Transocean Takes $2.76 Billion Charge Amid Glut in Drilling Rigs

This article by Will Kennedy and David Wethe for Bloomberg may be of interest to subscribers. Here is a section:

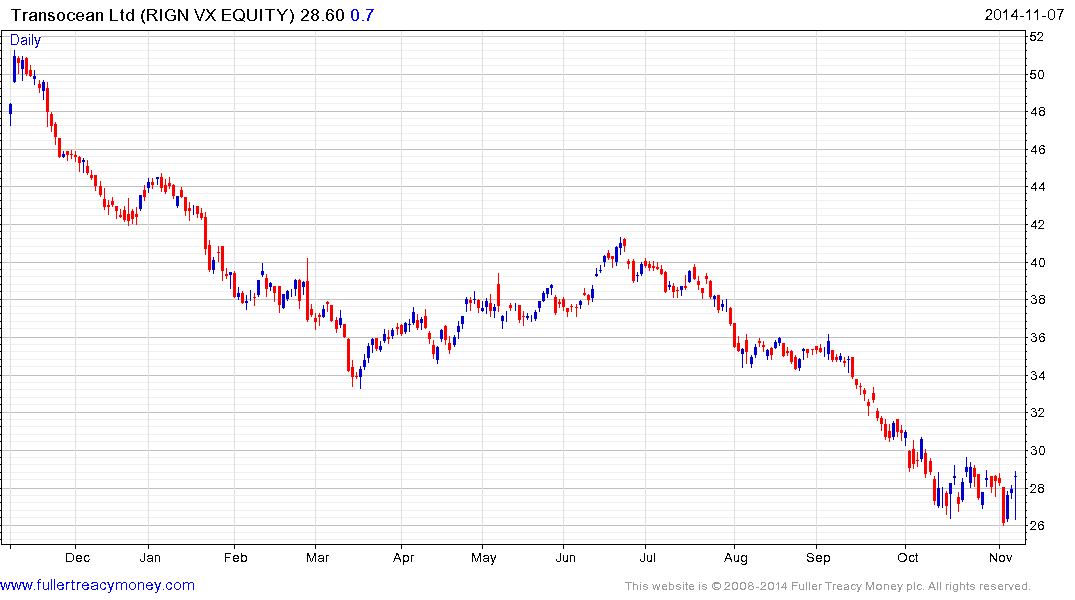

Transocean Ltd., owner of the biggest fleet of deep-water drilling rigs, is feeling the effect of an oncoming glut in the expensive vessels just as crude prices tumble.

The company will delay posting third-quarter results after saying earnings would be hit by $2.76 billion in charges from a decline in the value of its contracts drilling business and a drop in rig-use fees, the Vernier, Switzerland-based company said in a statement today. Transocean, which had been scheduled to report earnings today, fell 7.9 percent to $27.55 at 8:10 a.m. in New York before regular trading began.

Oil’s decline to a four-year low in recent months has caused companies to consider spending cuts, reducing demand for rigs and the rates it can get for leasing them to explorers. Rig contractors had responded to rising demand during the past few years with the biggest batch of construction orders for rigs since the advent of deep-water drilling in the 1970s. Almost 100 floating vessels are on order for delivery by the end of 2017, according to a June estimate from IHS Energy Inc.

?“Ouch,” analysts from Tudor Pickering Holt & Co. wrote in a note to investors. The announcement “reflects the reality of this oversupplied floater rig market globally.”

A topic of conversation at The Chart Seminar is “How do the majority of market participants predict how a market is likely to trade?” The short answer is that people predict what they see. When prices have been static for a period of time, expectations go down and people assume that the situation will persist. When oil prices were ranging above $100 oil companies and those that service them made decisions based on the situation persisting.

Some will have become overleveraged in an effort to squeeze the most possible advantage from the situation as they perceived it. Others are better capitalised and will be among those that exhibit early relative strength. At The Chart Seminar we define a range as “an explosion waiting to happen”. Brent Crude Oil prices have experienced a dramatic break down from the three-year range and have at least paused near $80. It remains to be seen whether this level will hold beyond scope for an unwind of the oversold condition relative to the 200-day MA.

