Uranium: Time "U" move?

Thanks to a subscriber for this report from Canaccord Genuity which may be of interest. Here is a section:

Here is a link to the full report.

Here is a section from it:

The going has been tough. After several false dawns for a renaissance in the nuclear sector, we have taken stock to consider if things really are different this time. Since the Fukushima disaster in March 2011, uranium equities have been decimated with companies listed on the ASX and TSX reducing in number from 585 to ~50, and a loss of over 70% of market value of major listed producers. Weak pricing, production curtailments and project deferrals have weighed heavily on investor sentiment, overwhelming the critical role that nuclear power still has on providing base load energy and meeting global emissions targets. However are green shoots starting to appear?

Destocking to offset curtailed production, but only to a degree; Uranium spot price risks to the upside: Recent cuts by Cameco (CCO-TSX : C$14.45 | Not rated; ~5% of global production) and 10% cuts at KazAtomProm should see increased destocking and supply up to 20% of consumption (2017 market size of ~170mlbs). Overall enriched inventories remain at six years, which is sufficient for energy utilities, however, utility under buying and emerging purchasers such as newly listed Yellow Cake (YCA-LSE : 224.00p | Not rated; buying ~7Mlbs in 2018) investment vehicle could place upward pressure on mined supply. Prolonged restarts aside, if mobile inventory approaches sensitive levels, there is a risk to the upside on spot pricing, in our view.

Long term contracts starting to roll off, marginal production can be rationalised. The long term nature of pricing and deliveries has offered a degree of price protection to producers over recent years (current U3O8 price; LT US$34/lb, spot US$26/lb). As these have rolled off, large producers are fulfilling obligations with opportunistic spot purchasing (i.e. Cameco meeting up to 80% of 2018 sales through this strategy) in lieu of loss making mine production. Despite increasing rates of reactor restarts (nine in Japan thus far in 2018), this could be a risky strategy in our view, with over 50% of utility providers seeking to renegotiate LT supply contracts over the next five years. This could place pressure on previously insulated higher cost producers.

The uranium market is in a unique position such that the world’s largest miner of the metal would rather buy on the spot market than mine itself. That says a lot about the marginal cost of production relative to current prices.

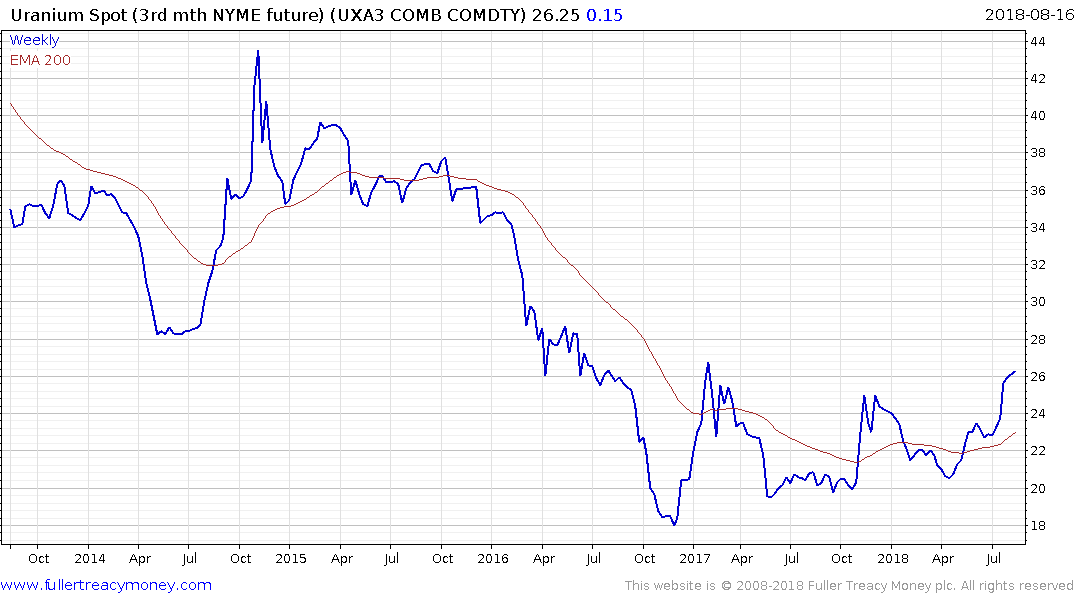

That condition will not last forever because supply will eventually run out when mine activity is unprofitable. The uranium price has held a progression of higher reaction lows within its base formation since late 2016 and rallied over the last month to break the medium-term progression of lower rally highs. I need to hold the move above the trend to confirm a return to demand dominance.

Cameco is back testing the region of the trend mean and will need to bounce soon if a return to demand dominance is to be reconfirmed.