BOE's Forbes Says U.K. Economy May Soon Need a Rate Increase

This article by Jill Ward for Bloomberg may be of interest to subscribers. Here it is in full:

“If the real economy remains solid and the pickup in the nominal data continues, this could soon suggest an increase in bank rate,” BOE policy maker Kristin Forbes says in text of speech released on Tuesday.

MPC should be willing to move policy in either direction as needed “even if it means reversing recent adjustments”

NOTE: BOE cut rate 25bps to 0.25% in Aug.

Forbes says wage growth and inflation could pick up faster than expected, though uncertainty over Brexit may make firms reluctant to increase pay

Risks to forecast depend on how pound drop impacts inflation, how wages evolve and consumers respond

“It will become increasingly difficult for me to justify tolerating such a large and likely overshoot of inflation -- especially when compared to such a small and uncertain softening in growth and unemployment:” Forbes

Disagrees with MPC on equilibrium unemployment rate; says it is likely below 5%, but not as low as 4.5% published by BOE last week

I think it is safe to say the Bank of England will not raise rates until it absolutely has to. In the period following the credit crisis the bank was willing to run inflation a little hot to erode the outstanding debt and there is no reason to suspect that it will not do the same considering the uncertainty Brexit represents to its forecasts.

In fact policy makers are more likely to keep rates low considering the economy has been relatively resilient in the face of the devaluation of the Pound. They are unlikely to want a stronger currency which could endanger the UK’s competitive advantage as it heads into negotiations with the EU.

Sterling has been ranging mostly between $1.20 and $1.28 since October. This is the fourth similar sized range in the course of what has so far been a 30-month downtrend. It has now succeeded in closing the majority of its overextension relative to the trend mean by virtue of going sideways. The Pound posted an upside outside day to check the four-day slide today, but a sustained move above $1.27 would be required to signal a return to demand dominance beyond short-term steadying.

The FTSE-250 Midcaps Index hit a new closing high today and appears to be in the process of completing a 20-month consolidation.

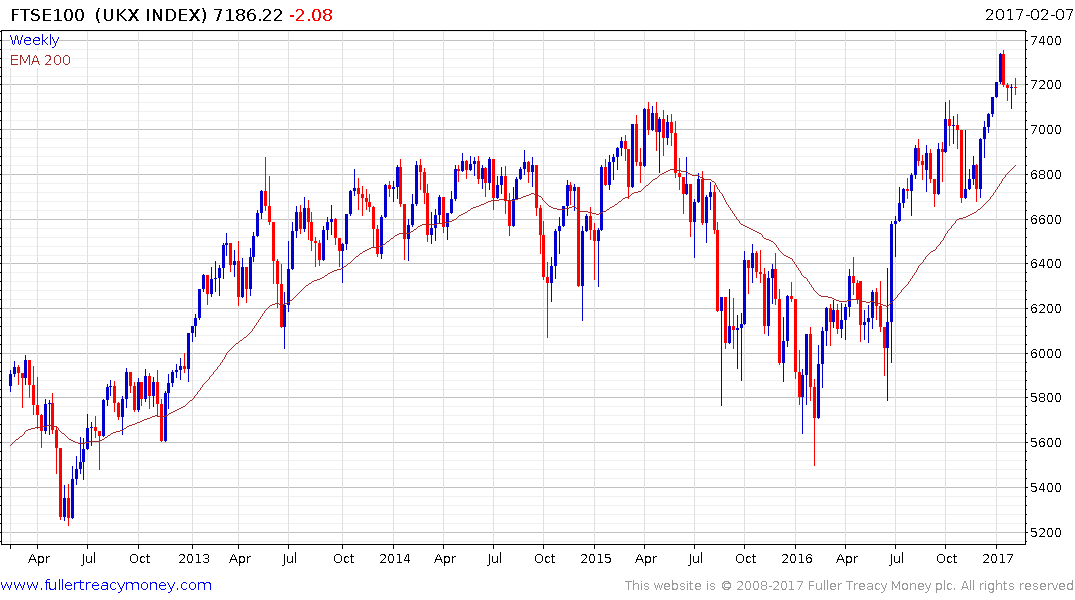

The FTSE-100 Large Cap Index has so far held its breakout from a 17-year range and a sustained move below 6900 would be required to question medium-term potential for additional upside.

The impressive bounce back in homebuilding shares, buoyed by the prospect of easier access to building permits is also a potential positive for the economy. Persimmon for example is representative and is back trading above its trend mean.