Quality, Value or Growth?

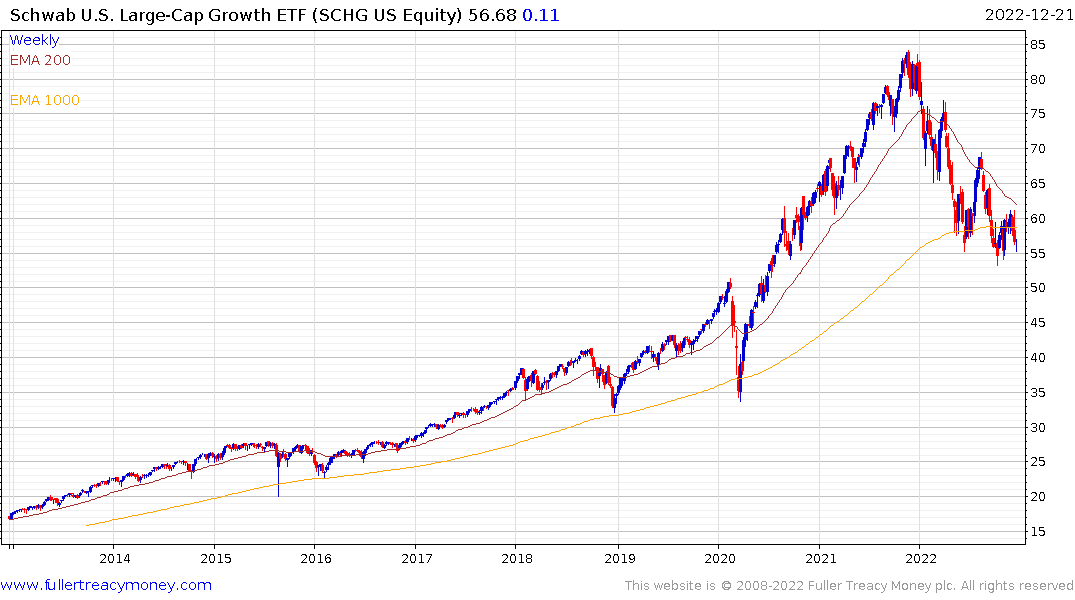

The underperformance of growth stocks has been the standout issue of 2022. Inflation surged and central bankers belatedly accepted it was not a transitory event. That has resulted in the swiftest pace of interest rate hikes in decades and it has also been a truly global phenomenon. This was accompanied by a swift run-up in the Dollar that tightened liquidity even more.

One of the most significant challenges for investors is many of the largest technology companies are also considered quality companies. Additionally, since technology companies do not tend to have large metal bashing manufacturing sites, they tick many of the ESG boxes too. The net result is the growth and quality factors look identical. What will surprise may investors is some value factors also share the same pattern. It appears there is more than one way to gauge hard value.

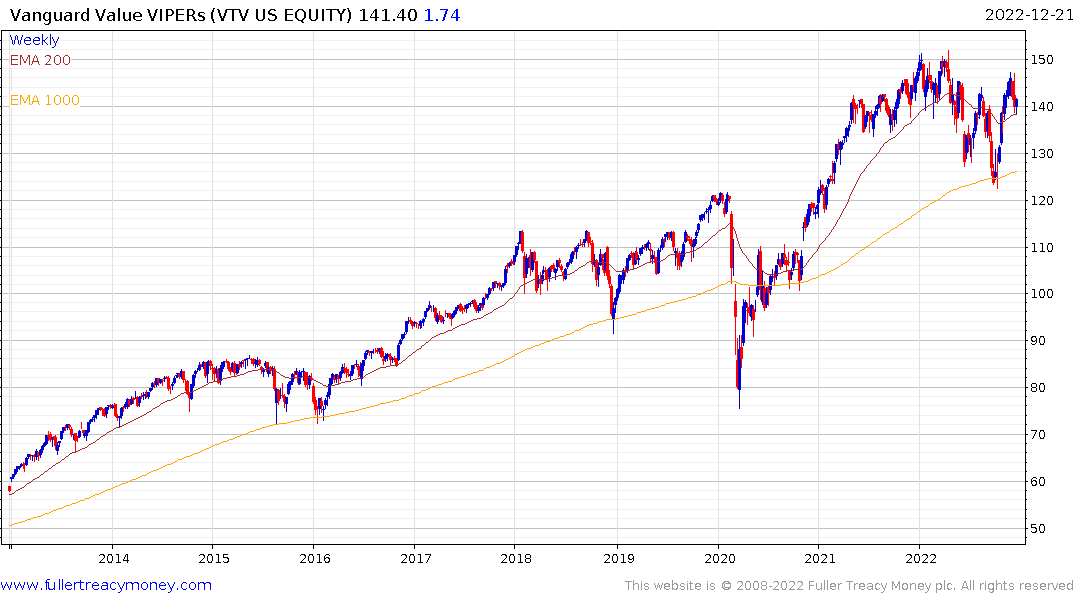

The Vanguard value ETF has held up better. That outperformance has been achieved simply by not holding the largest technology companies and focusing on reliable cashflows.

Meanwhile, dividend aristocrats are also considered quality companies. The ETF has held up much better because most of the large technology companies do not have sufficiently long records of increasing dividends to qualify for membership.

Meanwhile, dividend aristocrats are also considered quality companies. The ETF has held up much better because most of the large technology companies do not have sufficiently long records of increasing dividends to qualify for membership.

The defensive qualities of dividend aristocrats mean they only go on sale when the economy experiences true stress. They bounce back quickly when a recovery begins because they then represent value too.

Back to top