Secular Themes Review August 6th 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on May 7th. These reviews can be found via the search bar using the term “Secular Themes Review”.

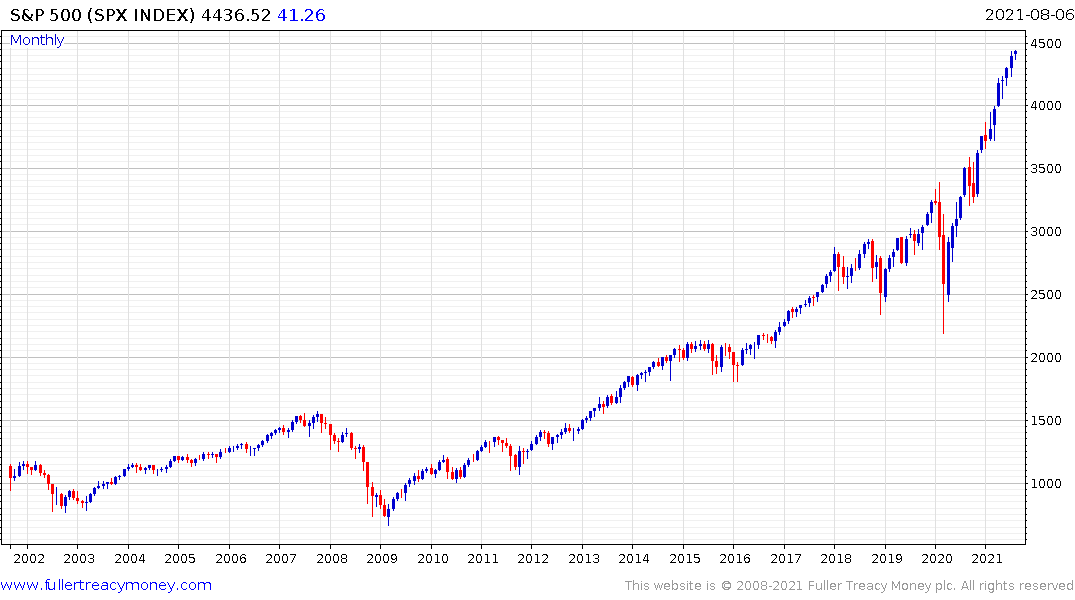

We are 17 months on from the panic low in 2020. At this stage it is quite normal to marvel at the speed of the advance and worry that the pace can’t possibly be sustained. The abiding sentiment is something like “surely, the world is not nearly as good as it was before the pandemic and therefore how on earth can prices be so high?”.

The world is not as good as it was before, millions of people have been deeply inconvenienced and many are traumatized by the events of the last 17 months. The counter argument is the quantity of money in circulation has only been matched during wartime and that has helped to inflate the price of everything. That’s the key to the argument. Having spent so much to achieve this recovery does anyone really believe central banks are going to endanger it? So where do we go from here?

I am very much reminded of the market sentiment in 2010. At that stage, the S&P500 had almost doubled. The majority of investors were still terrified that the proverbial “other shoe was going to drop” and were unwilling to redeploy cash after such a big advance. The memory of major losses was still too raw for risk appetite to surge.

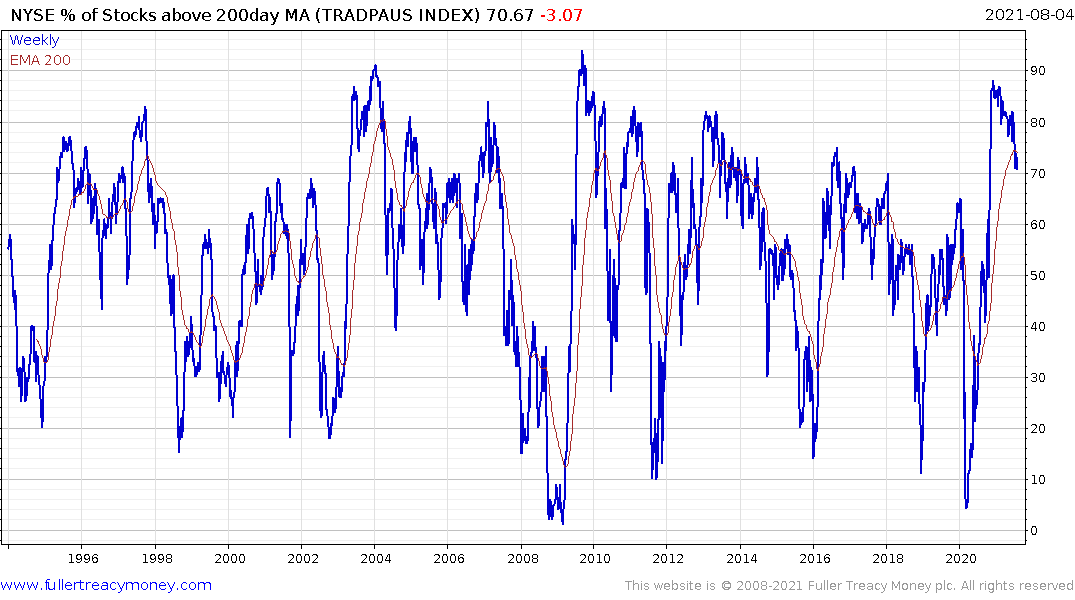

The percentage of stocks trading above their respective 200-day moving averages on the NYSE is a graphic illustration of what happens during big market declines. The measure declines sharply during stock market shocks. Those big declines shock everyone and monetary policy eases in response. That fuels broad-based advances, with most stocks taking part, so the measure surges back towards the upper side of the range. That’s what happened between 2009 and 2010 and it happened again between March and November 2020.

After the initial rebound some reordering occurs as the winners are winnowed from the also rans. The regions, sectors and stocks most attuned to the post crisis reality continue to outperform but the rest of the market gets busy with convalescence. This winnowing process narrows the breadth of the market which is exactly what we are seeing today. This is where things get complicated.

No two cycles are the same. Here is what Amazon’s chart looked like in 2010. It had rallied impressively off the lows in 2008 and was at a new high by the end of 2009. That strong performance prepared no one for the enormity of the gain over the following decade. It’s said that generals are always fighting the last war. These mega-cap companies were the first stop for investors in 2020. They were uniquely positioned to benefit from the stay-at-home orders. They were able to gain market share in one fell swoop, but it is going to be extraordinarily difficult to repeat that growth. Meanwhile many of these companies are bumping up against the law of large numbers.

If we combine the market caps of Apple, Amazon, Alphabet, Microsoft, Facebook, Netflix and Nvidia the total is now close to $10 trillion. That’s almost equal to China’s 2017 GDP. We always get these kinds of outrageous comparisons during manias, so this must be a mania. However, that is not a timing tool.

The nominal market cap figure does not give us a lot of information. When we look at it versus the market cap of the whole market, we get a better understanding of what is going on. The FANGMAN stocks peaked at a market cap of 21% of the whole market in August 2020, and experienced a deep setback. The ratio has recovered somewhat over the last two months and is back above the trend mean. At a minimum this is a loss of momentum for the mega-cap sector akin to the pause in 2018/19. It might yet recover and push onto to new relative higher, however, it is also worth considering this is a relative top formation. It’s a relationship that needs to be monitored.

The influence very large stocks have on market cap-weighted indices is greatest at the top. As they peak, their influence diminishes because the new relative strength leaders gain market share. It’s important to highlight that the pullback for the mega-caps in August did not result in more than a mild pullback for the wider market. That’s because the average share was still rallying. Therefore, in order for a major market peak to occur, both the relative market cap of the mega-caps and the performance of the average share would need to roll over.

