A $6 Trillion Wall of Money Revives Arcane Part of Wall Street

This article from Bloomberg may be of interest to subscribers. Here is a section:

Companies are grappling with the twin burdens of higher interest rates and slower economic growth, and some have already suspended dividends or put assets up for sale to pay debt. But with $6.3 trillion of outstanding corporate bonds alone coming due by the end of 2025, many are seeking alternative ways to protect their balance sheets.

Mall landlord Unibail-Rodamco-Westfield is one firm that’s been selling assets to pay down debt after its purchase of Westfield for about $22 billion in 2018 soured.

“We over-levered the company,” Unibail-Rodamco-Westfield Chief Executive Jean-Marie Tritant said in an interview. Falling values after the acquisition meant “our loan-to-value started to increase to a point where investors were somehow concerned about our ability to face our obligations.”

Tritant took over the firm in 2021 after a successful activist campaign backed by French technology billionaire Xavier Niel. As well as the disposals, the CEO stabilized the company by axing the dividend, limiting capital expenditure and extending debt maturities.

Rising interest rates are a challenge for borrowers. The longer rates stay high, without a meaningful uptick in demand for what they are selling, the greater the risk of default. There are all manner of companies borrowing in this space but the most important today are those looking to refinance commercial real estate debt.

The length of Unibail-Rodamco-Westfield’s name is a clue to how aggressive they have been in attempting to expand into a global marketplace. The share continues to trade within the range that began following the rebound in late 2020.

The length of Unibail-Rodamco-Westfield’s name is a clue to how aggressive they have been in attempting to expand into a global marketplace. The share continues to trade within the range that began following the rebound in late 2020.

The bullish bet is the company can secure leases at rates approaching pre-pandemic levels and borrowing costs retreat. As recently as late 2021 some of the company’s debt was trading with a negative yield, now its is closer to 4%. The company has €1.5 billion to refinance over the next year. That will occur at much less favourable rates than in the past. If this is a base formation it is likely to be lengthy.

The European solution to lockdowns was to keep people on payrolls rather than fire them. That could be a saving grace for European commercial real estate if the companies survive and buildings approach full occupancy.

In the USA, Brookfield defaulted on two towers in Los Angeles this week. Here is a section from a related article:

The financial package in default on the 52-story Gas Company Tower, located at 555 West 5th Street, includes a two-year, floating rate $350M mortgage provided by Citi Real Estate Funding and Morgan Stanley, a $65M mezzanine loan and a $50M junior mezzanine loan. The mezzanine loans were provided by Principal Financial Group.

The financing that came due on 777 South Figueroa—also a 52-story tower—includes a $269M mortgage provided by Wells Fargo and a $50M mezzanine loan.

In a Nov. 10 filing with the SEC, Brookfield’s fund said it was in compliance with all of its loan agreements as of Sept. 30, but declining cash flows, net operating income—and the declining value of the office towers—were putting it on the precipice of foreclosures.

And

The default is the third involving DTLA “trophy” office towers in the past three weeks: Oaktree initiated a foreclosure on its equity stake in Coretrust Capital Partners’ 48-story DTLA tower at 444 South Flower Street, a building made famous as the fictional HQ in the hit 1990s television show L.A. Law.

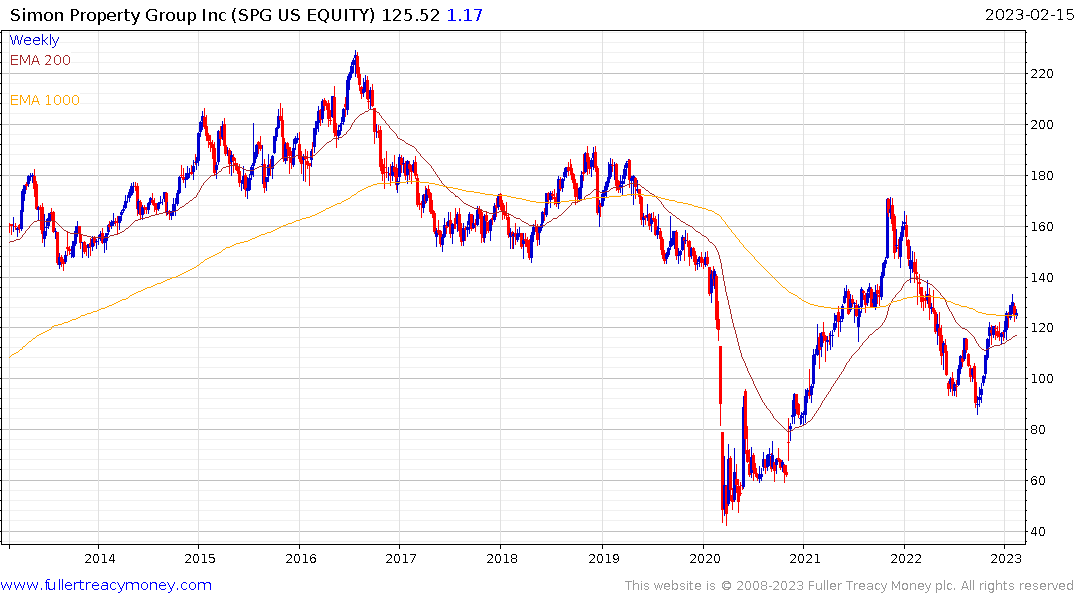

Simon Property is also in the process of defaulting on some of its debt. In this case it is a mall in New Jersey. Here is a section from a related article:

"Right now there's a shortage of refinancing dollars in the market place and yes, they're not going to be alone," said Thomas Fink, senior vice president of Trepp, which tracks the commercial real estate loans. The loan for the Mall at the Source had been securitized as bonds in a commercial mortgage-backed securities (CMBS) trust.

"They're not necessarily going to be forced to surrender the property," he said. "They may negotiate some type of a workout, possibly with the trust."

The default may lead to compare Simon with No. 2 U.S. mall owner General Growth Properties Inc GGP.N, which has said it may file for bankruptcy protection due to its inability to refinance its maturing debt. However, allowing the debt to default may just make business sense for Simon and its partners, Fink said.

"We have seen other operators who were recognized as being astute give up properties that they no longer found value in and just walk away from," he said.

I was chatting with a friend in San Francisco this morning who related this anecdote. The tower that was the old Union Bank building is now up for sale. The cost to build it would be around $1000 per square foot. They are asking $200 and the going rate in the market is closer to $100. Considering the magnitude of the homelessness in San Francisco there is talk about repurposing the building into apartments but the cost of a retrofit is in excess of $1000 per square foot.

WeWork has $19.6 billion in debt and $460 million in cash. Most of the debt matures in 2025 and they expect to lose $193 million this year. To say the company is on borrowed time is an understatement, the only path to survival is massive renegotiations of existing contracts and prayers that rates will be lower two years from now.

The fact the CCC-BB spreads have contracted during the risk-on rally that began in January has supported the shares of all these companies but that does not mean the hard questions about solvency has disappeared.

WeWork remains in a consistent medium-term downtrend.

WeWork remains in a consistent medium-term downtrend.

Brookfield Corp continues to pause in the region of the 200-day MA.

UK-listed Workspace has put in an impressive rally but is now pausing in the region of the 200-day Ma.

UK-listed Workspace has put in an impressive rally but is now pausing in the region of the 200-day Ma.

The magnitude of the potential problem from write-downs of commercial real estate improve potential that creditors will agree to work out arrangements. A crash is not inevitable but the situation will need to be monitored very closely. Rising interest rates will eventually cause some large creditor to break and that is likely to be the catalyst for looser monetary policy.

Back to top