Australia's Stock Market Is Decoupling From the World

This article by Adam Haigh and Garfield Clinton Reynolds for Bloomberg may be of interest to subscribers. Here is a section:

``The banks are in a different dynamic,'' said James Audiss, a senior wealth manager at Shaw and Partners in Sydney, where he helps oversee about A$10 billion. ``U.S. banks make good money from trading and as rates go higher they have more spread to work with. Aussie banks don't really have that and if anything there is going to be a compression of the spread between central bank rates here and there.''

Trump's rise to the presidency has buoyed U.S. bank shares since early November, with the financial sector among the biggest winners under the new administration. While American lenders made little headway in January as the rally stalled, a gauge of Australia's biggest banks posted the worst month since August.

It's unusual to see this decoupling. Moves on Australia's benchmark stock index are more closely tied to those on both the S&P 500 and the MSCI World index than any other major gauge in the region over the past five years, as this chart shows. Financial shares often tip the balance as they comprise more than one third of the Australian index.

Ahead of the financial crisis the market cap of BHP Billiton and Rio Tinto was roughly equivalent to the combined valuation of Australia’s four largest banks. That all changed with the collapse in commodity prices. The miners went through a painful bear market, while low interest rates raised the allure of banks’ competitive yields. The S&P/ASX 200 Financials Index now represents 37.6% of the broader S&P/ASX 200 Index.

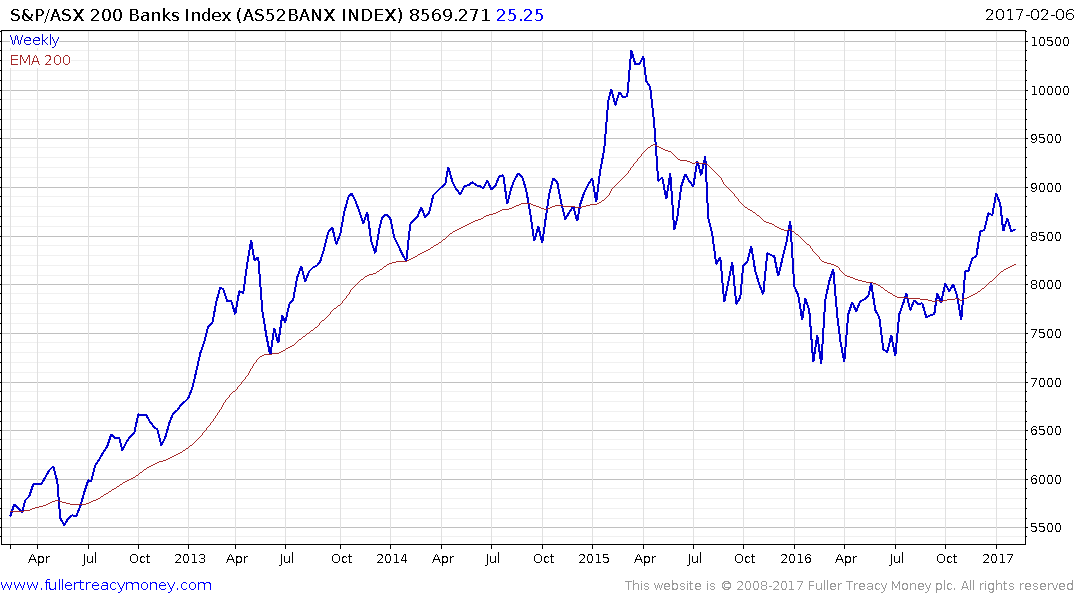

What I found most interesting about this article was not so much the observation that there has been short-term decoupling between the ASX and US and MSCI Indices. I was more interested in how it ignored the fact that the S&P/ASX 300 Banks Index trended lower from early 2015 to early 2016 and then held an incremental progression of higher reaction lows as it consolidated. The Index shared the breakout in global bank shares from early November and a reversionary pullback is now underway. A sustained move below 8000 would be required to begin to question medium-term scope for continued upside.

Meanwhile Australia continues to run an impressive trade surplus boosted by the rebound in commodity prices. The S&P/ASX Resources Index remains on an upward trajectory and continues to hold a progression of higher reaction lows.

With the 10-year government bond yield at 2.7% and RBA Cash Target Rate 1.5% there does not appear to any urgency in raising rates which has weighed on the Australian Dollar. It continues to range below 78¢ and a sustained move above that level would be required to signal a return to medium-term demand dominance.