'Die Hard' Tower Lacks Christmas Cheer as Debt Deadline Looms

This article from Bloomberg may be of interest to subscribers. Here is a section:

Debt markets are increasingly sorting US leveraged loans into two categories: money good, and distressed.

A growing proportion of prices in the market are either very high, or very low. About 5% of the market is trading under 80 cents on the dollar, a share that has more than doubled since June, according to a JPMorgan Chase & Co. analysis. And more than half the market is trading above 96 cents on the dollar, an amount that has also more than doubled.

With more loan prices reaching extremes, companies that run into any sort of difficulty can see their loans plunge quickly. That can translate to surging borrowing costs, boosting the chance of corporations defaulting.

“This puts the worst companies at risk, as they’ll have a harder time refinancing,” said Roberta Goss, senior managing director and head of the bank loan and collateralized loan obligations platform at Pretium Partners LLC, in an interview.

I used to live around the corner from “Nakatomi Plaza” and always got a kick out of driving past the setting for the Die Hard movie. This property is a prime example of the issues facing many commercial properties. Occupancy rates are spotty. Regions depending on the tech sector are most at risk of high vacancy rates. That is going to put pressure on owners are they refinance loans in a tight liquidity and high interest rate environment.

Total returns on leveraged loans have held up surprisingly well over the last year. The Index is back testing its sequence of lower rally highs but is closing out the year in the region of the 2019 peaks. As we look at what surprises 2023 will bring, the biggest would be if leveraged loans hold their outperformance relative to the wider debt markets.

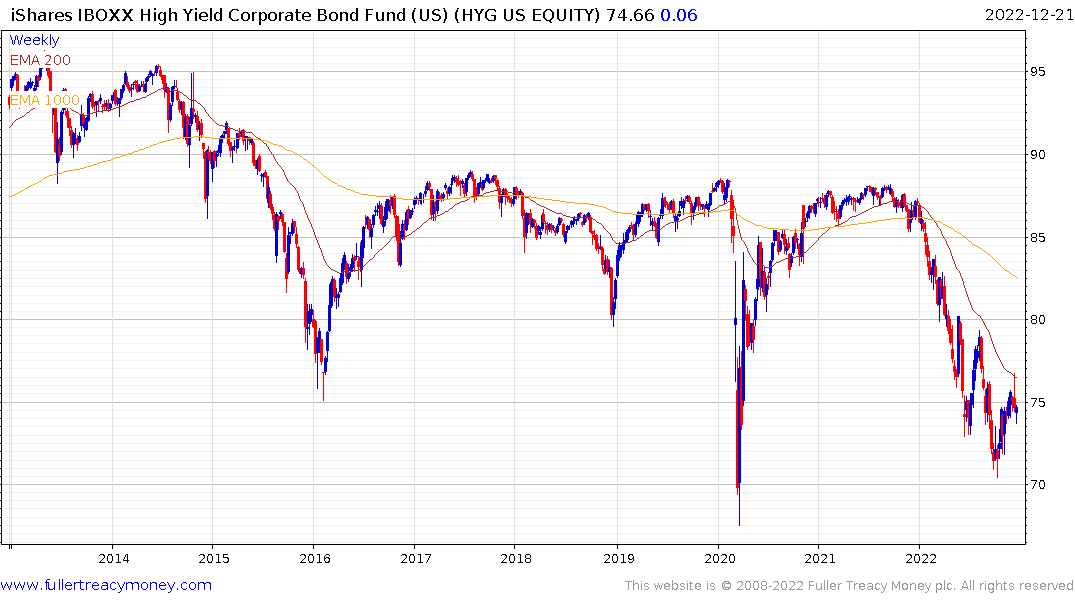

High yield bonds are rolling over, having encountered resistance in the region of the 200-day MA.

High yield bonds are rolling over, having encountered resistance in the region of the 200-day MA.