Email of the day on the VIX

Hi Eoin, isn't the VIX approaching a level or is already at a level where it is very attractive to go long the VIX? how much downside could there still be?

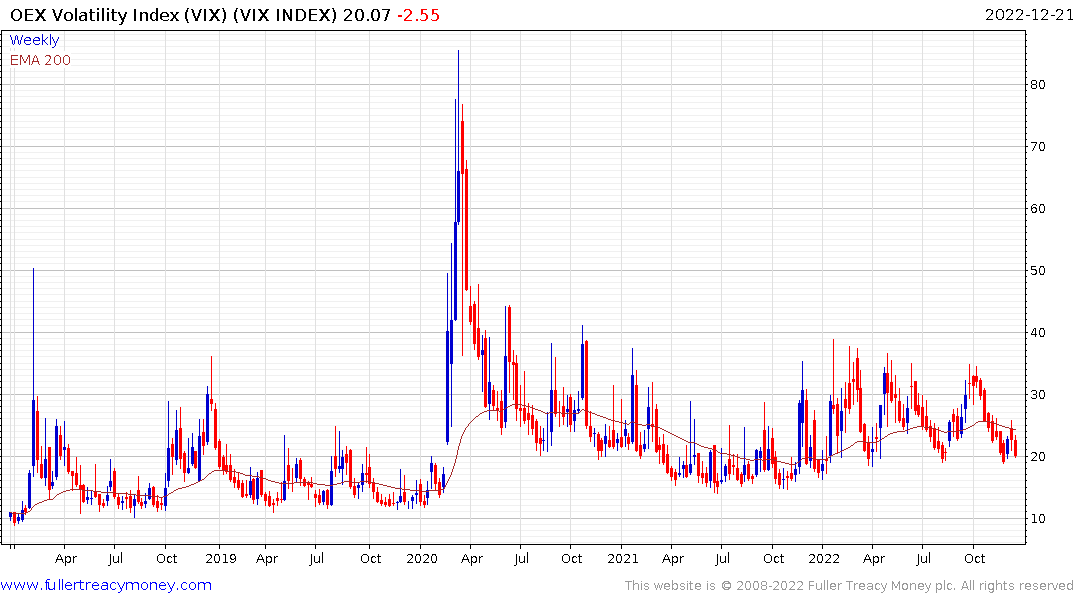

Thank you for this question and I’ve been pondering this same topic myself. One of the primary issues I have been thinking about is the fact the VIX has contracted at the same time as the S&P500 has been falling. That’s quite unusual since the VIX is primarily calculated based on demand for put options.

As we are approaching the last trading week of the year, there is a lot of positioning going on right now to make the most of 2022. Investors took heart today from solid earnings by Nike and Fedex. Nevertheless, housing starts continue to moderate and liquidity is tightening. Amid a short-term oversold condition that suggests mild potential for a short-covering rally. I continue to hold my Nasdaq-100 short because I don’t believe this steadier action is going to last.

The VIX continues to hold a triangular pattern with both an incremental sequence of higher reaction lows and lower rally highs evident. The Index is back testing the lower boundary at present so I agree there is scope for a rebound. The only real question is whether that will occur before or after new year.

As a liquidity barometer bitcoin has tended to lead moves in the stock market by about a week. The price barely steady in the region of the lower side of the short-term range.