Gold mining companies making losses

This article by Julian Philips for Mineweb may be of interest to subscribers. Here is a section:

Around 50% of the world’s gold mining companies are now making losses. Close to 100% of platinum mining companies are. Silver miners may be faring better, but as the bulk of silver is produced as a by-product of base metal mining we do not think silver production itself will be hurt by lower prices. Scrap sales of gold are down as sellers are seeing prices too low, so market supply overall is falling.

Miners have done a bad job of containing costs in a declining gold price environment. Issues relating to free cash flow and offering investors the leverage to the gold price they desire are well known and fully priced in. If half of all miners are now selling gold at below their all-in cost, the situation is unsustainable beyond the short term. Some will go bust, but the stronger performers will subsequently be left in a better position to compete.

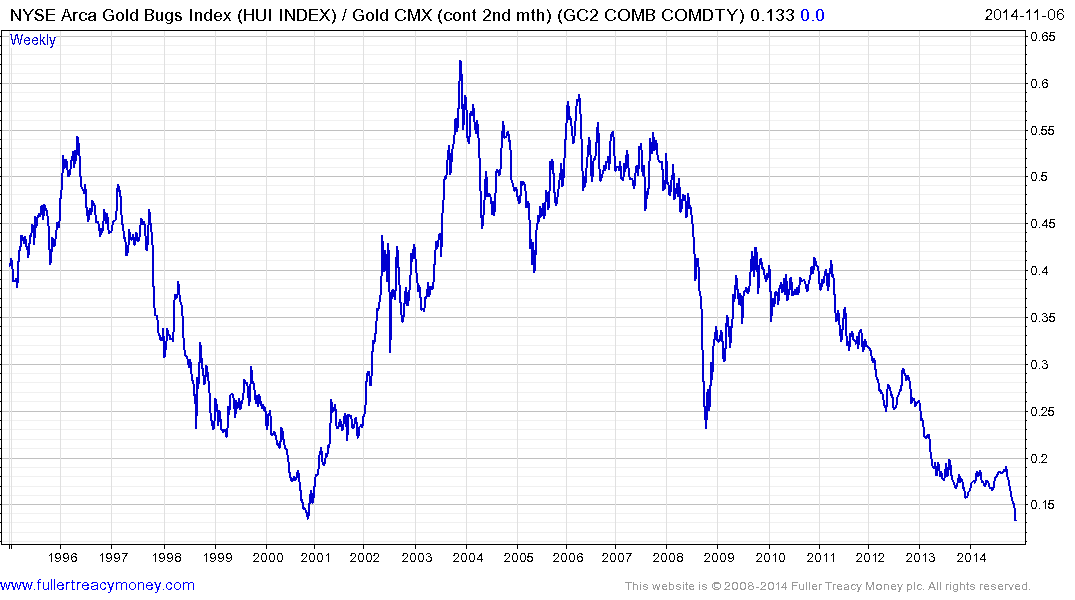

The NYSE Arca Gold Bugs Index / Gold price ratio hit a new all-time low this week. Gold shares are now trading below where they traded relative to gold before the bull market started.

.png)

In absolute terms the NYSE Arca Gold Bugs Index found at least short-term support this week in the region of the 2008 lows. Such has been the speed of the decline that a reversion back up towards the 200-day MA would represent an almost 50% rally from the low.

Among the better performers:

