Biotechnology rotation

The Nasdaq Biotechnology Index is going through a significant rotation. Some of the biggest companies that led on the breakout from the long-term base in 2012 are now trending lower. Gilead Sciences is representative. It was among the best performers on the breakout but peaked in 2015 and has continued to trend lower while many of the other major constituents have spent a year ranging.

The focus thrown on drug pricing during the US Presidential Election has long lasting repercussions because it has highlighted the practice of raising prices for legacy drugs. That is the exact opposite of what we see in other sectors where competition forces prices lower over time. The Trump administration is now talking about bringing down drug prices and enhancing the ability of Medicare to negotiate bulk prices and allow consumers to buy drugs overseas. These issues represents a significant issue for legacy pharmaceutical companies and established biotech companies without the compensating factor of a promising drug pipeline. It also means demand for M&A is likely to continue to increase.

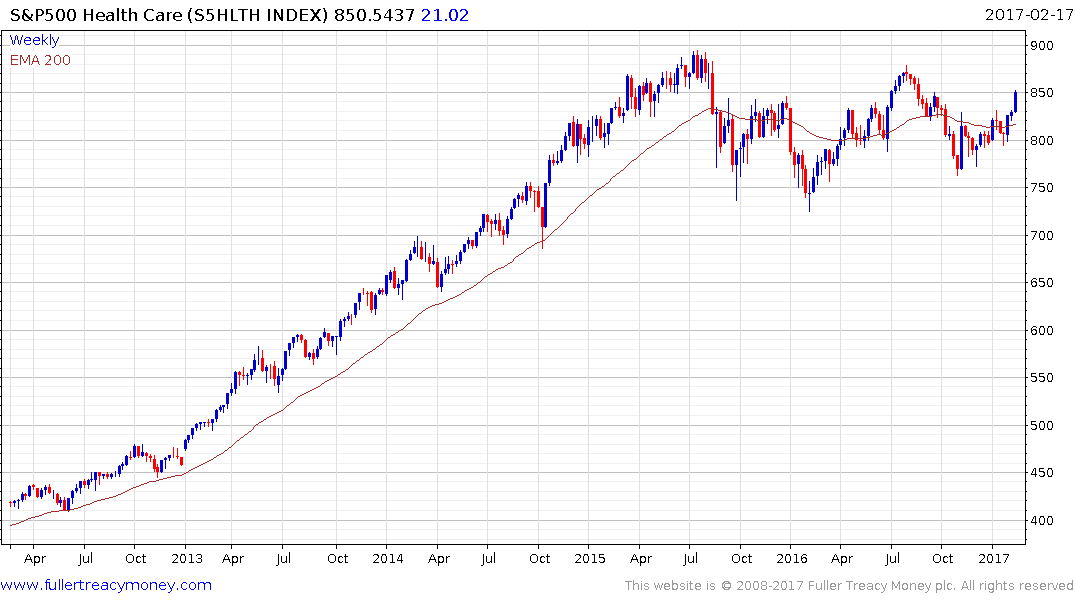

The S&P500 Healthcare Index has been ranging in a volatile manner for nearly two-years and is now rallying back towards the uppers ide of its congestion area. A break above 900 will be required to signal a return to demand dominance beyond short-term steadying.

The Trump administration is also talking about the prospect of streamlining drug approvals which could be a major bullish catalyst for small development stage companies. Additionally, the release last month of Illumina’s new architecture, which is expected to usher in $100 gene sequencing within the next three to five years, is a major catalyst for change. That one development will do more to enable the era of personalized medicine than any other single factor because the cost of development is on an exponential downtrend.

That has contributed to immuno-oncology companies being among the clearest outperformers over the last six months. Customised therapies relying on genetic sequencing of a patient’s genome, microbiome and tumors are quickly reaching commercial utility. At just the time that the cost of customized medicine is rapidly declining, developing new broad spectrum drugs is becoming prohibitively expensive and the cost continues to rise.

Esperion Therapeutics is in the process of completing a yearlong base formation.

Foundation Medicine which concentrates on the genetic sequencing of tumors may also be in the process of completing its base formation.