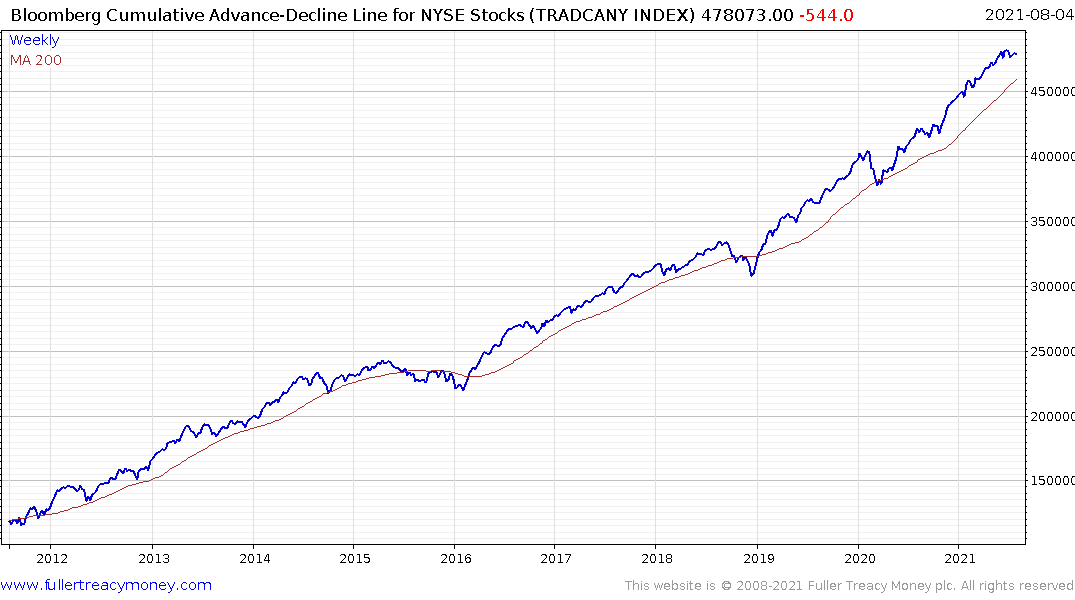

The Cumulative Advance Decline Line gives us a visual representation of what the average stock is doing and it is still trending higher. This measure has been a reliable lead indicator for major trouble in the stock market. It peaked and trended lower form 1998 and again in 2007; well ahead of peaks in the wider market. The measure has gone nowhere for the last two months but it has not broken down either.

A good part of the reason for the continued strength of stock prices is financial conditions are still extremely accommodative. With so much money floating around looking for a home, demand for all manner of hard assets is surging. That’s true for everything from prime real estate to all manner of collectibles.

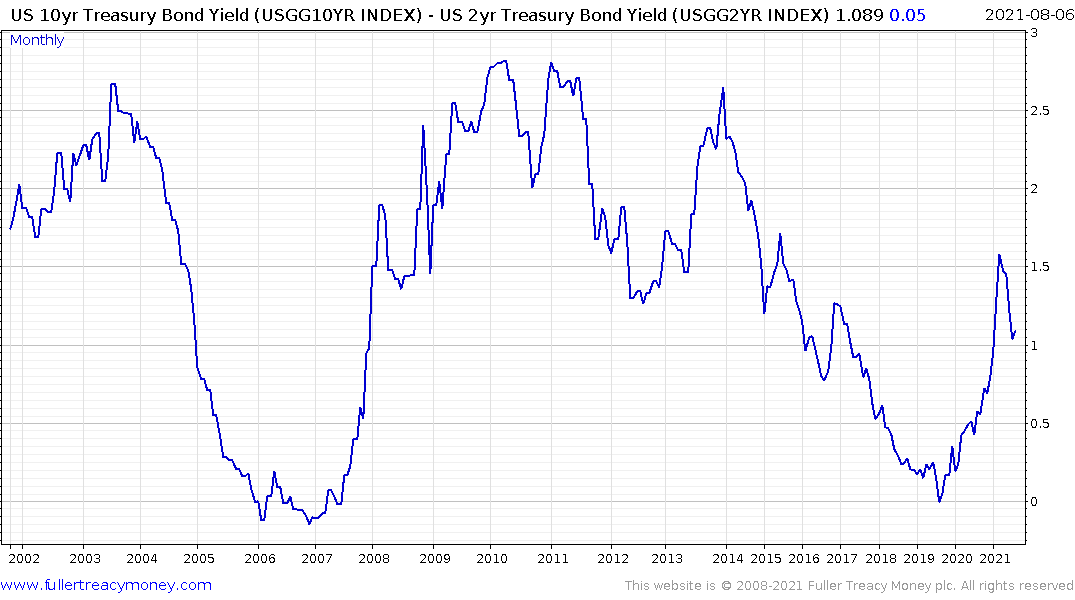

The yield curve spread has put in a medium-term peak. This helps to emphasise the point that bond yields can’t rise meaningfully without causing trouble for governments; everywhere. That brings us to the outlook for the pandemic and the associated outlook for inflation.

As I have mentioned over the last week, I think we are currently in the goldilocks phase of the pandemic. It’s enough of a problem to ensure liquidity remains abundant but not so much of a threat to extend lockdowns. The contrast today between the rising number of cases and strong job creation is a good example of that. This is complacency looks likely to be challenged in the near term.

.png) Today’s big move in US Treasury yields suggests investors are pricing in the winding down of assistance, lower fiscal deficits and eventually higher rates. The simultaneous contraction of government deficits with the US expecting to spend $2 trillion less in 2022 represents a challenge for asset prices.

Today’s big move in US Treasury yields suggests investors are pricing in the winding down of assistance, lower fiscal deficits and eventually higher rates. The simultaneous contraction of government deficits with the US expecting to spend $2 trillion less in 2022 represents a challenge for asset prices.

The big challenge to comparing market and monetary responses today with the past is the capacity of the virus to mutate. This is not a credit cycle where you can only go bankrupt once and stronger investors come in and swoop on cheap assets which helps to form a low. Instead, today we are forced to make a judgement call on the perception of whether technological solutions will continue to solve humanity’s gravest threats.,

