Blackstone Tenants Get a Shot at Buying Their Rental Houses

This article by Heather Perlberg for Bloomberg may be of interest to subscribers. Here is a section:

Selling rental homes to tenants is a way for investors to make more money than they would selling in bulk, and saves them the costs of renovating and carrying the properties until they sell on the open market. It’s also a way to help people stay put, keep their kids in the same schools and stabilize neighborhoods, according to Bartling.

“This is an important part of the maturation of the industry and for Invitation Homes as we grow over time,” he said in an interview.

About 25 percent of Invitation Homes renters who move out each year are leaving to become buyers, according to the company. That’s similar to what the industry’s other large firms are experiencing. Colony Starwood Homes has reported losing about 23 percent of departing tenants to homeownership, and American Homes 4 Rent has said its figure is about 30 percent.

American Homes 4 Rent, the No. 2 single-family landlord, with about 48,000 houses, didn’t respond to requests for comment about whether it would be selling homes to tenants. Colony Starwood, the third-largest, with about 31,100 homes, declined to comment, spokeswoman Caroline Luz said.

Investors amassed significant inventory of houses during the peak of the foreclosure process more than five years ago. The fact that a number of REITs were listed in the last couple of years and that some are now reducing inventory suggests both they are taking profits and that the market has moved on from the distressed opportunity is represented following the credit crisis.

With bond yields continuing to compress the potential for valuations to move on from reasonable to overvalued, represents a risk that has yet to be addressed considering that interest rates are unlikely to move meaningfully higher in a hurry.

Blackstone has pulled back significantly over the last year and continues to encounter resistance in the region of the trend mean. It has fallen back to test the region of the January lows and a clear upward dynamic will be required to signal demand returning to dominance in this area.

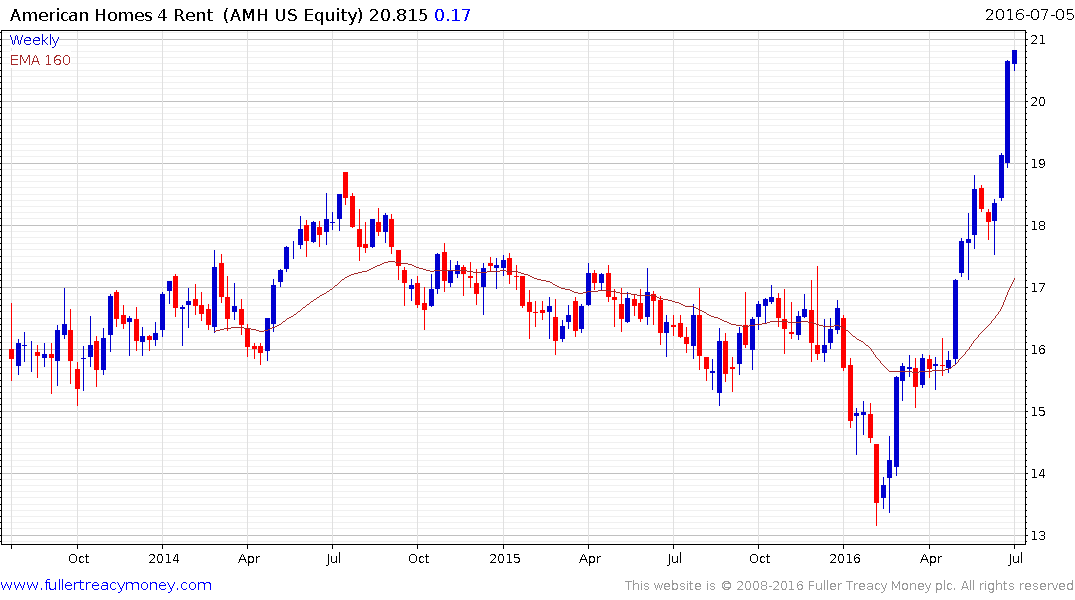

American Homes 4 Rent IPOed in 2013 and has surged higher over the last three months which has resulted in yield compression. While overbought in the short term a clear downward dynamic will be required to check momentum beyond a brief pause.

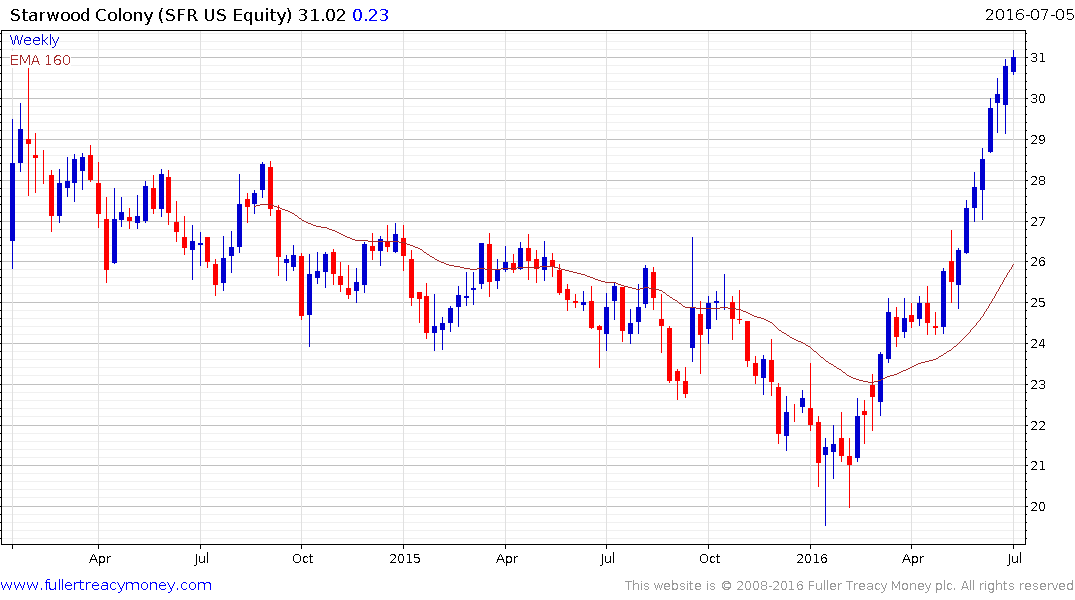

Colony Starwood rallied to break a progression of lower rally highs evident since its IPO in February and has held a progression of higher reaction lows since.