Buyback Extravaganza

Thanks to a subscriber for this interesting article from investorfieldguide.com. Here is a section:

First take all cash spent on buybacks, subtract all cash raised from issuance, plus all cash spent on dividends. Then divide by current market cap for a “yield.” (net bb + divs))/market cap

Same as above, but now include net debt issuance/reduction, where companies paying down debt in addition to dividends and buybacks are ranked more favorably. (net bb + divs + net debt reduction)/market cap

We will call the first “shareholder yield” and the second “stakeholder yield” because debt is part of the equation. For these purposes, I am excluding financial stocks, because they use of debt is so much different from other sectors. In practice, you’d want to make sector specific adjustments to measurements of debt, but here I am just keeping things pretty simple.

Now let’s run at typical test of the returns for stocks in the top decile by these two yield factors. Both have been strong selection factors. Here is the rolling 3-year excess return earned since the late 1980’s by the highest “yielding” stocks.Across the entire period, Stakeholder yield has delivered a return of 14.5%, and Shareholder yield a return of 12.4%. This means that investors have been rewarded more by buying stocks which are both paying back shareholders AND reducing their debt. But that script has flipped somewhat after the global financial crisis, arguably because interest rates have been so low. Companies taking advantage of cheap money in recent years seem to have had an edge.

Share buybacks have made a lot more headlines over the last couple of years than I remember them making before the credit crisis. This is despite the fact their weighting as a percentage of total market cap was higher than now. Some of the reasons for this include the fact that ETFs tracking buybacks are now available but also because so much debt has been issued at ultra-low rates to buy back shares.

Funding buybacks with debt issuance has been welcomed by investors not least because they don’t have to worry about paying tax on dividends and can hold the shares for long-term capital gains treatment. In fact most traders are happy with any piece of financial engineering that helps to inflate asset prices. However, as the above article points out the best type of buyback is accompanied with reductions in overall debt so that the supply of shares decreases along with financial leverage and helps to create value. This is not as evident today as it once was

Considering how reliant the market is on buybacks to act as a persistent source of demand, the potential for corporate spreads to rise as a result of the pullback in Treasuries is a potential concern since it would act as a headwind to additional bond issuance.

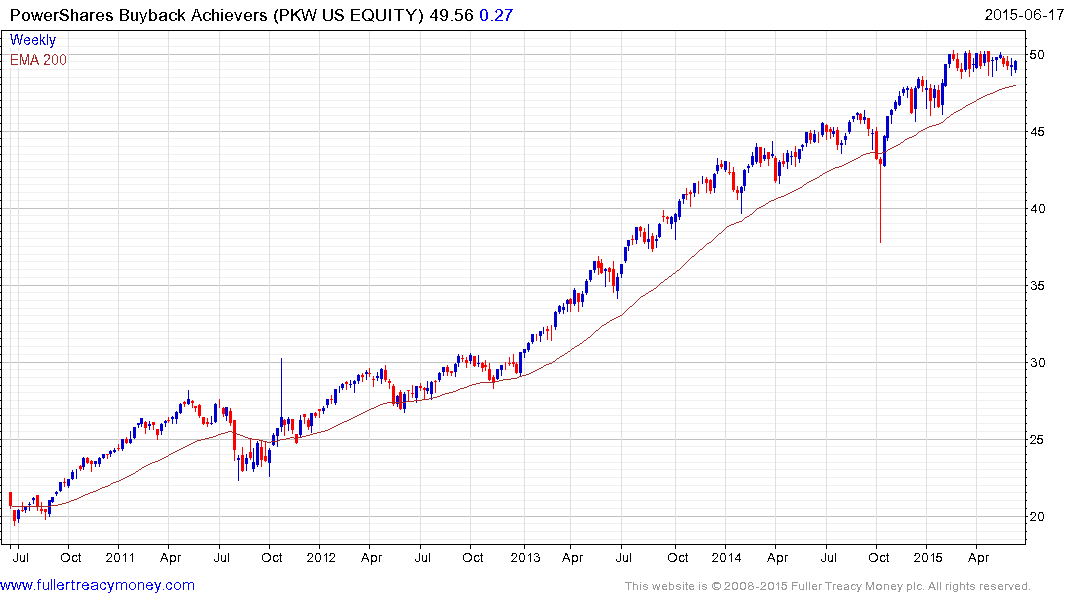

The PKW Buyback Achievers has been confined to a very tight range since late February and is currently bouncing from the region of the 200-day MA. It will need to continue to hold in the region of the trend mean on pullbacks if the medium-term trend is to remain consistent.

Back to top