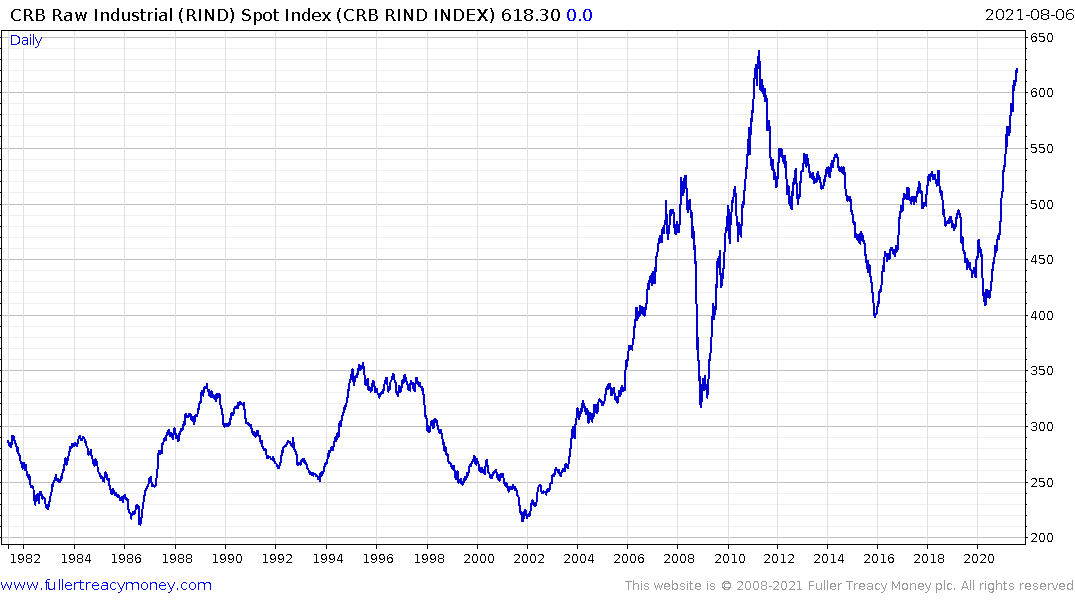

Inflationary pressures are mounting. Shipping rates have quadrupled in the last year. Shortages of goods and the damage done to supply chains is putting upward pressure on prices. Wage demand growth is ramping higher and commodity prices are trending higher. Additionally, the consumers are impatient to live their best lives and are frontrunning purchases because they believe prices will be higher in future or they are unwilling to wait for prices to decline. The additional psychological element is central banks have said they want an inflationary bias and unwilling to raise rates until they get it.

At present central banks are talking about how to normalize policy. A number of central banks in the emerging markets have already begun to raise rates. This week the Bank of England talked about tapering. The Federal Reserve is talking about tapering. Both the Bank of Canada and Reserve Bank of Australia are already tapering. India’s RBI is also draining liquidity from the system at present amid rising inflationary pressures.

I regard these plans as akin to a maternity birth plan. You can come up with whatever sequence of events you like but if surprises occur, you will do what is necessary. As major companies press ahead with the opening offices back the question of whether the Delta variant is manageable is going to become more pressing. Additionally, attention is increasingly turning towards the Epsilon and Lambda variants.

Treasuries yields surged but the short-term sequence of lower rally highs remains intact. The sell-off today was initiated by the view that the era of extraordinarily loose monetary conditions is ending. Therefore, the outlook for growth and reflation is very much tied to how the threat from the Delta variant is perceived.

If it results in a slowing down of plans to open up that will delay plans to taper and the status quo will be sustained. The big swing factor is the willingness of governments to continue to boost borrowing. If the delta variant proves too much of a challenge for opening up, then another stimulus will be likely and that would further support asset price appreciation for stay-at-home champions.

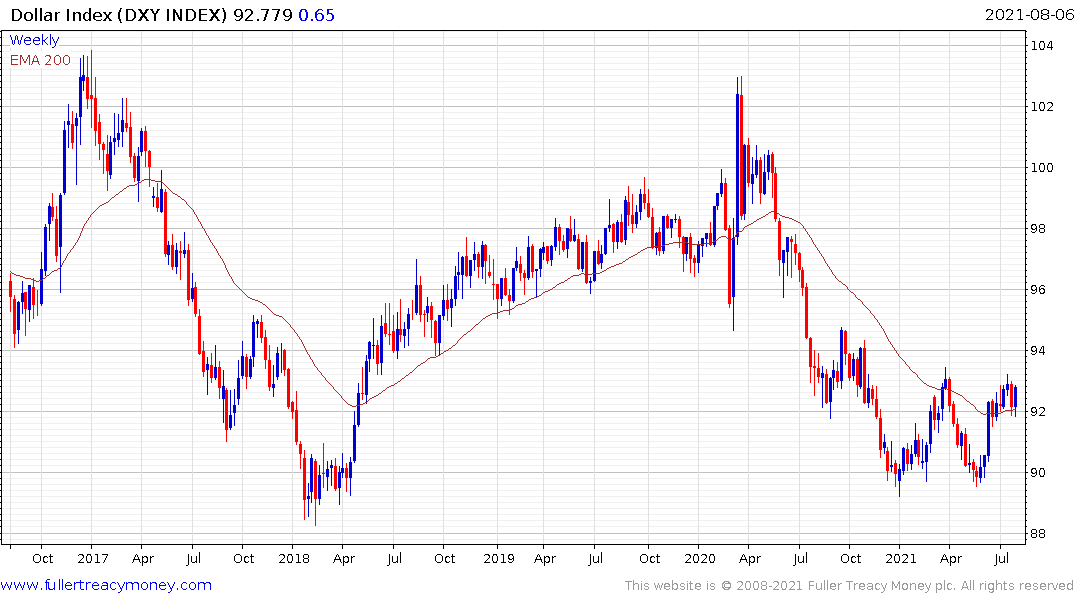

Gold pulled back sharply today as the potential for less government spending boosted the Dollar. It is now testing its most recent low and will to rebound soon if the end of the yearlong correction hypothesis is to remain credible.

Gold pulled back sharply today as the potential for less government spending boosted the Dollar. It is now testing its most recent low and will to rebound soon if the end of the yearlong correction hypothesis is to remain credible.

Silver also pulled back sharply to close below the trend mean for the first time in more than a year.

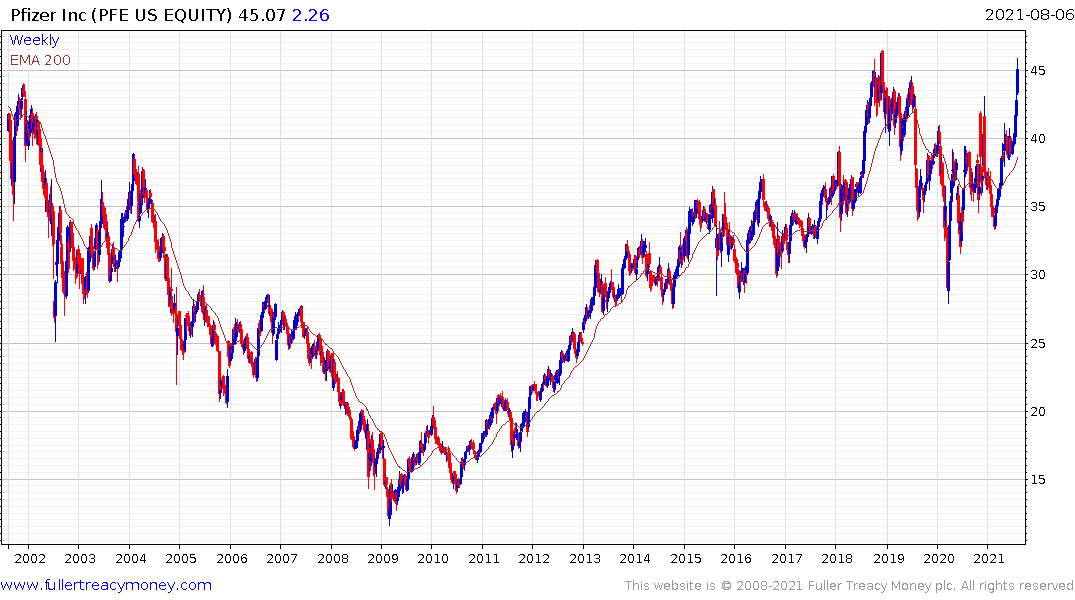

Vaccines have become a globally significant sector over the last year and that is likely to persist given the propensity of coronaviruses to mutate. It’s certainly helping to support shares like Pfizer and Moderna.

