U.S. Housing Starts Fell to Pandemic Lows in January

This article from Dow Jones may be of interest. Here it is full:

U.S. housing starts declined in January to its lowest level since June 2020, a sign residential construction is pulling back amid the current downturn in the housing sector. Here are the main takeaways from the Commerce Department's report released Thursday:

Housing starts, a measure of U.S. homebuilding, decreased 4.5% in January month to a seasonally adjusted annual rate of 1.309 million. This is the lowest annual rate since June 2020, at the onset of the Covid-19 pandemic.

Economists polled by The Wall Street Journal expected starts to decrease 2.3% to 1.35 million.

Housing starts were 21.4% below the same month a year earlier.

The drop was driven by both single-family and multi-family projects, which declined by 4.3% and 5.4%, respectively.

Housing starts data for December was downwardly revised to 1.371 million from 1.382 million initially estimated.

Monthly housing starts data are volatile. January data came with a margin of error of 15.9 percentage points.

Residential permits, which can hint at future home construction, increased by a marginal 0.1% in January on month, to a seasonally adjusted annual rate of 1.339 million. Economists expected permits to increase 1.5% on month.

Sentiment among home builders rose sharply in February for a second consecutive month, in a sign that the current downturn in the housing market could be bottoming out, according to data from the National Association of Home Builders published Wednesday.

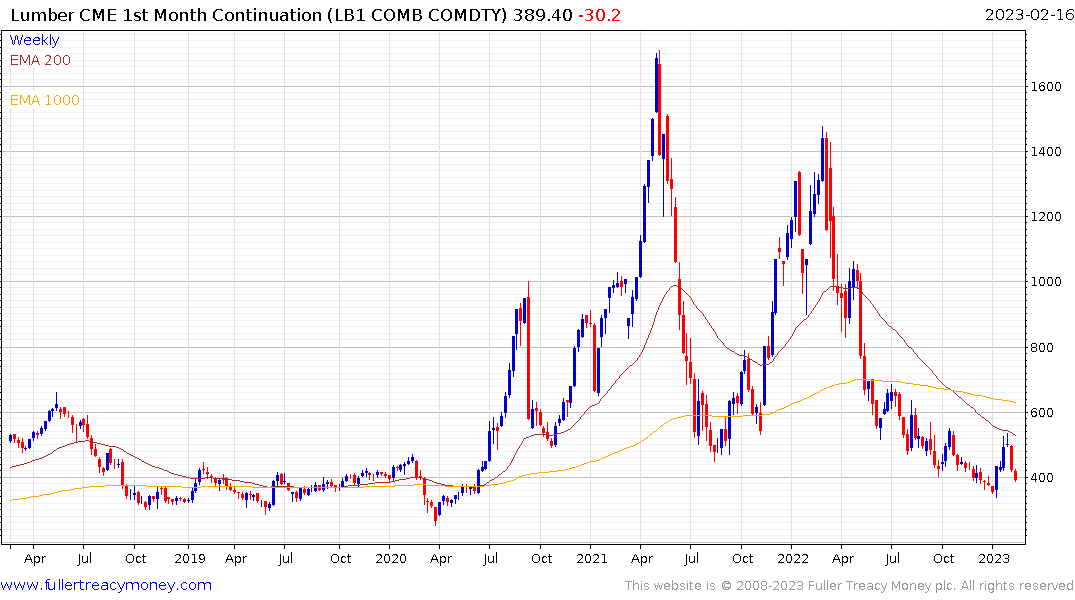

The lumber price has completely unwound its rebound and is back testing the lows posted in December. That decline is more about the reticence to build with so much uncertainty about mortgages rate than a sudden increase in lumber supply.

Homebuilders have staged impressive rallies and several shares are back testing their respective peaks. At least some consolidation is likely. However, since there is no excess supply and fewer people are willing sell because the cost of refinancing is so high, homebuilders are in a reasonably strong position. That suggests residential housing is unlikely to be the focus of strife on this occasion.