China's CATL Is Said to Pick Banks for $5 Billion Swiss GDR Sale

This article from Bloomberg may be of interest to subscribers. Here is a section:

CATL accounts for the largest share of the global electric-vehicle battery market, according to data from Seoul-based SNE Research. It sold a total of 165.7 gigawatt-hours of batteries in the January-November 2022 period, almost three times as much as second-placed BYD Co., a Chinese automaker that also manufactures batteries.

CATL’s market share was about 35% in the first 10 months of last year. The Fujian-based company supplies carmakers including Volkswagen AG, Geely Automobile Holdings Ltd., Nissan Motor Co. and Tesla Inc., which delivered fewer EVs than expected last quarter, despite offering some price cuts.

In 2017, CATL raised about $822 million in an initial public offering in Shenzhen. The company raised another 45 billion yuan ($6.7 billion) in a private share placement last year. China Securities was the lead sponsor, while CICC, Goldman Sachs and UBS were among the co-lead underwriters.

Shares of CATL have fallen about 18% in the past year, valuing the company at about $172 billion.

The opportunity to buy CATL shares will be welcomed by the global investment community since not everyone has the opportunity to trade in domestic Chinese stocks. The challenge is CATL has appreciated significantly since its IPO so in buying today one is betting both the company retains its dominance as a battery manufacturer and market growth approaches optimistic forecasts. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/battery-2030-resilient-sustainable-and-circular

The Chinese listed share is currently firming from the region of the 200-day MA; no doubt buoyed by the GDR news.

The Chinese listed share is currently firming from the region of the 200-day MA; no doubt buoyed by the GDR news.

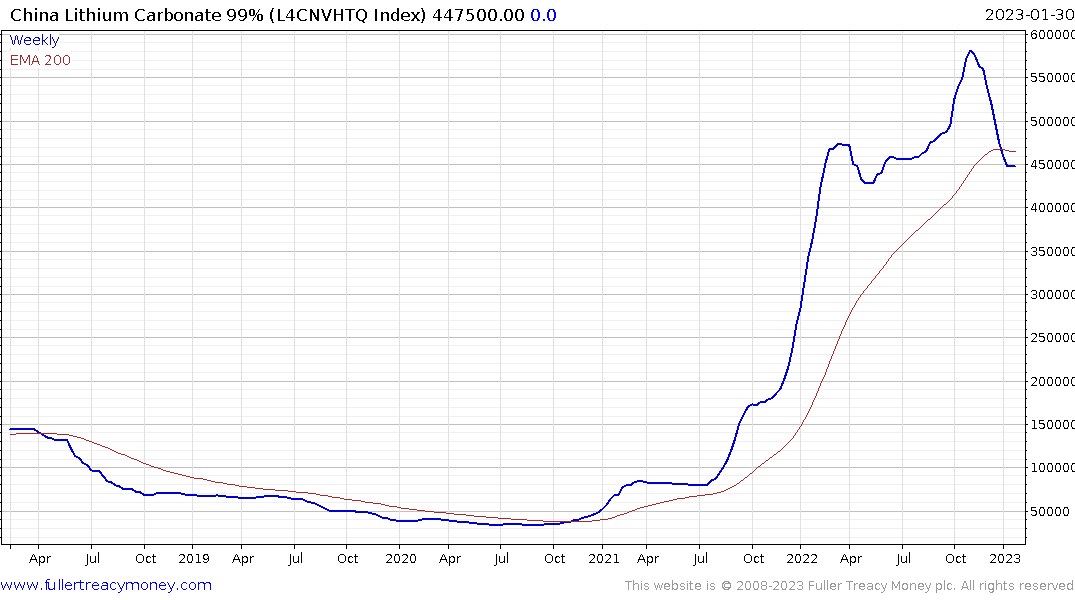

Lithium prices have peaked. As additional supply comes to market there is scope for a significant unwinding of the 2021/22 advance.

Lithium prices have peaked. As additional supply comes to market there is scope for a significant unwinding of the 2021/22 advance.

Copper rebounded impressively over the last six months but is now susceptible to at least some consolidation.

Copper rebounded impressively over the last six months but is now susceptible to at least some consolidation.

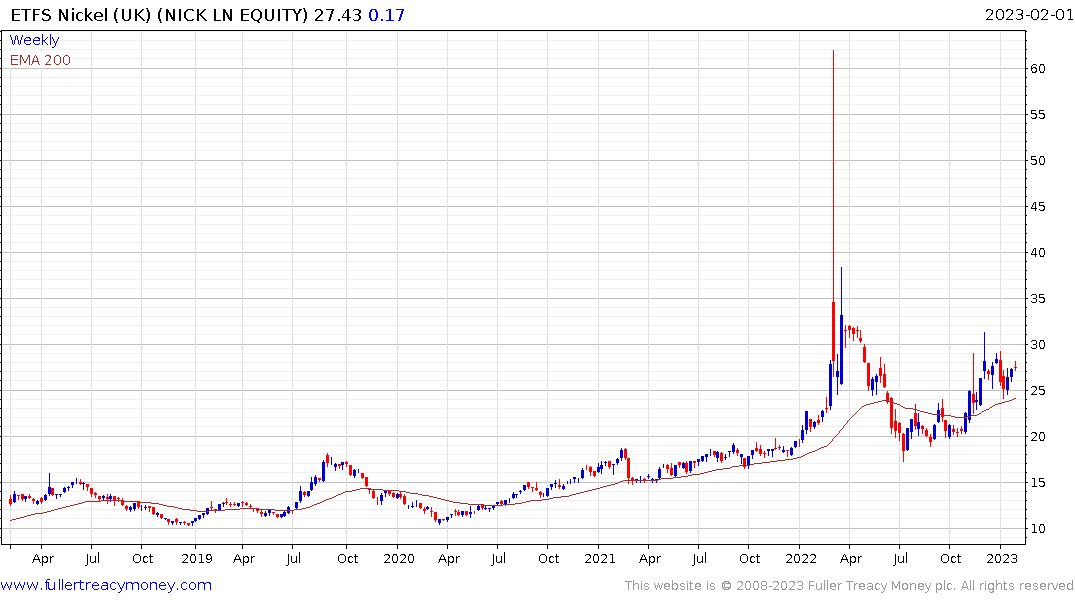

Nickel is pausing in the region of the upper side of its three-month range.

There has been a lot of excitement about the prospect of zinc-iron batteries. The zinc price is pausing at the upper side of its six-month range.

Stable to lower input prices should be beneficial for battery manufacturers. Meanwhile, the FTSE-350 Metals & Mining Index no longer includes BHP but shares a similar pattern anyway. It is currently unwinding the short-term overbought condition.

Stable to lower input prices should be beneficial for battery manufacturers. Meanwhile, the FTSE-350 Metals & Mining Index no longer includes BHP but shares a similar pattern anyway. It is currently unwinding the short-term overbought condition.