Email of the day on batteries

Welcome back from China, I would also reciprocate the glowing comments

on Saturdays missive.FYI attached please find some headlines from the Asian Nikkei, unfortunately I am not a subscriber, but for all the battery fanatics following you and I agree with the view that battery technology is a game changer. I thought you would be interested

in the following :GS Yuasa's new battery to double electric car range- Nikkei Asian Review

As a fund manager, I visited the company in Kyoto 20 years ago, and even then I thought it something special. Regards to the family.

Battery technology was a fringe industry for a long time because there was no compelling commercial reason to invest the money required to develop it. That changed when oil prices surged higher and consumers were forced to begin to think about economizing to reduce how much they were spending on energy.

The dynamics that have unfolded in the energy sector are a perfect example of how high prices influence spending decisions by producers and economizing by consumers while low prices have the opposite effect. These long-term dynamics contribute to the long-term cyclical nature of markets.

The growth of the mobile devices sector has been the animating force behind demand for lithium for much of the last couple of decades. Meanwhile the evolution of electric vehicles and energy storage are direct responses to high energy prices and the uptick in associated environmental concerns. They represent gamechangers for the sector.

Tesla can be credited with demonstrating that battery technology has progressed enough to reach commercial utility in the transportation and storage sectors. The race is now on to widen that fissure into the conventional energy market by investing both in additional manufacturing capacity as well as new technologies. The energy market after all is by far the world’s most economically significant.

Here is a section from the Nikkei article:

Lithium Energy Japan, a joint venture with trading house Mitsubishi Corp. and carmaker Mitsubishi Motors, will develop the cells, which will be produced at its plant in Shiga Prefecture and supplied to automakers in Japan and Europe.

Mitsubishi Motors' i-MiEV compact, for instance, has a scope of around 170km per charge. The new battery would extend the range to some 340km, comparable to that of a large electric vehicle which can hold a bigger battery, and close to the limit of a gasoline-fueled car with a full tank.

GS Yuasa rallied a year ago to break a medium-term progression of lower rally highs and has held an upward bias since. It rallied impressively on the above news and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

This article from Mining.com highlights some of the technological advances being made in the development of new kinds of batteries.

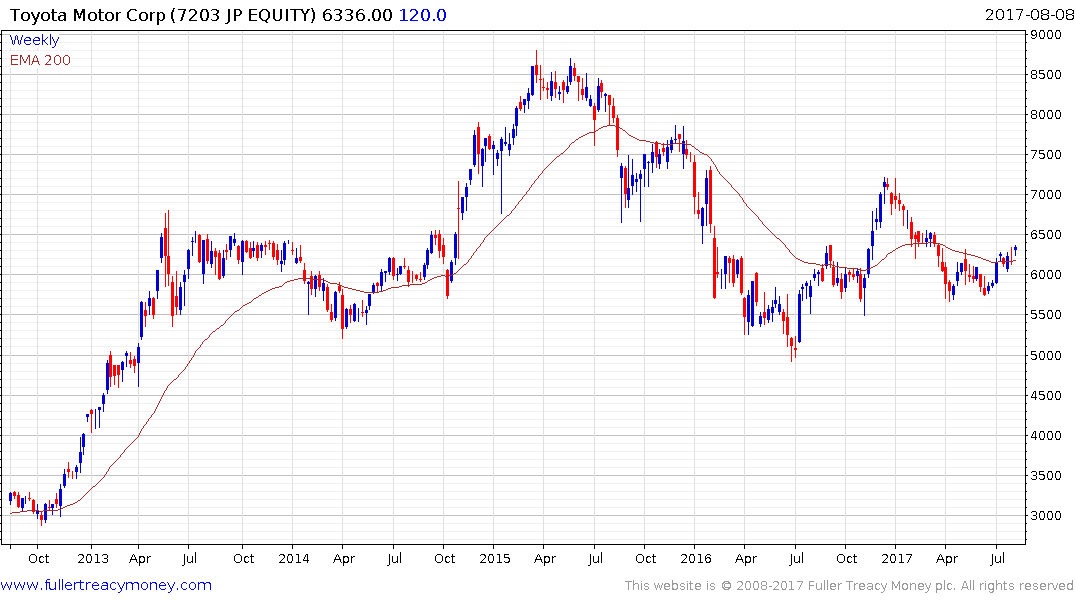

The article highlights the patents Toyota has lodged for its solid-state lithium-ion technology where the release data has been pushed back from 2020 to 2022. Here is a section:

Solid-state lithium-ion technology has real promise, but it’s an open question whether Toyota can hit its 2022 release date. After all, it’s not the first time the company has made this claim. The Clean Technica link in the image caption above is to a 2013 story, in which Toyota reported it would have solid-state electrolytes on the market by 2020. Four years later, the company has only bumped its projected date back two years, which does reflect some progress, but this is clearly a moving target. Meanwhile, other companies, like BMW, are also investing in their own solid-state designs.

This article from Fortune highlights Microsoft’s licencing of its connected car intellectual property to Toyota.

Conservatively battery energy density improves at 8% per year which means a doubling in 9 years while I have also seen reports that doubling has been observed every 5.3 years. The main point right now is that electric vehicles are approaching the range limits of conventional internal combustion engines and will likely exceed them in the next five years. The rate of recharging and the number of cycles that can be achieved represent the next most pressing questions but the trend is clear. Batteries represent the clearest gamechanger for the energy and transportation sector over the next decade.

Back to top