenses and higher loan impairments in the third quarter, helping drive down the stock the most of any major British lender this year.

Standard Chartered “is going through a tough period of late after many years of solid growth and strong financial performance,” S&P analysts Joseph Leung and Giles Edwards said in the statement. “The group’s performance weakened partly because subdued trading conditions have hit revenues while operating expenses continue to grow.”

Chief Executive Officer Peter Sands, 52, and Chairman John Peace have come under pressure amid a 31 percent decline in the shares this year. The bank met with its biggest investors this month to outline a refined strategy and reassure them it would continue to cut costs to help return to profit growth. The London-based bank, which makes about three-quarters of its earnings in Asia, is closing businesses and eliminating jobs after a drop in earnings last year ended more than a decade of growth.

The majority of investors associate Standard Chartered with its Hong Kong and Chinese operations and it has made some high profile moves into developing African markets over the last decade which have also been welcomed.

One would assume the bank’s Chinese interests should be improving in line with the broader sector as monetary policy eases. However it is in their lending to resources companies where the bank has had issues. These are likely to be exacerbated by the declines in oil, iron-ore and today’s breakdown in the copper complex. Considered the depth of the decline, the sustainability of the share’s 5.76% yield is in question.

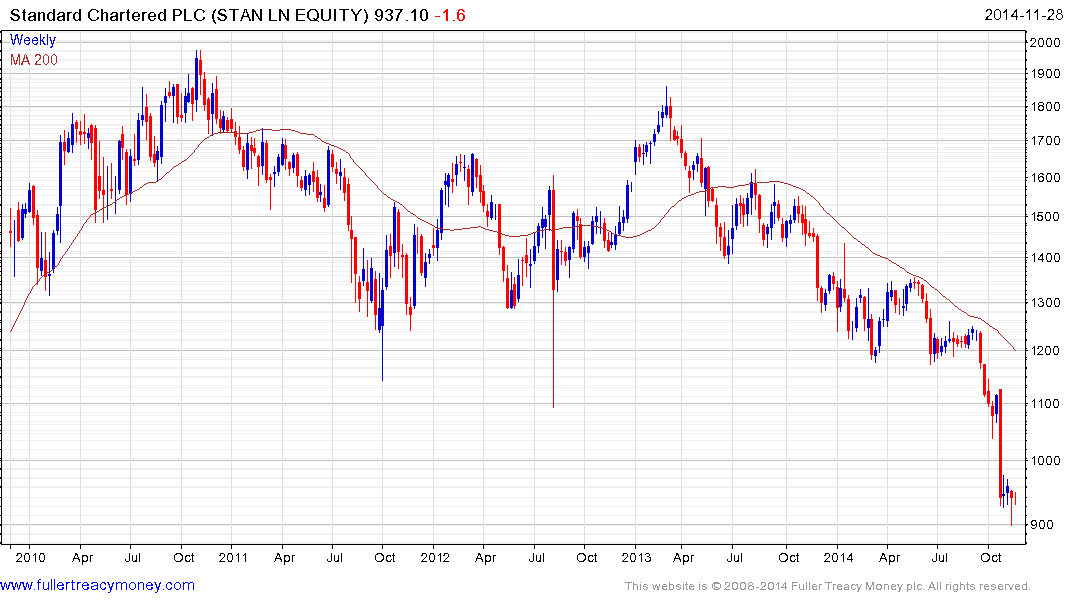

Standard Chartered has accelerated lower over the last month and while some temporary relief has been found in the 900p area, a break in the progression of lower rally highs will be required to signal more than a temporary return to demand dominance.

Back to top