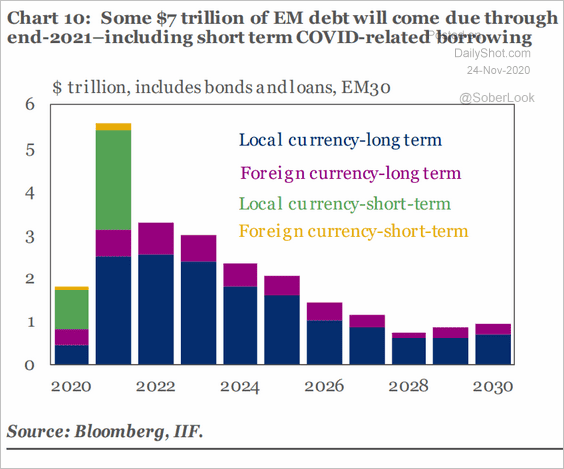

Meanwhile US high yield spread appear to have bottomed. Upwards of $5 trillion US Dollar needs to be refinanced in the emerging markets this year. Indigestion at the total quantity of refinancing demand is a likely cause of the difficulties at China Evergrande (the largest issuer in the emerging markets) and China Huarong Asset Management (the failing former bad debt manager). Emerging Asian spreads were trending higher and were led by China. However, that trend is rolling over just as US spreads bottom.

China’s efforts to exert greater control over the trajectory of capital and economic growth by penalizing investments in unapproved sectors are a sideshow compared to the challenge of keeping the debt gravy train on track. I remain of the view the country’s assets are un-investable and suitable only for traders.

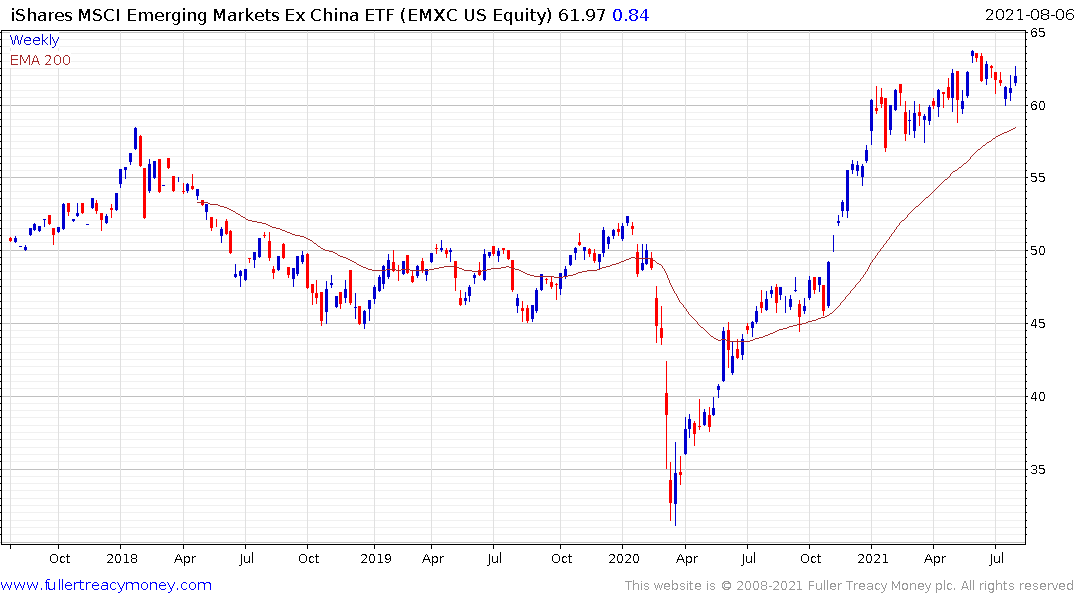

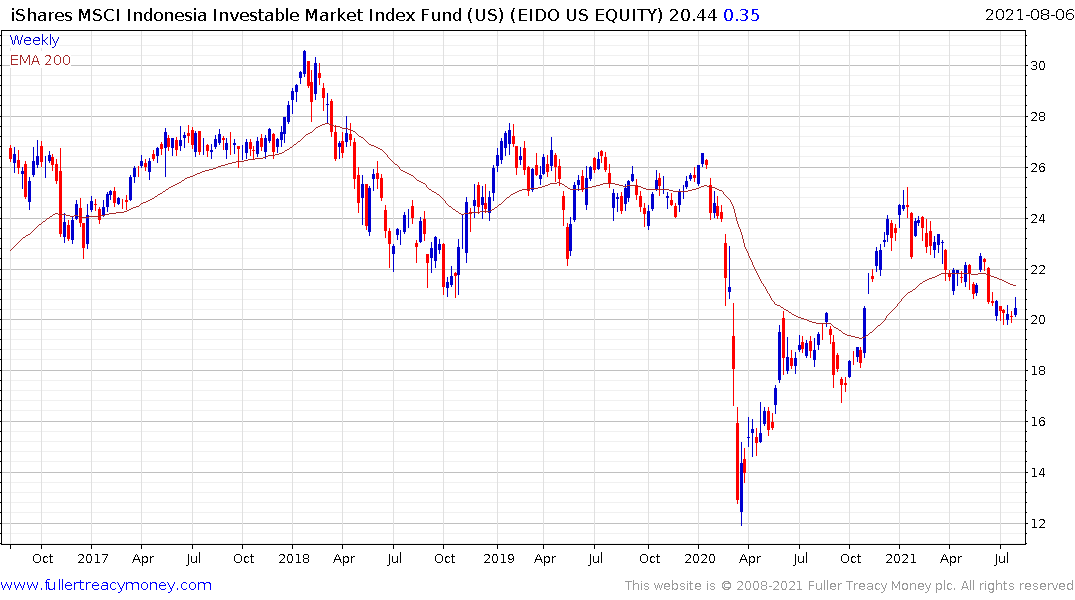

Despite the challenge represented by the delta variant in many Asian countries, the Emerging Asia-Ex China sector continues to outperform.

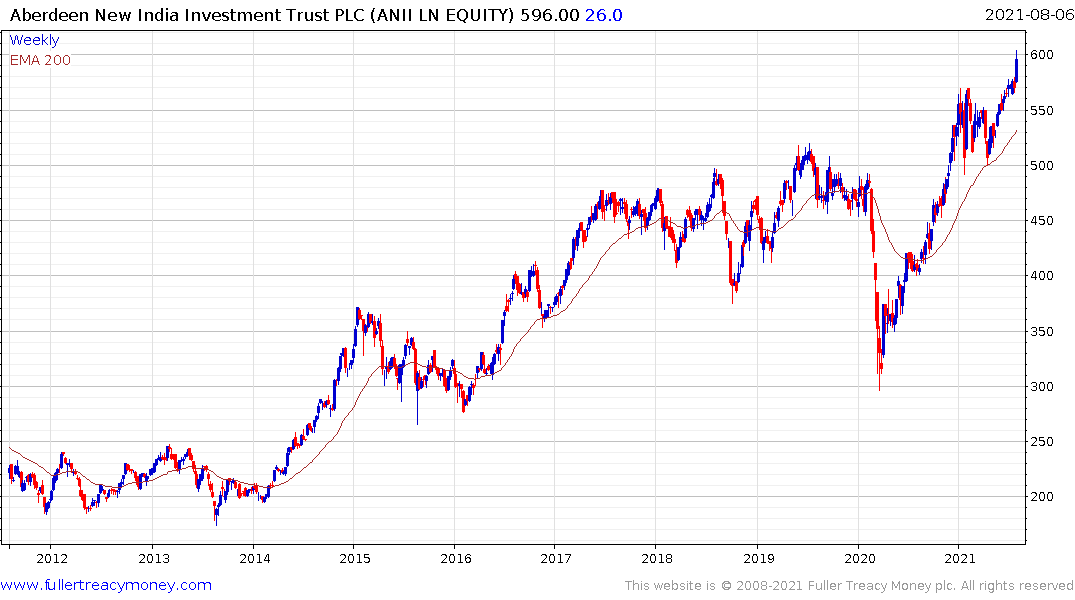

India remains a high growth market with the potential for standards of governance to improve over the long-term. Internally, there has been a significant recalibration of the housing finance sector over the last few years which appears to be ending. That signals the beginning of a new credit cycle which should help to support growth over the coming years.

