Biodiesel and Renewable Diesel: It's All About the Policy

This article from farmdocdaily may be of interest. Here is a section:

Biomass-based diesel (BBD) production in the form of renewable diesel is undergoing a major boom. What is not well understood is that the boom is entirely policy driven. This is most directly evident in the fact that the price of BBD (as represented by FAME biodiesel) is about twice as expensive as petroleum diesel. The implication is that little or no BBD would be produced and consumed in the U.S. without substantial policy incentives. A further implication is that the renewable diesel boom cannot be understood without understanding the policies driving the boom. In this article, we use a simple model of the BBD market to illustrate the impact of a variety of policy scenarios. When considered in isolation, the market impact of the policies considered are fairly straightforward.

The analysis becomes much more complicated when multiple policies are in effect at the same time. In particular, the impact of a given policy may be heavily dependent on which other policies are in place at the same time. In the U.S., all four of the following policies are presently in place and interact to determine the price and quantity of BBD: i) blenders tax credit; ii) RFS mandates; iii) carbon credits in California; and iv) import duties (tariffs). The interactions between these policies can produce surprising and poorly understood economic outcomes.

There was a great deal of enthusiasm for biodiesel in the run-up to the 2012 peak in corn and soybean prices. At that point the upward pressure using food crops to produce fuel was having on consumers became evident and the sector contracted. At that point food commodity prices collapsed because demand growth from the fuel business evaporated.

Today, the sense of urgency to do something to contain carbon emissions is higher than ever and Russia’s conventional diesel exports are no longer accepted in Europe or the USA. That has revitalized interest in the biodiesel/green diesel sector. The knock-on of elevated food price inflation is an even bigger factor today than it was a decade ago.

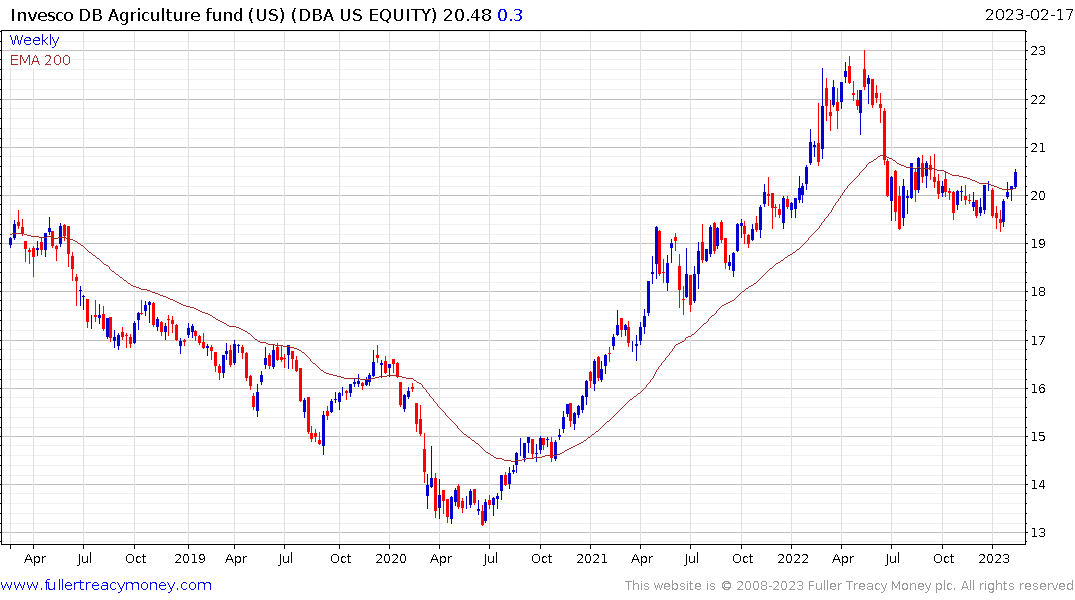

The Invesco DB Agriculture ETF is currently firming from the region of the 200-day MA.

The Invesco DB Agriculture ETF is currently firming from the region of the 200-day MA.

Corn and Soybeans continue to consolidate in the region of their long-term peaks.

Palm Oil has been building support in the region of the upper side of the long-term range for the last six months.

Palm Oil has been building support in the region of the upper side of the long-term range for the last six months.

Many of the fertiliser and seed companies are looking indecisive. If oil prices continue to firm from the $80 region that will lend further support to the green diesel argument, and support agricultural product prices.

Many of the fertiliser and seed companies are looking indecisive. If oil prices continue to firm from the $80 region that will lend further support to the green diesel argument, and support agricultural product prices.