Spiraling Offshore Wind Costs Show Limits of Biden Inflation Act

This article may also be of interest. Here is a section:

Orsted’s warnings are the most concrete example yet of the limits of the IRA, which was hailed as a key driver for America’s nascent offshore wind industry. While the law provides at least $370 billion in grants, tax credits and other incentives for climate and clean energy projects, that’s proving no match for rising inflation and borrowing costs. And by dangling higher incentives for companies sourcing US-made parts, it’s fueling demand before the domestic supply chain catches up, driving prices higher still.

“The irony here is that the Inflation Reduction Act probably has had some part in stoking inflation for some of the green goods that it intends to encourage,” said Kevin Book, managing director at ClearView Energy Partners LLC. The IRA is already spurring construction of new US factories to manufacture critical clean-energy gear, but that’s lagging behind renewable project development, exacerbating the issue in the short term. “It takes a long time to stand up a factory. It takes a long time to replace a foreign-sourced supply chain.”

This is a great example of how governments getting involved in the free market often introduce inefficiencies that drive up prices for everyone. Energy infrastructure is capital intensive. That’s an acceptable risk when companies have a clear vision of what works and have a captive demand pool of consumers.

The challenge for new energy companies is they come with an implied risk premium. The technology is unproven, longevity is questionable, and the competitiveness of supply is subject to political whim. That implies an interest rate sensitivity that is underappreciated by most investors.

Orsted continues to accelerate lower as the cost of walking away from major contracts is priced in.

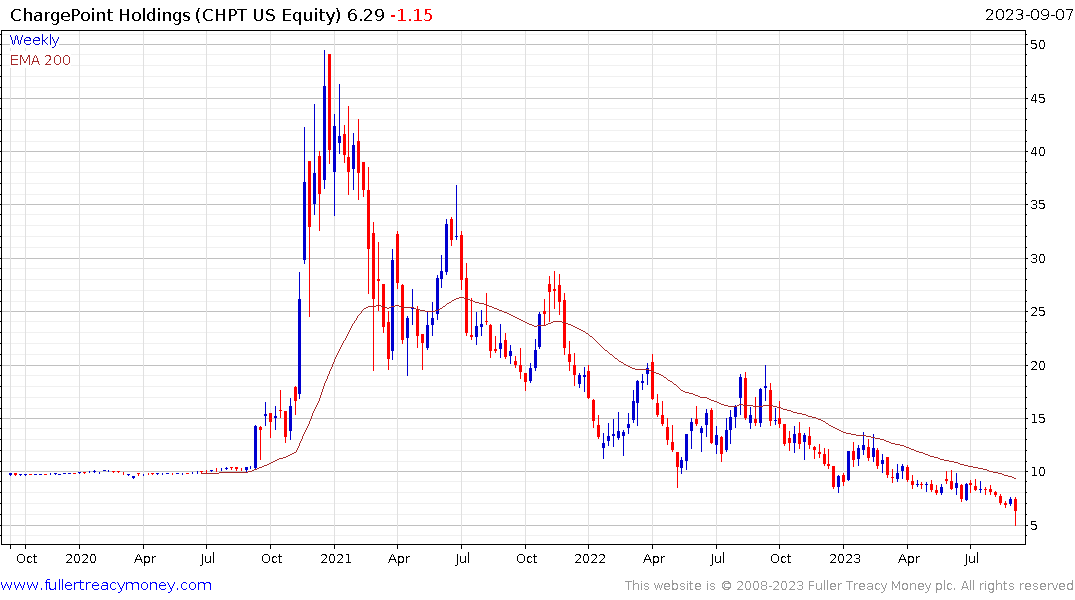

ChargePoint gapped lower today on weaker earnings. Blink Charging is also trending lower. Both companies are relying on subsidies to build charging networks to cater to demand for EVs that is still uncertain. The fact many people charge their cars at home means the total addressable market is probably also smaller than initially claimed.

QuantumScape has enough money to take it through until 2025 but does not expect to generate significant revenue until 2028. That implies significant additional revenue raising over coming years and that is assuming the solid state battery technology can be scaled, manufactured, and shipped on time. For now the share is in a prolonged base formation punctuated by occasional short-term jumps.

QuantumScape has enough money to take it through until 2025 but does not expect to generate significant revenue until 2028. That implies significant additional revenue raising over coming years and that is assuming the solid state battery technology can be scaled, manufactured, and shipped on time. For now the share is in a prolonged base formation punctuated by occasional short-term jumps.