Housing Development Finance Corp rebounded impressively from the region of the trend mean this week.

The Aberdeen New India Investment Trust remains in a steep but consistent uptrend.

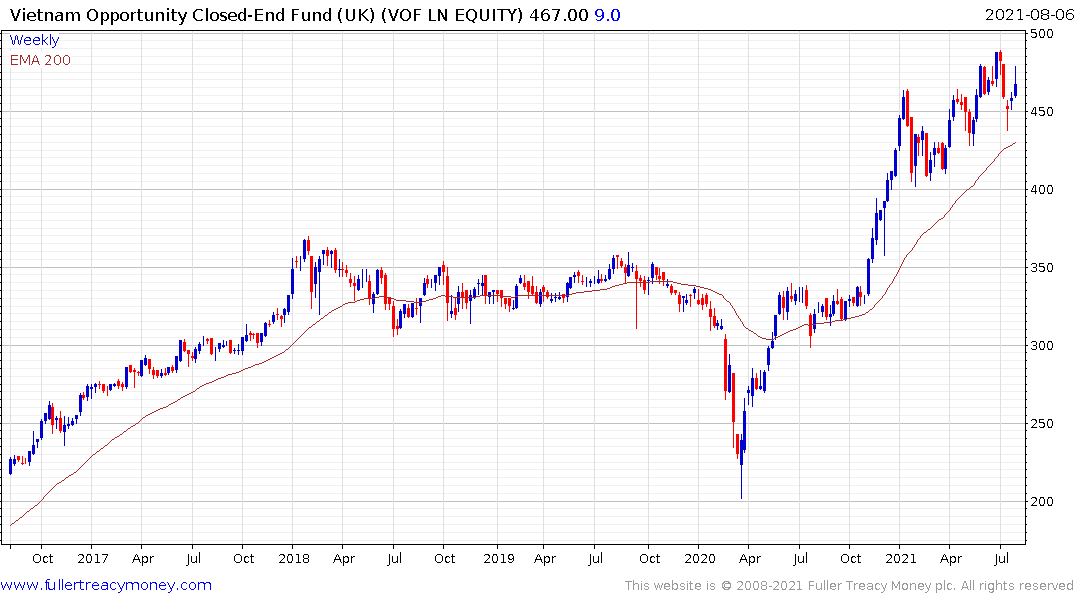

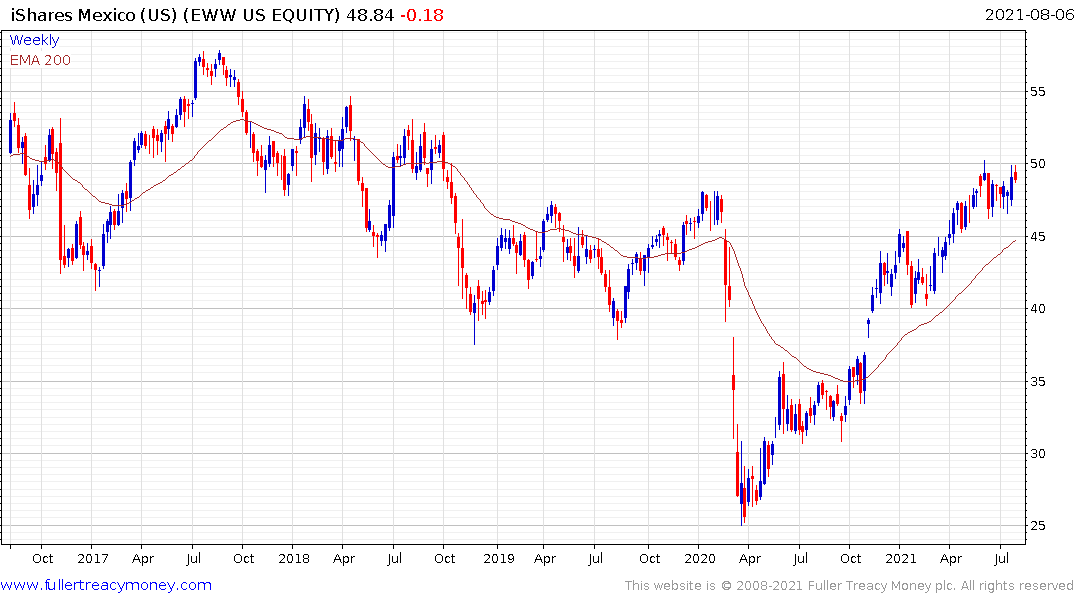

The pandemic has taught the world two things. The first is how reliant we are on small cheap components like microcontrollers to fuel the economy. The second is that much of what the world relies on comes from China and they are not as friendly as they used to be. Nearshoring, stockpiling and diversification of supply is inevitable as a result.

That’s beneficial for countries like Mexico, Vietnam, India and Indonesia.

The diversity of locations and tighter emissions regulations are conspiring to elevate shipping costs. The Baltic Dry Index continues to extend its breakout from a long-term base.

The diversity of locations and tighter emissions regulations are conspiring to elevate shipping costs. The Baltic Dry Index continues to extend its breakout from a long-term base.

The Breakwave Dry Bulk Shipping ETF trades in shipping futures. Meanwhile the Sonicshares Global Shipping ETF was launched this week and invests in related companies. At present is has only $1 million in assets.

