An Update from Our CIOs: Transitioning to Stagflation

This blog post from Bridgewater may be of interest to subscribers. Here is a section:

Today, our indicators suggest an imminent and significant weakening of real growth and a persistently high level of inflation (with some near-term slowing from a very high level). Combining this with what is discounted, the difference between what is likely to transpire in the near term and what is discounted is the strongest near-term stagflationary signal in 100 years, shown below. Longer term, as we play it out in our minds, we doubt that policy makers will be willing to tolerate the degree of economic weakness required to bring the monetary inflation under control quickly. More likely, we see good odds that they pause or reverse course at some point, causing stagflation to be sustained for longer, requiring at least a second tightening cycle to achieve the desired level of inflation. A second tightening cycle is not discounted at all and presents the greatest risk of massive wealth destruction.

The pendulum analogy gels rather well with the above view. The current effort to unwind inflationary forces, arising from excessive money supply growth, is going to result in a growth shock.

The Job Openings chart has topped so surprises are going to be on the downside. The steep decline in retail job openings today supports that view. In response the Fed may not be comfortable with continuing to restrict monetary conditions; even if today they are vocally committed to doing whatever is required to bring inflation down.

The challenge with looking through the current challenge and forming an investment thesis on the next challenge, even if that is a few years out, is you miss the potential for significant swings in between. As the aftereffects of the pandemic panic are worked through it is reasonable to expect shorter cycles of economic expansion and contraction with some large swings in asset prices in between. That is likely to foster a trader’s mentality among investors.

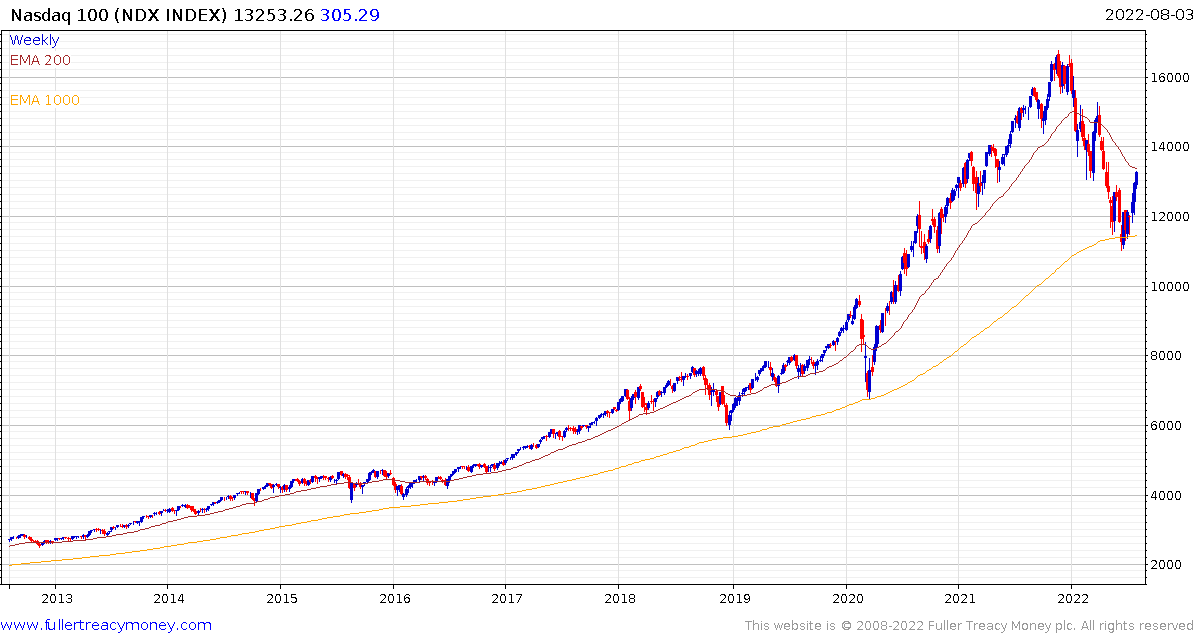

The Nasdaq-100 closed above 13,000 today to test the region of the 200-day MA but it is now pushing back up into the overhead short-term range. A sustained move back above the trend mean would encourage more cash in off the sidelines.

The Nasdaq-100 closed above 13,000 today to test the region of the 200-day MA but it is now pushing back up into the overhead short-term range. A sustained move back above the trend mean would encourage more cash in off the sidelines.

A large number of speculative stocks are at the upper side of their respective 3-month ranges/bases. PayPal’s progress in containing costs and $15 billion buyback bolstered confidence in recalibration of growth stocks today.

My daughters describe Slack as “Discord for adults” but there is no getting around the fact that I have been invited into several Slack groups over the last month. Salesforce paid up to buy the company and the share is now testing the upper side of its three-month range following a steep decline over the last year.

My daughters describe Slack as “Discord for adults” but there is no getting around the fact that I have been invited into several Slack groups over the last month. Salesforce paid up to buy the company and the share is now testing the upper side of its three-month range following a steep decline over the last year.