Australia Pledges $1.4 Billion in Bid to Be Hydrogen Superpower

This article from Bloomberg may be of interest to subscribers. Here is a section:

As countries compete for capital, investors and developers have said aggressive subsidies like the US Inflation Reduction Act — which provides $374 billion in funding for clean energy — will be needed to attract the vast investment required.

The new measures are a “great first step,” Fortescue Metals Group Ltd. said in a statement on Wednesday. The Australian iron ore miner has ambitions to become one of the world’s biggest green hydrogen producers and plans to reach final investment decisions on five projects around the world this year.

The announcement of significant investment in the green hydrogen sector comes hot on the heels of opening the Northern Territory to natural gas development. Regardless of how the global energy sector evolves Australia looks likely to be significant beneficiary. That also applies to coal exports for both steel and electricity generation.

The big unknown at present is how China’s demand for iron-ore and copper are going to evolve. National priorities dictate a stable property market but the days of developing new infrastructure at a breakneck speed are over. Instead, the new national priority is technological dominance and that is much less infrastructure dependent.

Fortescue Metals might be intent to dominate the future of hydrogen but all the company’s income comes from iron-ore. The share is holding the region of the 200-day MA at present but needs a catalyst to drive performance.

Fortescue Metals might be intent to dominate the future of hydrogen but all the company’s income comes from iron-ore. The share is holding the region of the 200-day MA at present but needs a catalyst to drive performance.

Woodside is just about holding the upper side of its seven-year range and needs to continue to find support in the A$31 area if the benefit of the doubt is to be given to the upside.

Woodside is just about holding the upper side of its seven-year range and needs to continue to find support in the A$31 area if the benefit of the doubt is to be given to the upside.

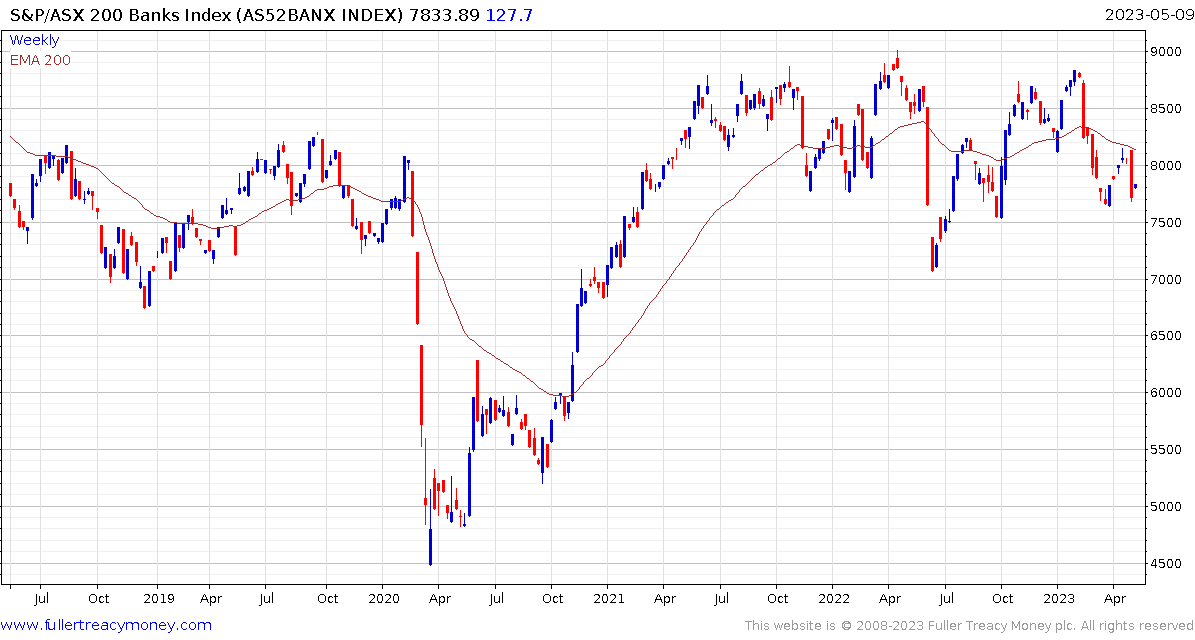

The underperformance of the Australian banks is noteworthy. The RBA continues to raise rates and that is weighing on the sector. The S&P/ASX 300 Banks Index has type-3 top characteristics and pulled back sharply last week to test the lower side of its range. Even with the government set to report its first surplus since 2008, the inflationary trend is only beginning to turn so more accommodative policies are unlikely in the short term.

The underperformance of the Australian banks is noteworthy. The RBA continues to raise rates and that is weighing on the sector. The S&P/ASX 300 Banks Index has type-3 top characteristics and pulled back sharply last week to test the lower side of its range. Even with the government set to report its first surplus since 2008, the inflationary trend is only beginning to turn so more accommodative policies are unlikely in the short term.