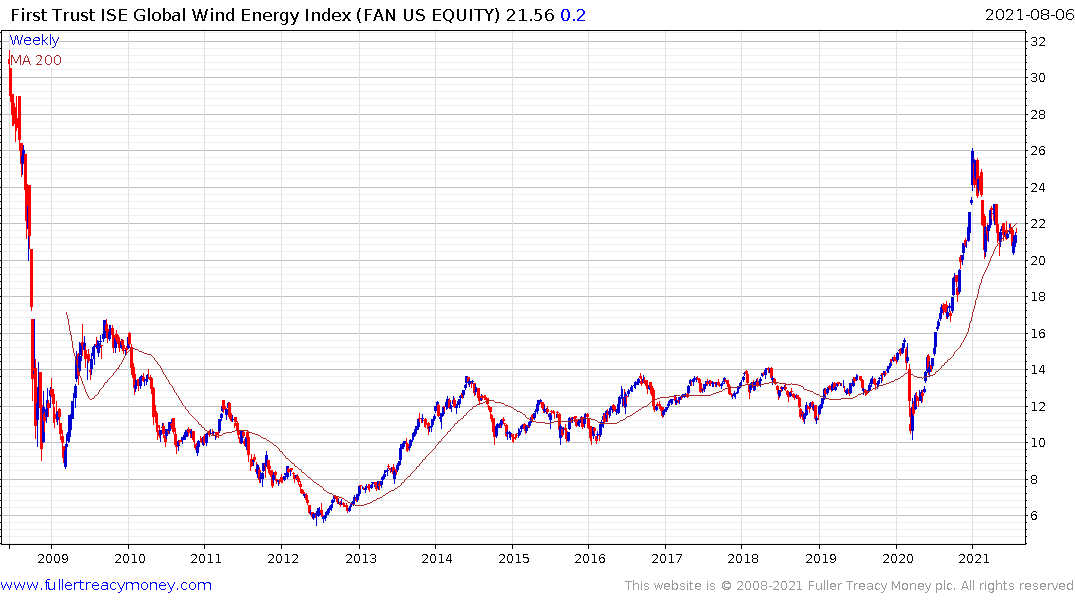

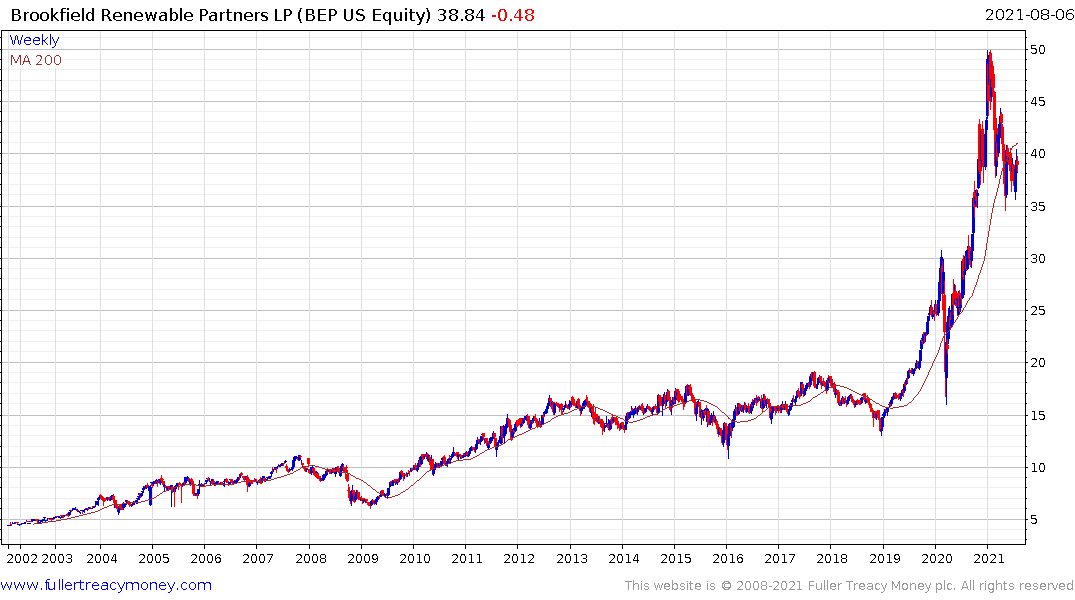

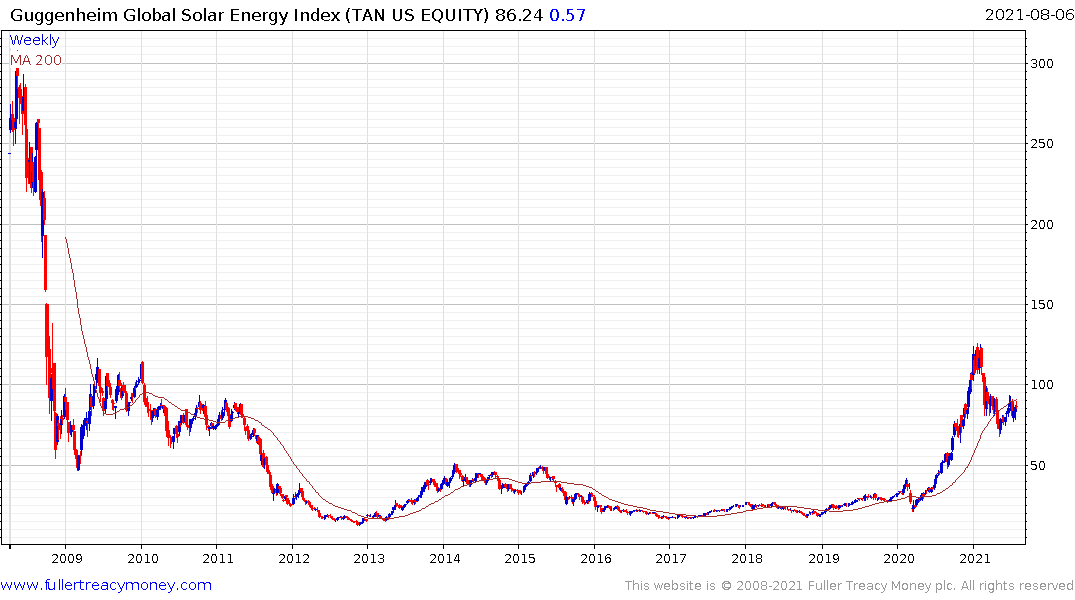

Increasingly politicians are talking about the fact that the ambition on containing global warming to 2 degree is not enough. They are increasingly calling for an acceleration of the pace of decarbonization. These are relevant considerations because the supply of ESG bonds is surging and the prices of the solar, wind and Brookfield Renewable Energy Partners funds are all trading in the region of the trend means.

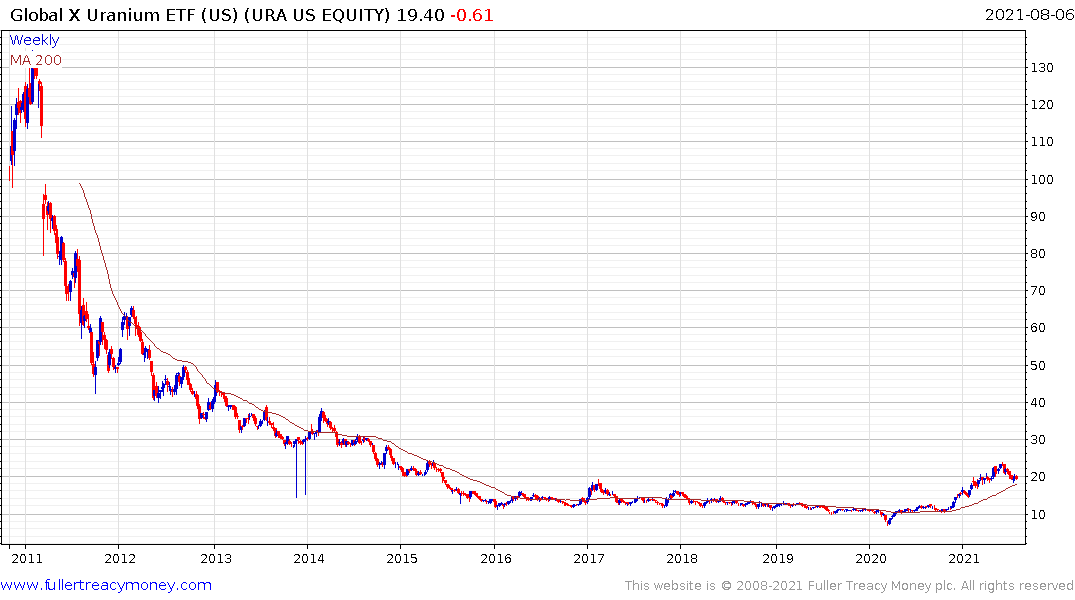

Any call to accelerate decarbonization should be positive for the nuclear sector but the Global X Uranium ETF is also trading back in the region of its trend mean. China’s molten salt reactor is due to come on line in the next month or two and should help to improve sentiment towards the sector provided it is successful. It is also likely that more hydro will need to be both upgraded and built. California’s Oroville power station was turned off today for the first time in its history because of drought. This report from the IEA may also be of interest.