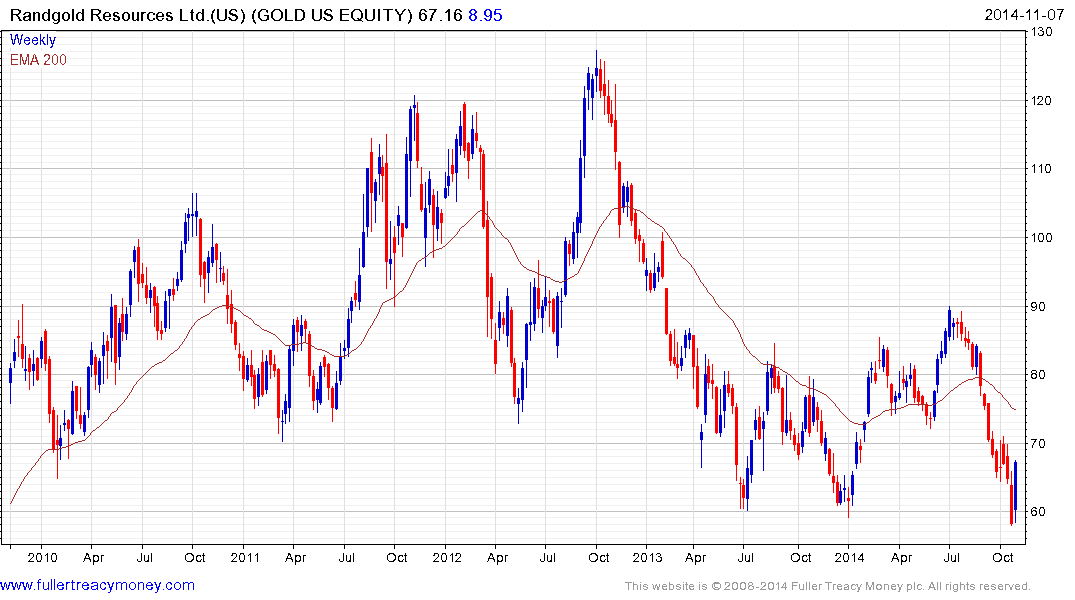

Randgold Resources found support this week in the region of the lower side of a two-year range and a sustained move below $60 would be required to question potential for additional upside.

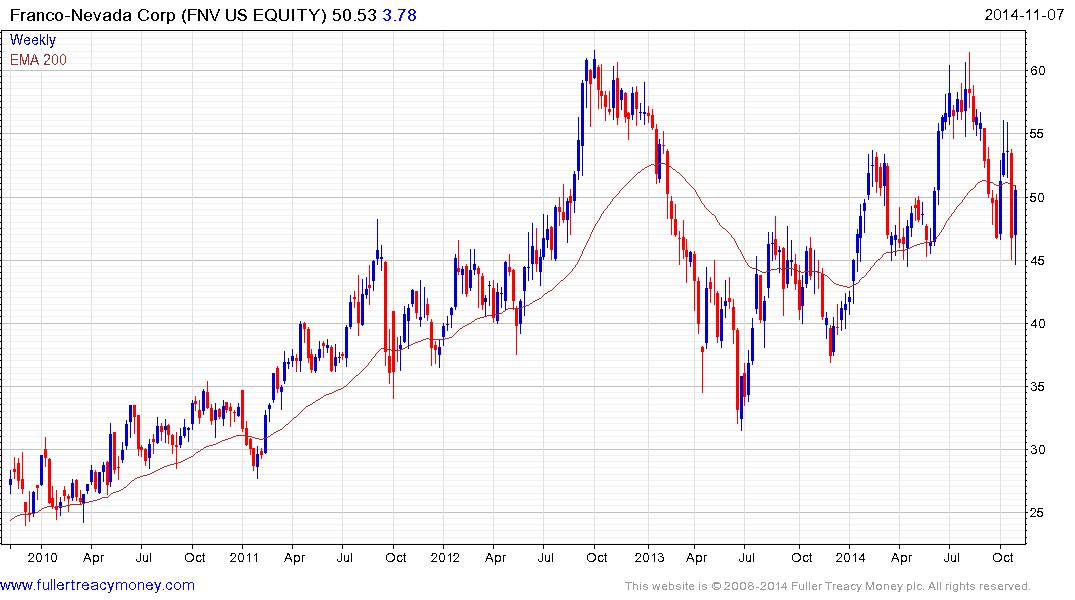

Royalty streamers Franco Nevada and Royal Gold both found at least short-term support this week to continue their patterns of relative outperformance.

Back to top