Basking in Sun, Italian Markets May Face a Bleaker Autumn

This article by Marco Bertacche and Heather Burke for Bloomberg may be of interest to subscribers. Here is a section:

The quickening growth and solid corporate earnings that have propelled the rally face a series of stern tests in the coming months, not least a looming general election in which populist, anti-euro parties may play a key role. The country is also one of the most exposed to a shift in monetary policy from the European Central Bank, which has bought almost 284 billion euros ($335 billion) of Italian debt under its latest asset- purchase program.

“Enjoy a quiet August ahead of September’s challenges,” UniCredit SpA Deputy Head of Fixed-Income Strategy Luca Cazzulani and Chief Italian Economist Loredana Federico wrote in a note last week. “What could go wrong in the coming weeks? Not much, really. The usual culprits are poor economic data at the domestic level, politics, a step up in expectations of policy tightening and a sudden shock in global financial markets,” all of which have only an outside chance, they said.

In the current window, the good news has stacked up for Italy. The nation’s Services Purchasing Managers’ Index reached a 10-year high on Aug. 3, supporting the view growth is catching up with the rest of Europe. The International Monetary Fund has upgraded its forecast for the country’s expansion to 1.3 percent, which would be the fastest in seven years.

The ECB wouldn’t be considering beginning to taper the size of its quantitative easing program unless economic growth were improving. Some of the countries hit hardest by the region’s recession have the greatest potential for recovery not least because they are coming off such low bases.

The Italian FTSE/MIB Index hit a new recovery high today and is being led by its banking sector.

The DJ Euro STOXX Banks Index is challenging its May peak and a break in the medium-term progression of higher reaction lows, currently near 125, would be required to question medium-term recovery potential.

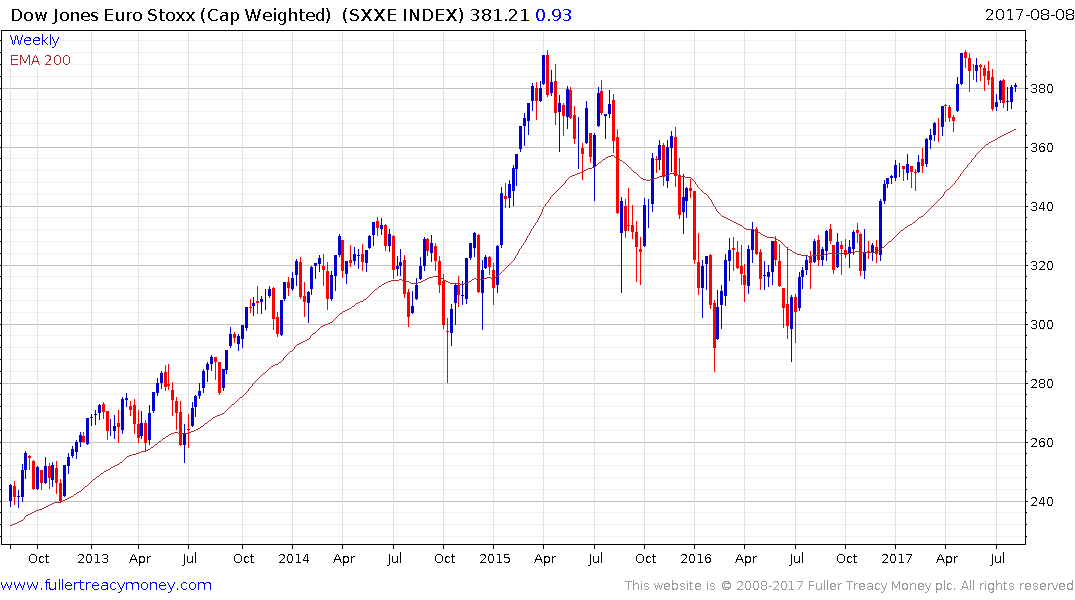

The broader DJ Euro STOXX Index, meanwhile, is firming from the region of its trend mean having completed a reversionary process in a reasonably orderly manner.

Elsewhere the Portuguese Index has been ranging for the last couple of months and is currently firming from the lower boundary have unwound most of its overbought condition relative to the trend mean.

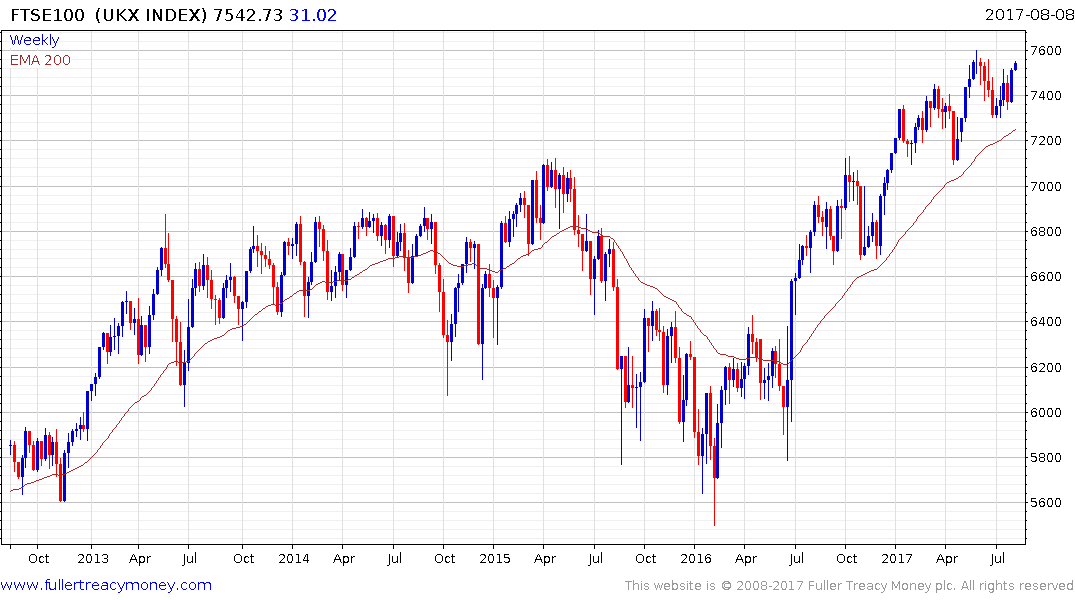

The UK’s FTSE-100, bolstered in nominal terms by the Pound’s recent weakness, continues to firm from the region of the trend mean.