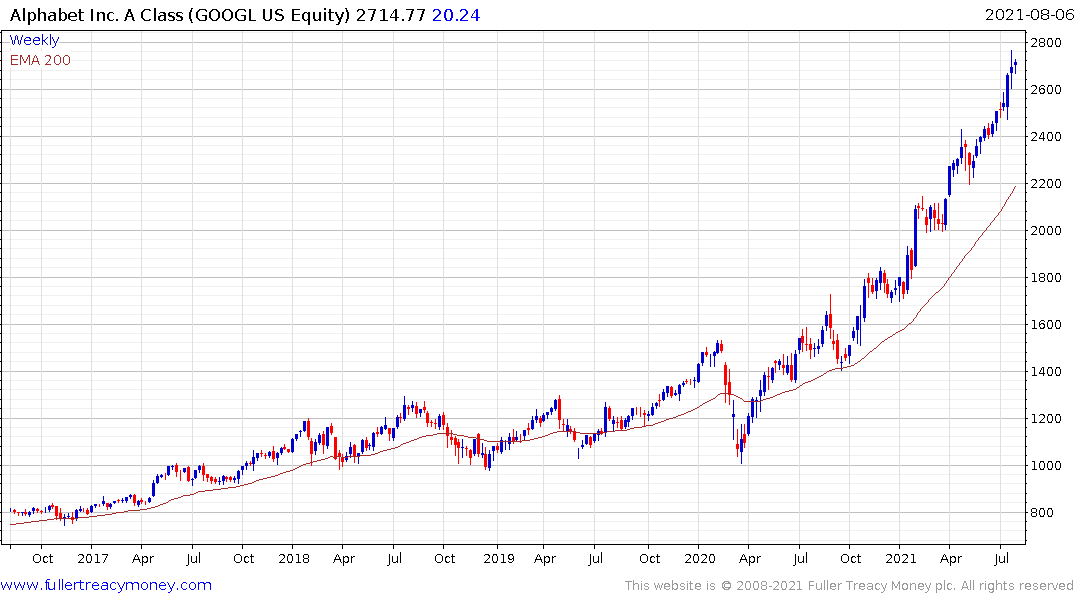

Alphabet has been all over the news this month. The company appears to have solved the protein folding problem using its deep learning computer team. By releasing the information for free to the world, it will aid in accelerating the pace of innovation in the materials, energy, food and healthcare sectors.

The company has also announced they have used their quantum computer to develop a time crystal. At present that is an impressive statement in its own right and helps to confirm that private companies are more than capable of conducting the kind of primary research we have previously relied on governments to do. Alphabet doesn’t make money from their discoveries but it may do in future.

Of course, the big prize is autonomy for which global competition is heating up. Tesla is going for natural learning. Google is going with detailed mapping and China is creating a central repository for data to boost innovative solutions.

The share remains in a steep but consistent uptrend.

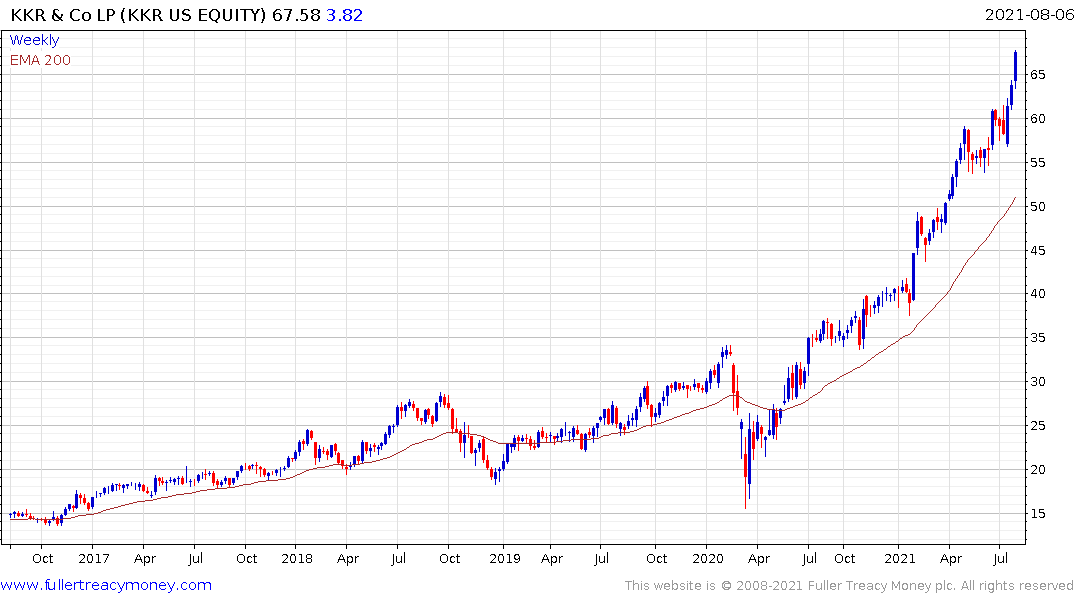

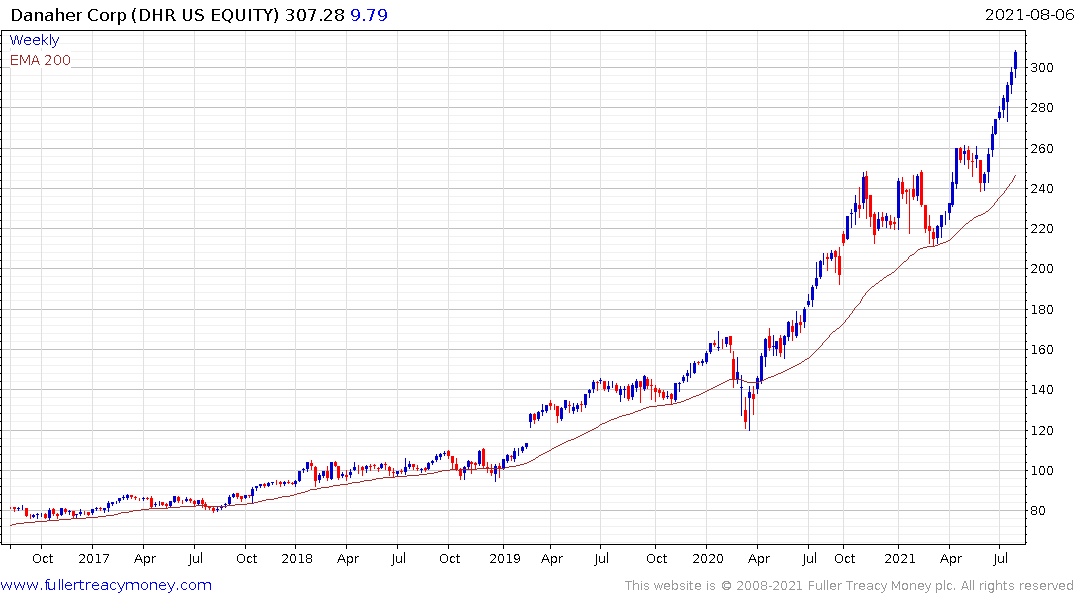

Private equity firms have accelerated higher over the last month. Their business model thrives in a lower interest rate environment and is threatened by any whiff of liquidity being withdrawn. Blackstone, KKR, Man Group and Danaher have accelerated of late and are susceptible to consolidation if bond yields continue to trend higher.

