The January Barometer

This article from Putnam may be of interest. Here is a section:

Table 1 contains historical return data for the S&P 500 in the first five days of January as well as annual returns. This is the “Early Warning System.” The last 46 times that the first five days had positive returns, the full-year return was positive 38 times, for an 82.6% accuracy ratio. The average S&P 500 gain was 14.3% in those years.

The second part is the S&P 500 return in January and the accuracy in forecasting the return for the year. In years when the S&P 500 had positive returns in the month of January, the average return for the year was 17.6%. The indicator has registered 10 major errors since 1950, for an 85.7% accuracy ratio.

74% of time, the stock market finishes up on the year in nominal terms. The big question for investors is whether the strong positive return for just about every asset in January will improve those odds. At least the market is starting from a lower level so the odds of achieving that goal has been improved.

The best performers on the S&P500 so far have been growth companies like Warner Bros Discovery, Tesla and NVidia. The worst performers have been defensive companies like Northrop Grumman, Pfizer and ADM.

At a minimum, the revival in the higher valued growth segment supports the view that interest rates will soon collapse. The Federal Reserve is still raising rates but Jerome Powell also said inflation has peaked in today’s press conference .

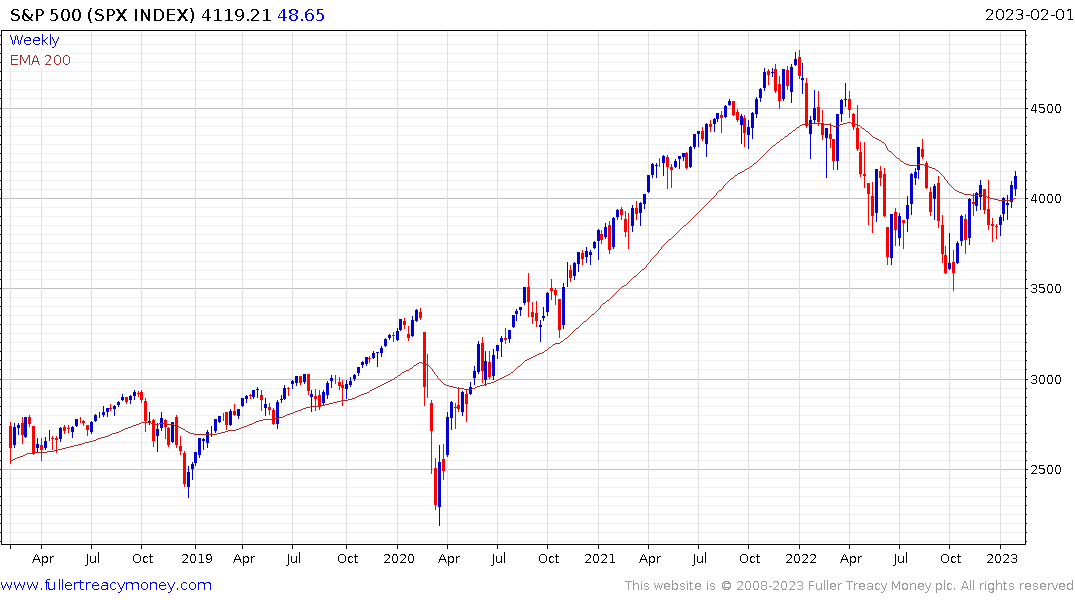

The S&P500 has been pausing in the region of the December peak. It needs to sustained the move above 4100 to confirm a return to demand dominance beyond short-term steadying. My guess for the end of the year is the markets are much more likely to range than trend in 2023.

The Nasdaq-100 extended its break above the 200-day MA and has broken its sequence of lower rally highs.

The Nasdaq-100 extended its break above the 200-day MA and has broken its sequence of lower rally highs.

Gold extended its rebound from yesterday’s intraday lows and continues to trend towards the peaks from back 2020 and 2022.