American Exposure to the European Financial Crisis

Thanks to a subscriber for this report from Geopolitical Futures which may be of interest to subscribers. Here is a section:

The locus of the 2008 financial crisis was in the United States, and rapid decision making was possible, even if the decisions made were controversial—then and now. The locus of the crisis we are describing will be in Europe, and the greater American exposure to Europe, the greater American pressure will be on Europe to act decisively. Since Europe seems incapable of rapid decision making, this could create a collision with the United States.

Ultimately, the US is not appreciably exposed directly to the Italian banking crisis. However, the US is deeply exposed to other major Western European countries, particularly France and Germany. The Italian crisis will have deep ramifications, especially for these two countries, and that in turn means that, indirectly, the US economy will feel significant effects from the overall crisis. Looming over it all is the question of derivatives, a question that is all the more ominous because its answer is ambiguous at best. Indirect evidence suggests that this is worse than what the official numbers say, but not so severe as to put the US directly in the path of the coming storm.

In our view, the US will be something of an on-looker this time. While the US will certainly feel the effects of a deeper crisis in Europe, European uncertainty in its response will not create a subsequent political crisis between the US and the EU. Still, the possibility should be borne in mind, depending in large part on how hard the American financial system is hit. Even minor pain and anxiety could cause the US to find the European approach intolerable. Financial crises of this magnitude are not solved by markets but by political systems, which are sensitive to these crises in very different ways than the financial system.

Here is link to the full report.

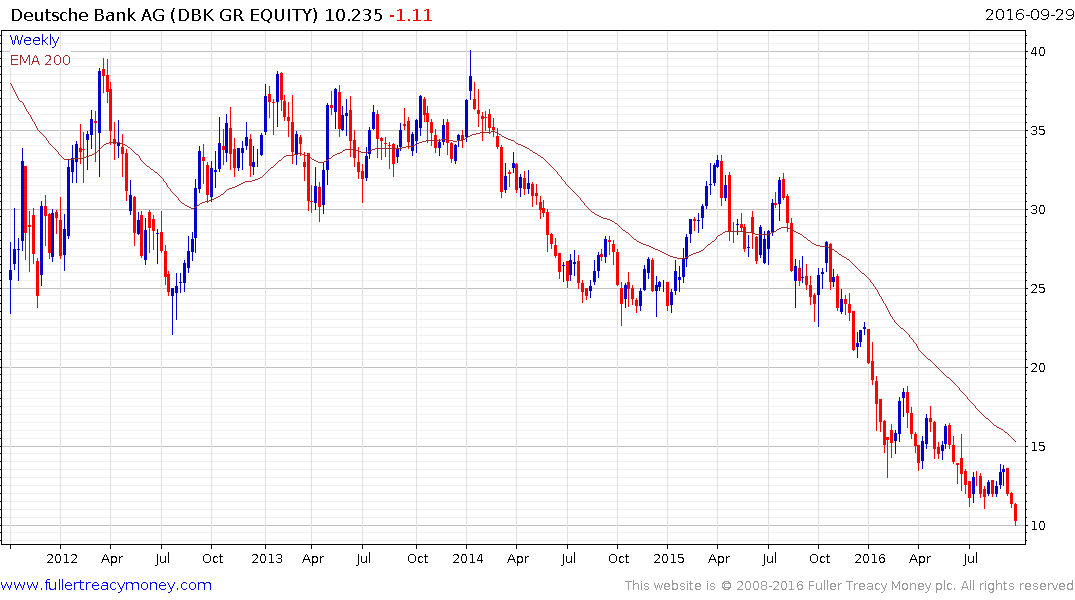

Deutsche Bank moved to a new low in afterhours trading today which reflects just how much stress the share is under despite the media fanfare over a single day rally yesterday. The overriding concern many investors will have is that the Eurozone solution to bank problems has included nationalisation rather than bailouts.

That represents a significant potential threat for both Deutsche Bank and Commerzbank. They are now the only two German banks that still have a listing since Deutsche Postbank was delisted last year and all of the Landesbanks and DZ Bank were nationalised following the credit crisis.