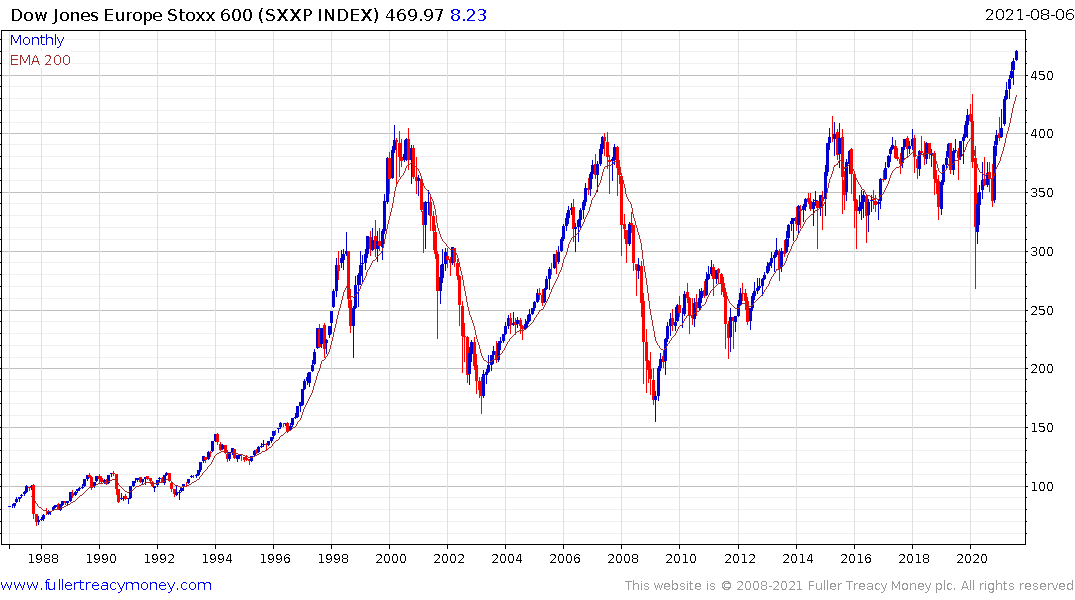

The one region where there is less talk of tapering is the Eurozone. That has helped the Europe STOXX 600 complete a 21-year base and Italy’s FTSEMIB Index completed a more than decade-long base formation.

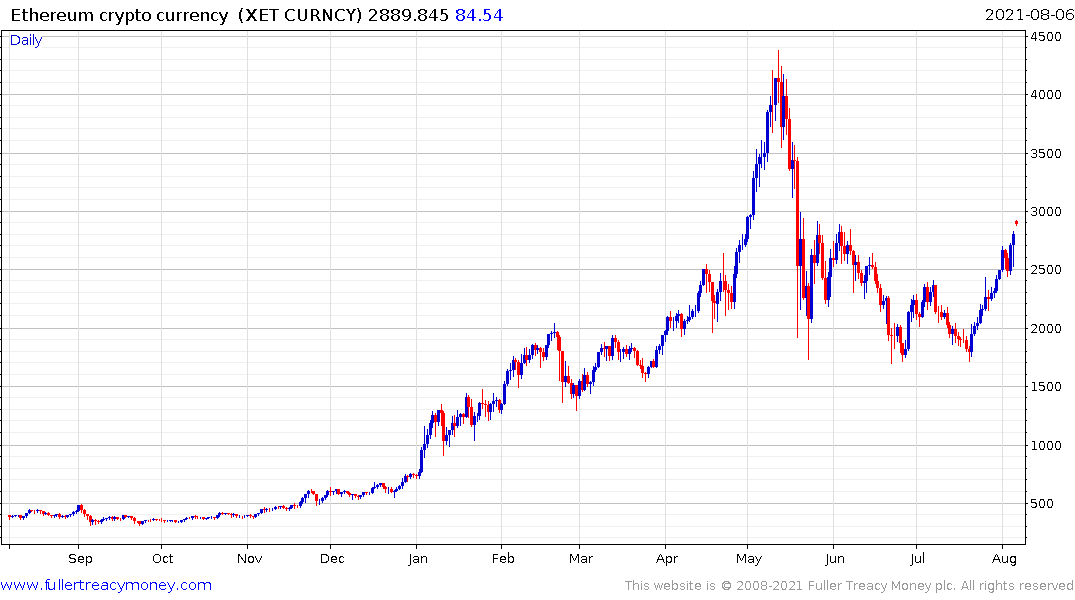

Last month I expressed my view that the medium-term correction in cryptocurrencies was likely to continue. I received the following comment from a subscriber who proved more prescient than I. Here is a section from his comment:

I value the input you provide Eoin. I however disagree with your comment that cryptos will next be of interest in 2023. Ethereum is a disruptive technology platform with strong network effects which is growing rapidly. In addition, the supply of ETH will diminish by about 85% (a triple halving) when Ethereum transitions from Proof of Work to Proof of Stake (POS), likely in December or early next year. Electricity required to power Ethereum simultaneously goes down by 99.99%. In addition, EIP1559 goes live at the end of this month, which both improves the user experience and burns the bulk of the fees (paid in ETH) - the combination with POS probably results in the number of ETH declining on a consistent basis. Holders of ETH can stake their ETH to own an attractive yield. In short, it is the most compelling opportunity I’ve come across in my decades as a money manager.

Here is a link to my response. I stand by my view that cryptos will eventually become invisible. However, I wonder if I am looking too far into the future. The reality is the London hard fork in Ethereum passed off without a hitch yesterday. That has reintroduced the limited supply argument to the sector. Ethereum extended its break above $2500 and bitcoin is now trading above the psychological $40,000. That suggests there is scope for additional upside in the near term. Cryptos are collectibles and are priced in real time. That is an added attraction for many investors.

As I look around the world at developing opportunities the two that remain front of mind are the threat of shale gas fields peaking and the promise of materials science to make single use plastics obsolete.

The evidence to support Goehring & Rozencwajg’s view that production in the Permian basin is peaking is still sparce so it is a sector worth watching. The missing ingredient in a new commodity-led bull market has been a bull case for oil and gas. Natural gas is currently testing the psychological $4 area so it is close to potentially completing its base formation. Crude oil has a long way to go to erode OPEC’s excess supply.

The challenge for the oil sector is in how well they can overcome increasingly onerous environmental regulations. Regulators look at how successfully they have forced legacy automotive companies to adopt zero emissions strategies and intend to extend that trend into additional sectors. That suggests a nascent bull market in biodegradable plastics is possible.

Major chemical companies like BASF, Danimer Scientific and Solvay are unloved. Celanese is leading on the upside.

The big message at present is we have been through a benign few months for markets. Threats to the status quo are rising not least from variants and central banks for polar opposite reasons. The basis for the strong trend over the last 17 months has been liquidity. If monetary and fiscal assistance is in fact withdrawn it is likely to weigh on asset prices. That’s unlikely to be fatal to the uptrend but it could represent a pause.

Back to top