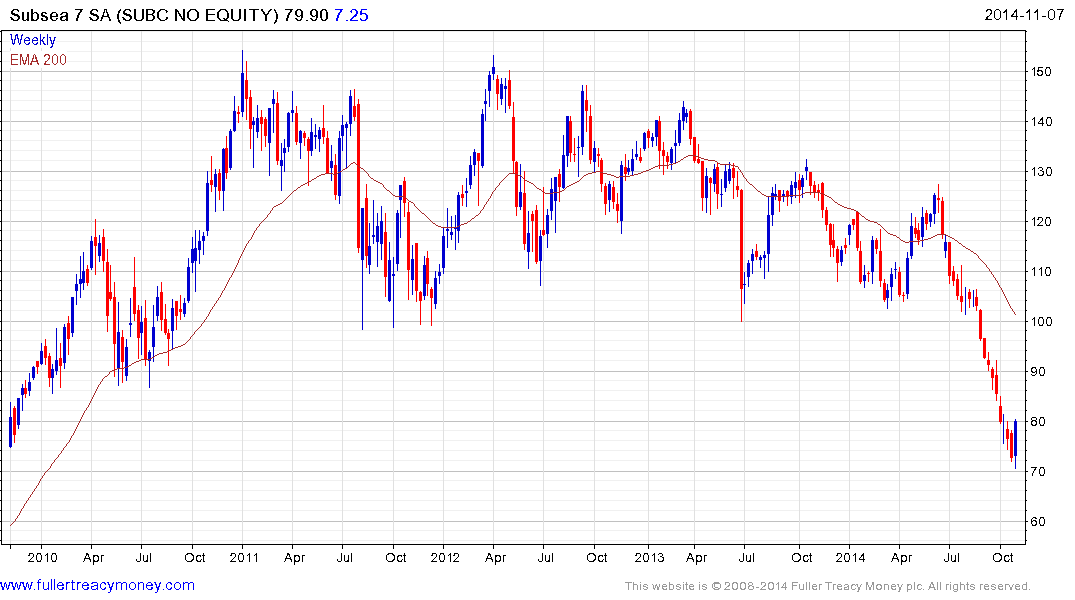

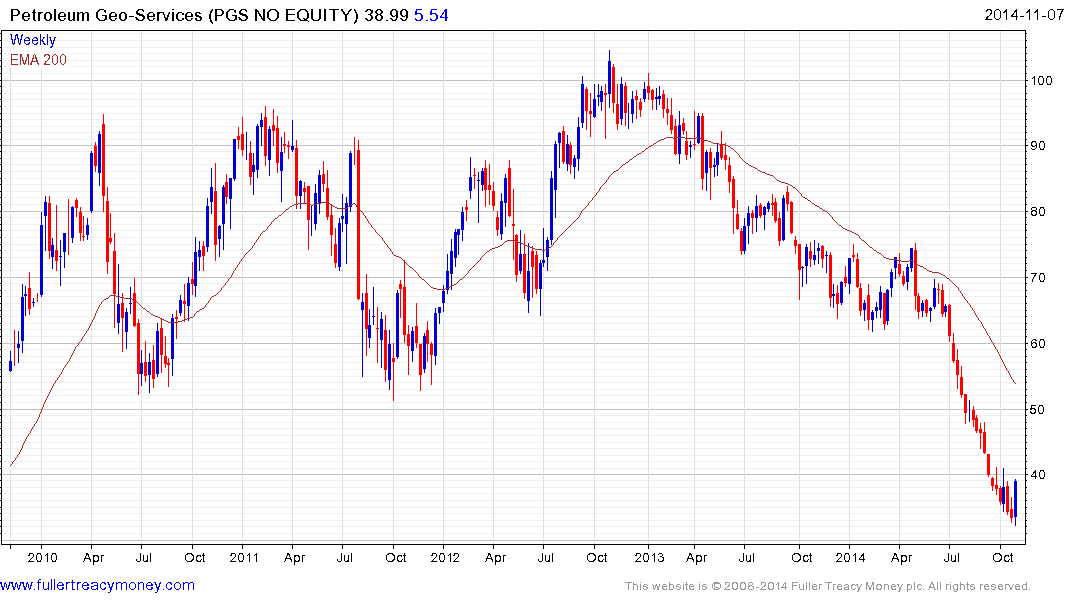

The upside weekly key reversals evident on Norwegian listed: Subsea 7, and Petroleum Geo-Services are particularly noteworthy at the end of what has been a tumultuous week for the sector. .

Elsewhere both Transocean and Diamond Offshore Drilling have found at least short term support.