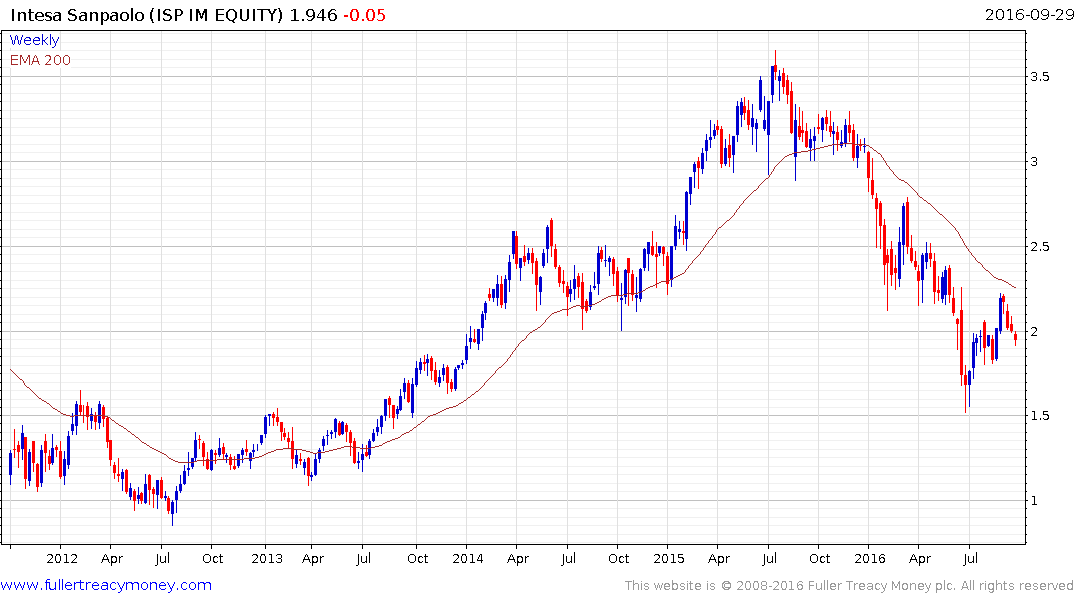

The issues with German banks appear to have superseded investor concerns facing the Italian banking sector of late and yet none of the issues facing them are close to having been solved. UniCredito Italiano has steadied over the last three months near the €2 area. However the problem it faces is it is one downward dynamic away from reasserting the downtrend and the same can be said for the majority of Italian banks.

Banca Popolare and Banca Carige have also at least paused near their respective lows but a catalyst is likely required to reignite investor interest and to pressure shorts.

Unione di Banche Italiane continues to trend lower while Banca di Monte Paschi di Siena is in an even greater state of distress.

Intesa Sanpaola has exhibited relative strength by rallying to close an overextension relative to the trend mean but it will need to hold the €1.80 area if the short-term progression of higher reaction lows is to remain intact.

Banca Popolare Di Sondrio, with a focus on commercial lending, has also been outperforming and is testing the upper side of a two-month range.

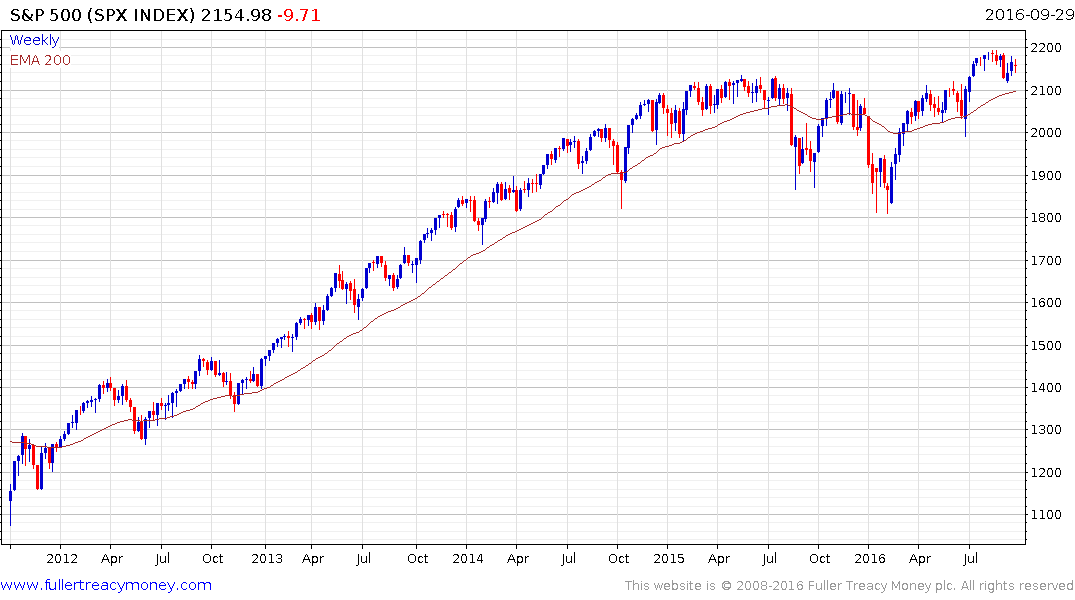

In a worst case scenario there could be a succession of bank failures in the Eurozone and that could have knock-on effects for the global market. The relative importance of Germany over Italy to US interests may have been a contributing factor in today’s weakness on Wall Street.

The S&P 500 continues to range above its 200-day MA and despite the fact volatility has picked up somewhat a sustained move below the trend mean would be required to signal a failed upside break.