China Has a Debt Ceiling Problem of Its Own

This article from Bloomberg may be of interest. Here is a section:

Before Covid, regional authorities got roughly 40% of their income from local taxes, with the rest split almost evenly between land sales and subsidies from the central government.

Last year, land sales tumbled 23%, while total expenditure rose 6%. Beijing did increase its subsidy, but its support was not enough to plug municipalities’ budgetary hole. As such, local government debt has ballooned to 66% of China’s gross domestic product, from 29% in 2012, according to CLSA Ltd. estimates.

On the other hand, Beijing’s own book remains fairly pristine. The central government’s debt-to-GDP ratio stands at only 24%, versus 15% a decade ago.

Because of this power imbalance, China’s sovereign debt manages to be solidly in the investment-grade territory, even though the nation has become one of the world’s most leveraged. When investors fret about China’s elevated borrowings, they refer to those from real estate developers or municipal authorities. They do not talk about the central government’s book.

However, it is increasingly clear this fiscal arrangement is near a breaking point. According to CLSA, regional governments already spent 10.8% of their revenue on interest payments. Their expenses would have been a lot higher if the People’s Bank of China did not pump liquidity into the financial system. The average cost of borrowing for municipals fell from 5.6% in 2018 to 4.1% recently.

China does not have a property tax. That means regional governments rely on land sales to pad out their coffers. Without a vibrant property market, there is no building and therefore no land sales. The simple fact is China’s regional governments are in real trouble without a property bull market.

There is no possibility regional governments will be allowed to fail but that also implies that the sovereign debt to GDP ratio is unrepresentative of the true state of affairs. In a Communist system the government owns everything and is therefore liable for everything.

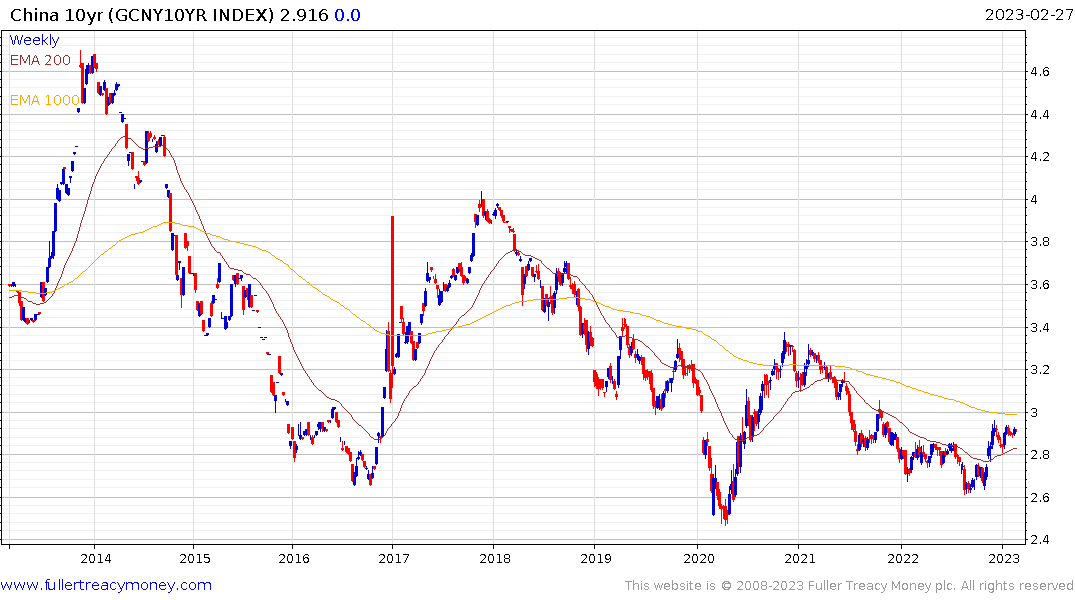

10-year yields have broken the two-year downtrend and continues to firm within the short-term range.

Having fully unwound the overextension relative to the 1000-day MA, the Renminbi has pulled back. It is now short-term overbought but a clear dynamic will be required to check the Dollar’s advance.