A Prime Minister, a Referendum and Italy's Turn to Get Worried

This article by Chiara Albanese and John Follain for Bloomberg may be of interest to subscribers. Here is a section:

It’s now a familiar refrain: A European prime minister calls a referendum, his job could be on the line and markets are getting worried.

This time it’s not Britain’s David Cameron but Italy’s Matteo Renzi, who has called a vote on an ambitious overhaul of the political system aimed at ending the country’s unstable governments. If he loses, Renzi has promised to quit, an outcome that Citigroup Inc. called probably the biggest risk in European politics this year outside the U.K.

The vote is expected in October, though it is already spooking investors and Italian bonds are once more under-performing their Spanish peers. The yield on 10-year Italian securities overtook those on similar-maturity Spanish debt for the first time in almost a year on June 27, a day after Spain’s Acting Prime Minister Mariano Rajoy defied opinion polls to consolidate his position in a general election.

A public opinion poll by Euromedia Research said that 34 percent of Italians would vote against Renzi’s plan, with 28.9 percent in favor, 19.4 percent undecided on which way to vote and 17.7 percent undecided on whether to vote. The poll based on 1,000 interviews was conducted on July 1. No exact date for the referendum has been set.

If one were to look at the yield on Italian government bonds (BTPs) it would be hard to discern whether Italy had any problems at all. With a yield of 1.26% Italy has close to the lowest borrowing costs it has ever enjoyed not least because the ECB is actively buying across a whole swathe of maturities.

.png)

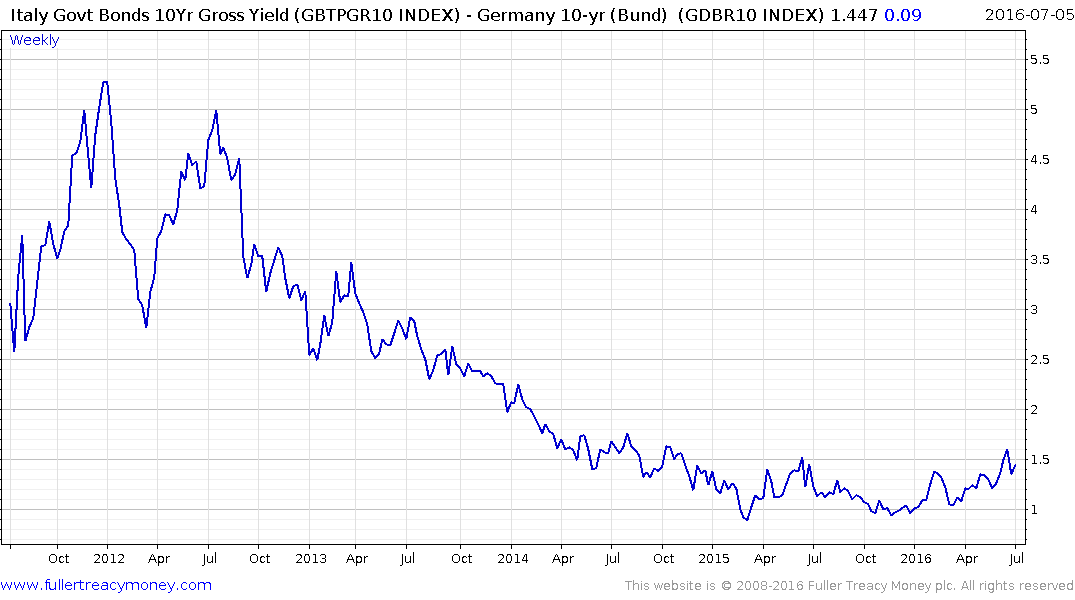

However when one looks at spreads over German Bunds we get a slightly more nuanced picture. A rounding characteristic is evident suggesting the process of spread compression is over and that Italian bonds no longer represent value on a relative basis.

The Italian stock market offers a better reflection of the increasing stress evident within the Italian financial sector. Its bounce from the post-Brexit setback has been modest to date and it will need to hold the lows near 15,000 if mean reversion is to be given the benefit of the doubt.

Italy’s markets highlight the fact that the stress induced by the UK’s decision to leave the EU is far from the only issue facing the bloc and a more cohesive solution will be required if the contradiction of one monetary policy with 27 fiscal policies is ever to be overcome.