US Natural Gas Futures Slump to a 28-Month Low on Warm Weather

This article from Bloomberg may be of interest. Here is a section:

US natural gas futures slumped to the lowest in 28 months as weather forecasts have shifted milder since last week, further eroding the prospect for heating demand this winter.

Gas for March delivery dropped 4% to $2.183 per mmbtu as of 8:51 a.m. in New York

Futures touched $2.168 earlier, the lowest since Sept. 2020Weather across the eastern two-thirds is looking warmer next week when compared with Friday’s outlook, with above-usual temperatures expected for southern states: Maxar.

See WHUT for a map of latest 6-10 day weather forecast: NOAA“The market appears ready to push natural gas steeply lower until storage surpluses stop ballooning and/or production responds more vigorously to lower prices,” analysts at EBW AnalyticsGroup said in a note to clients

Natural gas prices are accelerating lower and swiftly approaching the psychological $2 area for Henry Hub. The warm weather for this time of year is depressing prices in the short term. Nevertheless, natural gas is an essential commodity for the global economy and lower prices will ultimately encourage demand and suppress supply.

The price has seldom spent much time below $2 over the last thirty years and drops below it have generally been buying opportunities. I continue to hold my leveraged long and will add to that position on the first evidence of support coming in.

The price has seldom spent much time below $2 over the last thirty years and drops below it have generally been buying opportunities. I continue to hold my leveraged long and will add to that position on the first evidence of support coming in.

This extended weakness is taking a toll on gas company trends. Tourmaline Oil ha completed a type-2 top formation.

Birchcliff is now trending lower.

Birchcliff is now trending lower.

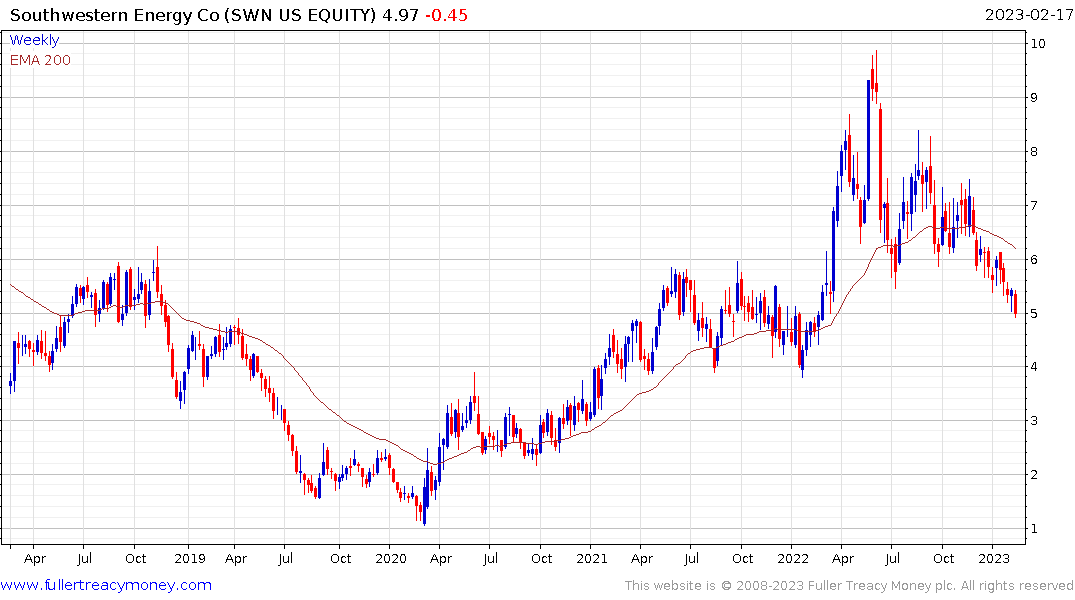

Southwestern Energy also continues to trend lower.

Southwestern Energy also continues to trend lower.

The obvious catalyst for renewed vigour in this sector will be an upside reversal for natural gas.

Back to top