China Offers Rare Tax Rebate to Spur Home Purchase in Crisis

This article from Bloomberg may be of interest to subscribers. Here is a section:

China’s central government offered a rare tax incentive for residential purchases, ramping up support for the country’s embattled real estate sector.

Residents who buy new homes within one year after selling old homes will enjoy refunds for personal-income tax on the sale, according to a statement on the finance ministry website. The tax refunds will take effect from October till the end of 2023.

The novel tax policy comes after a yearlong slump in the housing market. To spark a turnaround, the central government is allowing nearly two dozen cities to lower mortgage rates for purchases of primary residences, while the central bank vowed to speed up delayed homes with more special loans.

“The measure may help restore some confidence,” said Xu Xiaole, a property analyst at Beike Research Institute. “It’s another demand-side policy targeting homebuyers after mortgage rate cuts.”

The tax break suggests the central government is ramping up support for people seeking to upgrade their homes. Previously, most incentives focused on first-time buyers, echoing President Xi Jinping’s mantra that “houses are for living in, not for speculation.”

Unless the person has held on to the home for at least five years, most big cities charge personal tax income on property sales when there’s a gain in value, usually 1% of the full amount or 20% of the gain.

Under the new policy, people who buy more expensive apartments will enjoy a full refund in this area. The tax break only applies to home upgrades in the same city.

The range of measures China is putting in place to support the housing market continue to increase. That’s good news for the domestic property sector and commodity demand in general. By limiting the tax cut to those also selling a property, the government is attempting to avoid stimulating property speculation but more money for the sector is certainly a positive.

Chinese markets are closed for the autumn golden week so this announcement was timed to ensure it would not cause volatility. The Offshore Renminbi steadied on the news.

Chinese markets are closed for the autumn golden week so this announcement was timed to ensure it would not cause volatility. The Offshore Renminbi steadied on the news.

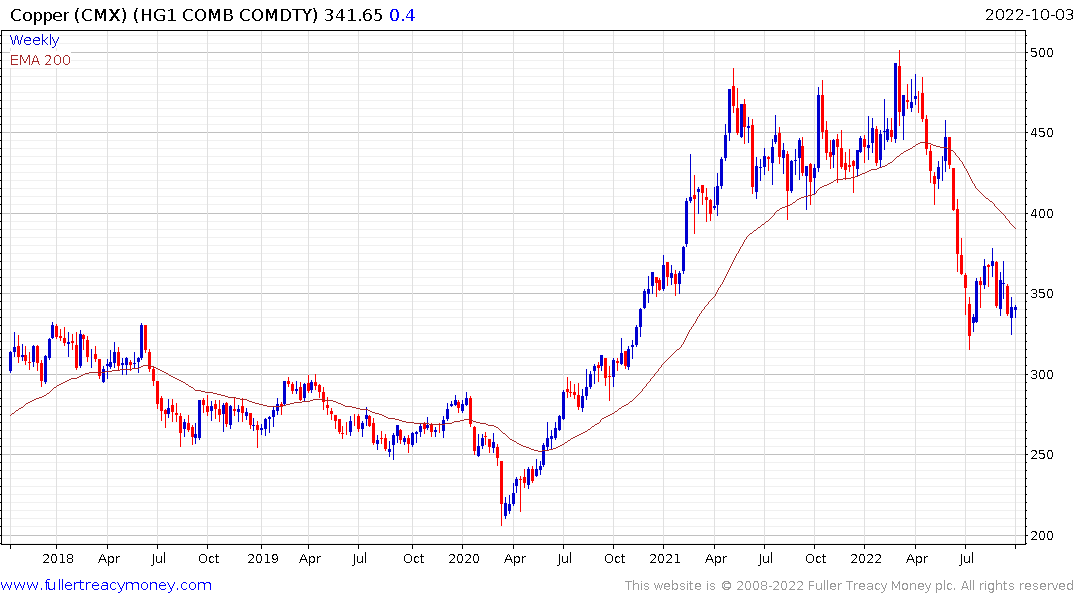

Copper is steading from above the July low so investors appear to be willing to wait and see how these stimulative measures pan out.