Applied Materials to Challenge ASML's Grip With New Machines

This article from Bloomberg may be of interest to subscribers. Here is a section:

The company’s Centura Sculpta machine — a so-called pattern shaping system — lets customers reduce the amount of time they spend on lithography, the process of using light to burn lines into silicon. Lithography has become increasingly complex and expensive, and the new approach will help streamline chip production while reducing waste, Applied Materials said Tuesday.

The move threatens to disrupt a lithography market dominated by ASML’s machines. Though Applied Materials isn’t challenging that company directly, it’s attempting to rethink the way the industry manufactures chips — the tiny electronic components that are built by depositing materials on disks of

silicon.

The investment case for ASML is that it is the undisputed leader in providing cutting edge equipment for the most advanced chip manufacturing factories. The company’s backlog of orders forms the basis for its high valuation. It’s also why investors have always been willing to step in and buy the big dip. The logic is that regardless of what happens in the semiconductor space, ASML’s products are essential for any company that wants to be the leader in the sector.

The challenge with such a dominant position is there is always an upstart that wants to compete for the crown. Applied Materials is not yet in a position to compete effectively but they are getting closer.

ASML rebounded from its intraday low today to confirm near-term support in the region of the 200-day MA.

ASML rebounded from its intraday low today to confirm near-term support in the region of the 200-day MA.

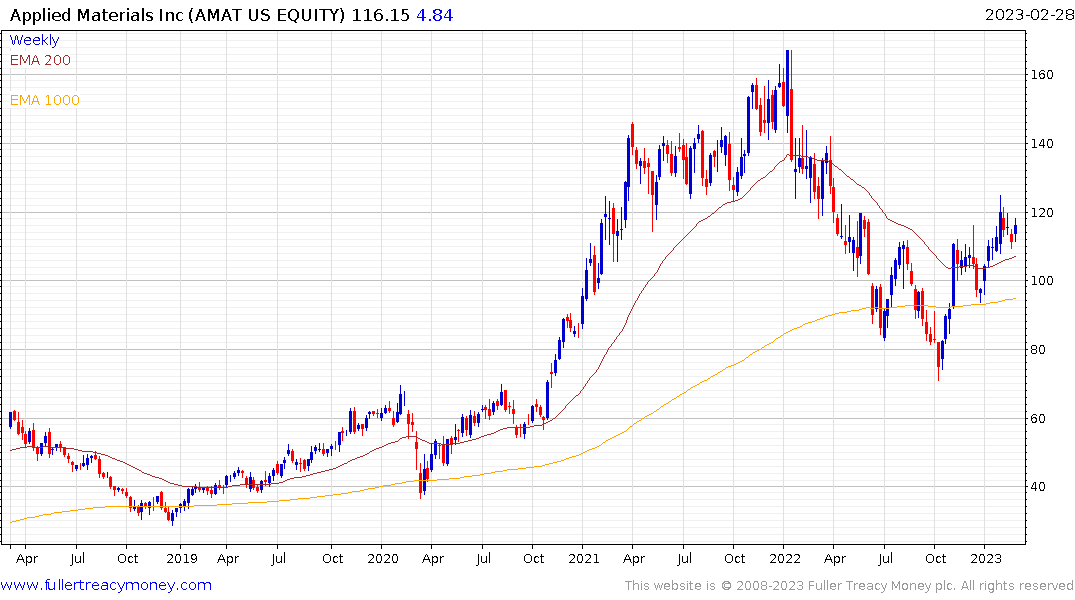

Applied Materials remains on a recovery trajectory as it bounces from its 200-day MA.

Applied Materials remains on a recovery trajectory as it bounces from its 200-day MA.