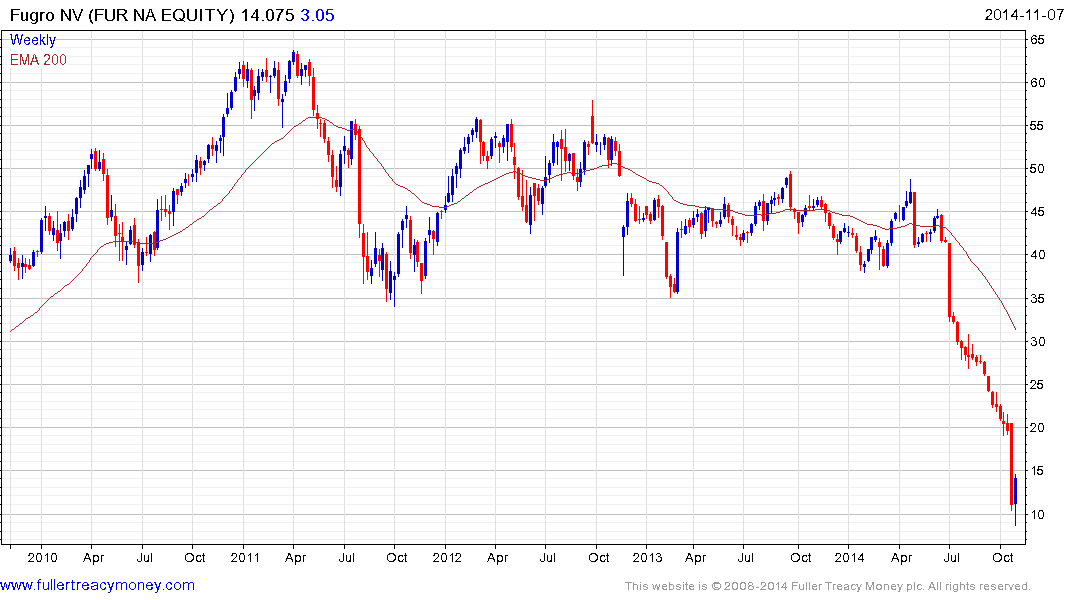

News that Boskalis has taken a 14.8% stake in Fugro stemmed its 19 consecutive week decline.

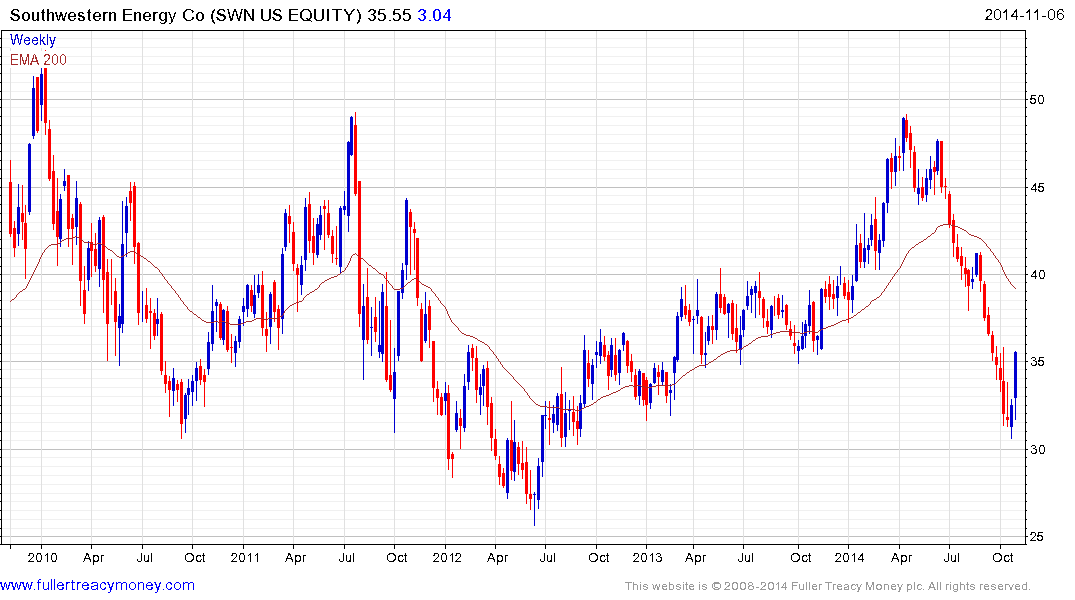

Elsewhere Southwestern Energy and Devon Energy are unwinding their respective oversold conditions relative to their 200-day MAs.

Back to top