Brookfield Cuts Value of Property Holdings Amid Market Swoon

This article from Bloomberg may be of interest to subscribers. Here is a section:

“Unfortunately, the negative sentiment is dragging down the real estate sector more broadly,” the firm’s president, Connor Teskey, told investors during an earnings call Wednesday. “We think that’s completely unfair.”

The Brookfield group is one of the world’s largest owners of prime office properties, with a portfolio that includes New York’s Manhattan West and London’s Canary Wharf. Office landlords in major cities around the world are being squeezed by a combination of higher borrowing costs and lower occupancy, as many companies continue to allow employees to work from home at least part of the time.

Brookfield Asset’s parent company has defaulted on mortgages covering more than a dozen office buildings, mostly in Los Angeles and around Washington.

The property market is “bifurcated” as high-quality assets perform well and lower-quality assets struggle, Teskey said on the call.

The durability of the work from home phenomenon will be tested by the upcoming recession. I’ve been working from home since 2007 and I can attest the better description is you live at work. However, the experience of entrepreneurial people versus those simply marking time is very different. Flexible time arrangements are not appropriate for every position. Efficiency metrics will quickly be developed to decide whether the cost of a large office building is outweighed by the productivity gain for happier more flexible workers.

How that trend develops is going to be a deciding factor in the outlook for the biggest commercial property buyers over the last decade and will play a significant role in pricing buildings going forward. Brookfield Corp continues to trend lower.

How that trend develops is going to be a deciding factor in the outlook for the biggest commercial property buyers over the last decade and will play a significant role in pricing buildings going forward. Brookfield Corp continues to trend lower.

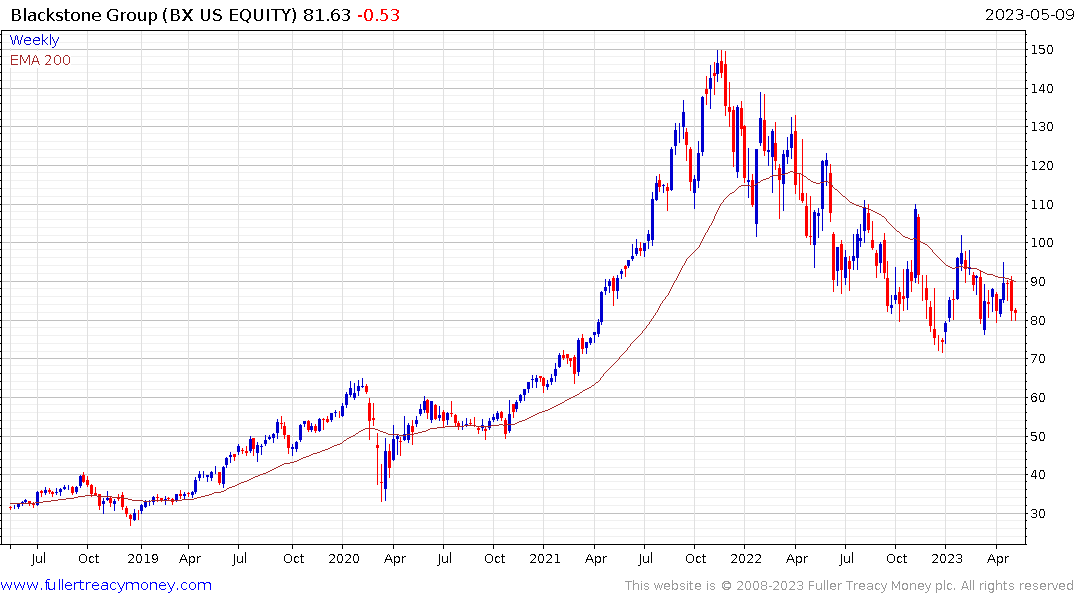

So is Blackstone.

So is Blackstone.

The USA’s regional banks have been among the most prolific lenders to the commercial property sector. As lending standards tighten, that is not great news for marginal commercial properties. The regional banks Index remains in a steep downtrend which suggests we are not yet at the end of this stressful period for the sector.

The USA’s regional banks have been among the most prolific lenders to the commercial property sector. As lending standards tighten, that is not great news for marginal commercial properties. The regional banks Index remains in a steep downtrend which suggests we are not yet at the end of this stressful period for the sector.