American Association of Professional Technical Analysts Conference 2017

It was a pleasure to meet up with a number of other US based analysts at this year’s conference in Kansas City last Friday and I thought subscribers might be interested in my observations.

My presentation focused on my belief that we might be in the latter stages of a medium-term expansion but are very likely to be in the early stages of a secular expansion. That informs my additional belief that we are not about to have a crash and that the Wall Street leash effect is an important characteristic which is gaining credence once more, following what has been a long

hiatus.

Here is a link to my presentation.

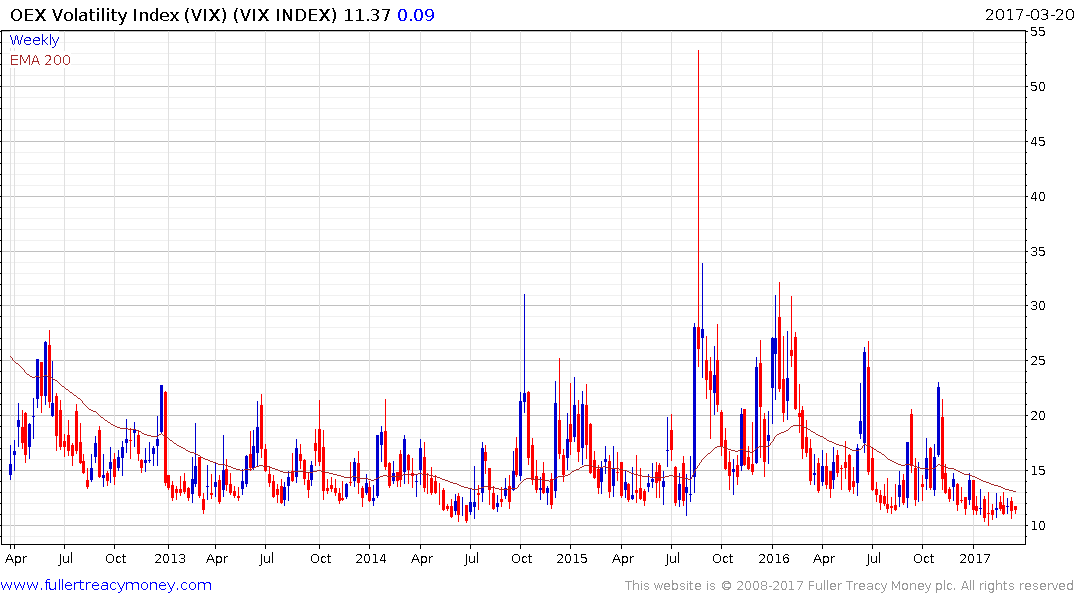

Larry McMillian’s presentation focused on how his service uses the put-call ratio to develop trading ideas. He has some interesting points to make on the VIX and how the time value of money contributes to a contango which many people misconstrue as an indication of traders’ belief volatility will rise in future.

The VIX Index is simply an indication of the price of put options. When the Index is low it reflects a dearth of demand for downside protection. The Index is trading below 13 which is a relatively depressed relative to even the low levels it traded at last year, but a sustained move above that level would be required to begin to suggest a return to demand for downside protection.

Jay Keppel spoke at length about seasonal trends, beginning with “Sell in May, come back on Labor Day” and finishing with the presidential cycle and the best days to be invested in a month which coincides with automatic IRA investments from millions of people’s bi-monthly pay checks.

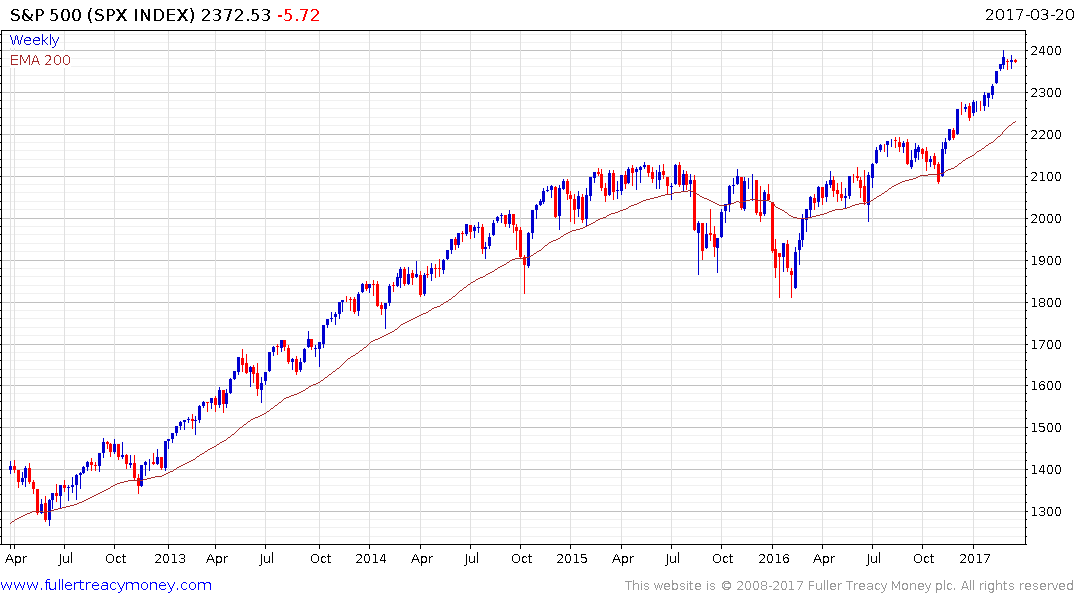

There is no denying that the period between late October and late April is when the best stock market returns are posted and that it is not unusual to have at least a hiccup sometime between May and late September. The S&P500 has been rallying in a robust manner since the Presidential election in November and if it is to remain consistent it is likely to remain within the current range for at least another few weeks.

Nevertheless, we cannot rule out the possibility of a reversion back towards the mean which becomes a greater potential outcome the longer the price continues to advance in a robust manner.