2020 Rate Cuts, Unimaginable Last Month, Show Up in Bond Market

This article by Liz Capo McCormick and Edward Bolingbroke for Bloomberg may be of interest to subscribers. Here is a section:

“What is the most striking aspect of this move is the extent of it in just two days and how the acceleration came out of nowhere right after a supposed amicable meeting between the U.S. and China,” Peter Boockvar, chief investment officer of Bleakley Financial Group, said in a note. “It’s almost as if the bond market screamed out, ‘It’s too late, the growth slowdown underway can’t be reversed.”’

The curve is flattening because even though cuts have moved on to traders’ radar screen the year after next, the Fed is still expected to lift rates this month and tighten further next year. Inversion has preceded every U.S. recession for the past 60 years.

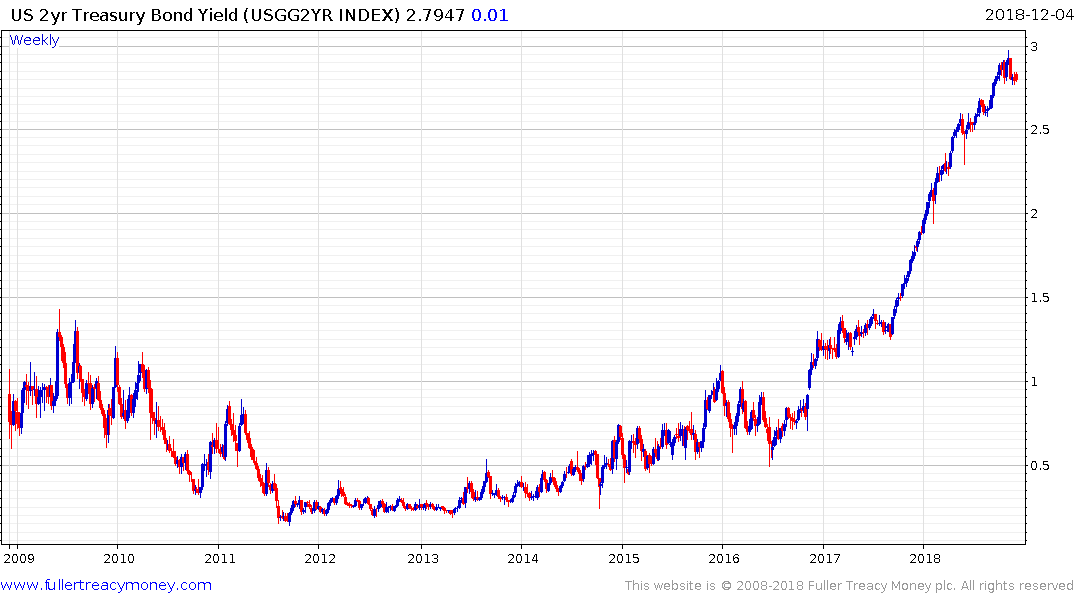

The spread between the 10-year and the 2-year contracted by another 3 basis points today to take the measure down to 11 basis points. This compression is being delivered by a substantial move in the 10-year and the relative inert trading in the 2-year.

.png)

The 2-year is pricing in a little more than two rate hikes by the end of 2020 but the market is turning towards the view that the Fed will be cutting rates by then. Therefore the 2-year is looking cheap, not least because it has yet to unwind its oversold condition relative to the trend mean.

It would behoove us to remember the “historic short” position in US Treasuries that was being publicised in the media a few months ago. Quite whether that was the result of options, futures hedging or risk parity, the surge over the last few days suggests short covering. The futures are now testing the region of the trend mean and a sustained move above 120 would lend credence to the bullish hypothesis.

Today, everyone is aware that an inverted yield curve portends a recession anything from 6-months to 18 months hence. The German, Italian, Swedish, Mexican, Japanese, Swiss and Canadian economies contracted last quarter so they will technically be in recession if they contract this quarter too. The US economy is still expanding robustly but the weakening situation globally likely has traders on edge.

As I discussed in last night’s audio/video, Wall Street has replaced a short-term oversold condition with a short-term overbought condition so there was scope for some consolidation. The ferocity of today’s downward dynamic signaled I was not the only person thinking along those lines suggesting there was an element of buy the rumour and sell the news to the G-20 meeting. The extent to which the Index can continue to hold its sequence of higher reaction lows from the February nadir will be the arbiter of whether this is a consolidation or an evolving top formation.

Here is a link to a note by Michael Cembalest for JPMorgan Asset Management. It is dated October 25th but the points he raises are relevant to the above discussion: Here is a section:

In our Labor Day Eye on the Market, I concluded that rising Fed policy rates, the end of Central Bank intervention (see page 2), US import tariffs, slowing growth outside the US (particularly in Europe2), rising US budget deficits and elevated levels of market concentration in a handful of tech stocks would cause equity P/E multiples to contract. What I might have underestimated was by how much they would contract, and how these forces would offset continued US earnings growth and stock buybacks. Part of the investment discipline at the end of business cycles is to understand what such periods look like. One critical question is this: how much lead time do investors have before asset prices peak? When the last two business cycles ended, corporate earnings, economic growth4 and equity markets all collapsed at roughly the same time. As a result, if earnings growth looked good, the cycle still had legs. But in the 5 business cycles before the last two, equities peaked around a year before economic growth slowed, and before earnings started to materially weaken. If so, what we are now witnessing could be the final stages of what has been one of the best performing US equity markets since the Great Depression in the 1930s.

The underperformance of the UK and Australian housing markets, which had been among the biggest beneficiaries of the monetary environment over the last decade when viewed from this perspective is potentially a worrisome sign.

I think it is also relevant to recount this story from my own experience. Mrs. Treacy has wanted to reopen a retail location since we moved to the USA for the simple reason that some items sell better in a store than online. Since our previous store was in a tourist area, the logical place to start up again was in a tourist area of Los Angeles. We had a meeting with a broker in early October about taking a street front location between the Chinese Theatre and the Egyptian theatre on the Hollywood Walk of Fame. It’s a new development and the space will not be ready until February. The landlord liked the concept and they gave us a right of first refusal on 685 square feet for a net rent of $11000 a month. We considered it since it is very high foot traffic area but decided now was not the right time to sign a lease considering what the turnover required to pay that kind of rent would be. They called back a week ago and offered the space for $9000. That says to me demand is moderating against a background where rents are close to record highs. Meanwhile real estate broker friends report higher supply and longer times to sales.

Back to top