Remember QT? It's About to Get a Lot More Interesting

This article from Bloomberg may be of interest to subscribers. Here is a section:

Based on $47.5 billion of QT this month and a monthly rate of $95 billion thereafter, the Fed’s balance sheet is slated to shrink by some $475 billion through the rest of the year. Here’s the thing,

though: the Treasury expects to rebuild its cash balances by some $85 billion through year-end.

In other words, instead of more than offsetting the impact of QT on bank reserves and the RRP, the TGA will start amplifying it. That in turn raises the question of where the brunt of what will effectively be $560 billion of QT will be felt. The Treasury’s latest quarterly refunding announcement offered up the prospect of only modest increases in bill issuance, which suggests that balances in the RRP facility will remain elevated. That in turn implies that there will be a sharp drop in bank reserve balances.

All of this is fairly well-understood by money market specialists, though perhaps it’s not appreciated quite as much by QT tourists. Thus far, bank liabilities have remained fairly steady -- there hasn’t been a significant drop in deposits. This is important because as the column linked above notes, it is when bank reserves as a percentage of liabilities drop below 11% or so that we should expect to see non-linear upward pressure on funding rates -- and thus calls for QT to end.

Banks shares have not been performing particularly well. The sector has been assailed by multiple issues such as inverted yield curves, the evaporation of refinancing demand for mortgages, and the need to set aside more reserves to allow for the possibility of a recession. Quantitative tightening will accelerate that process. In turn that will increase the chances of an issue developing in the money markets, similar to the repo surge in 2019.

The challenge for investors is this is not a near-term risk but is likely within six months as the pace of quantitative tightening accelerates and accumulates from September. In the present, traders are willing to bet on a rebound and are not paying attention to the inevitable challenges of the future. The only conclusion is investors do not believe the Fed will follow through on aggressive tightening. In fact the $560 billion total for QT implies less than half the 2020 splurge will be unwound.

The S&P500 Banks Index has been trending lower all year, with a succession of short-term ranges one below the last.

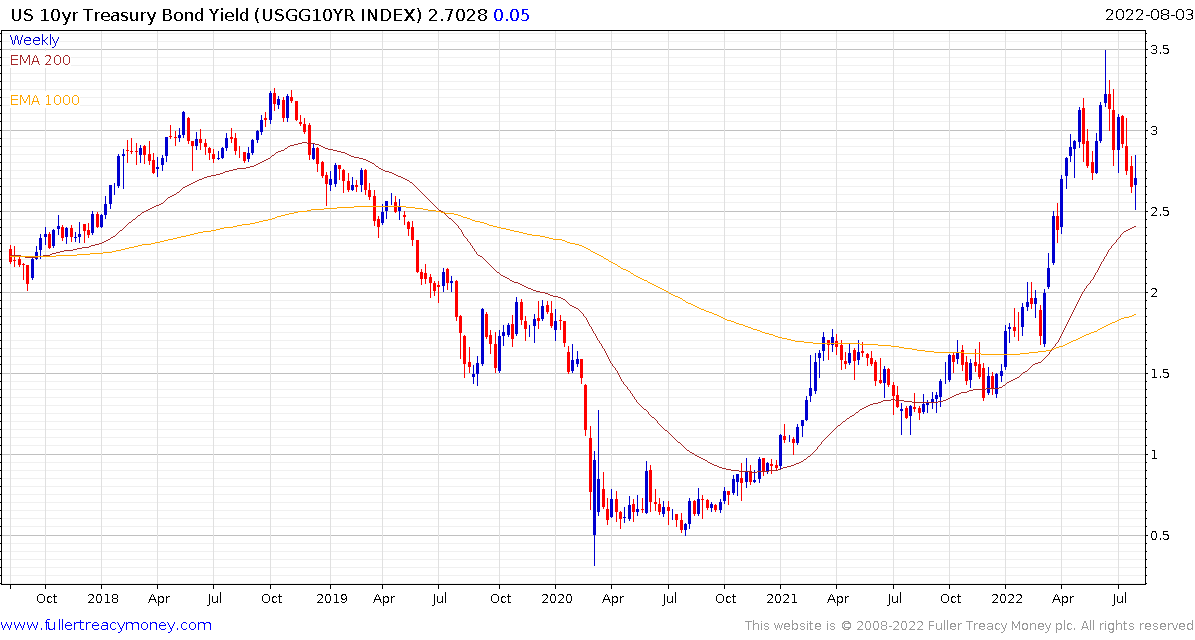

Meanwhile, the Dollar and Treasury yields failed to follow through on the upside today. That suggests bond market indecision in whether tightening will proceed or not.