OPEC Preview & Revising Down

Thanks to a subscriber for this report from the team at DNB. Here is a section:

As written above, Saudi Arabia see no reason to let higher cost producers continue to produce while themselves, a low cost producer, should cut oil production in a supply driven downturn. If you cut your output when demand is dropping you do not give your market share to someone else, but if the price drop is due to a supply growth story the situation is different. There were stories also leading up to the last OPEC meeting in November that meetings were held with non-OPEC producers in order to gather support for production cuts also from countries outside of OPEC. It turned out that there was no appetite to contribute from any non-OPEC nations then. The situation may of course however be different this time since now all oil exporting countries have felt the pain of lower prices while that was really not the case last autumn.

Again we are seeing in front of the OPEC meeting, which will be held on June 5, that some OPEC countries are trying to rally support from several non-OPEC producers to contribute to production cuts. Algeria and Venezuela are reportedly in dialog with Azerbaijan, Kazakhstan, Mexico and Oman in order to achieve a collective cut in production between OPEC and non-OPEC producers. The key is however Russia, which is still the world’s largest crude oil producer at 10.7 million b/d. A tiny percentage cut from Russia is more worth than a large percentage cut from Oman to put it that way.

Here is a link to the full report.

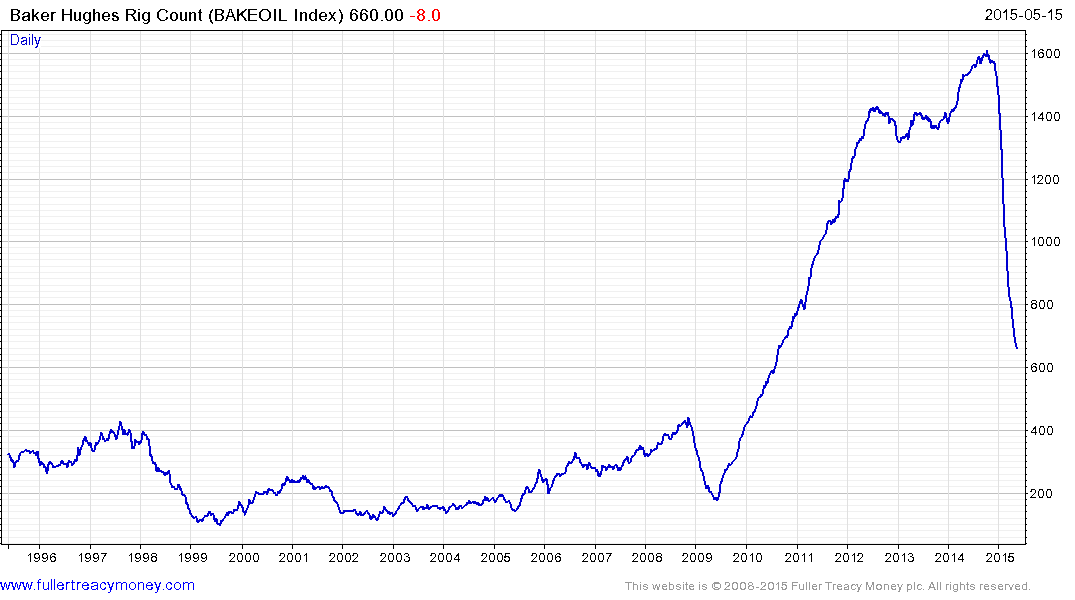

There is no sign yet that the Baker Hughes Rig Count has stopped falling despite the fact that oil prices are now trading in the region of $60; having been closer to $45 in March. As a result we don’t yet know what price will encourage fresh expenditure on drilling but we can conclude it is higher than $60. As a result it is still too early to conclude at what point the market will return to equilibrium. If the Saudi Arabians feel the same way they have no incentive to curtail supply.

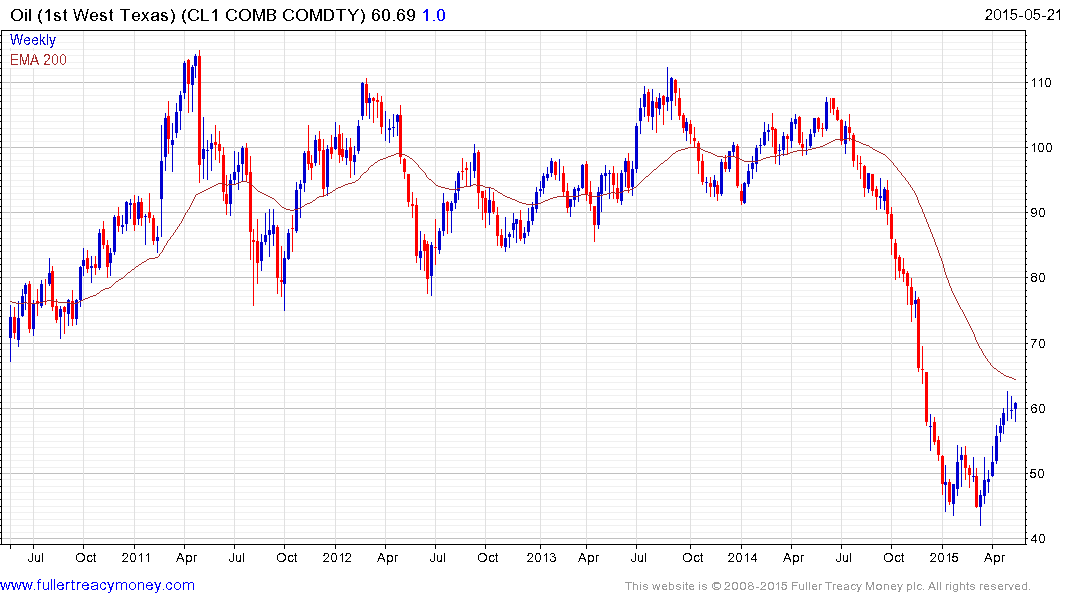

West Texas Intermediate Crude Oil has now unwound its overextension relative to the trend mean and has paused in the $60 over last three weeks. Following today’s firming within that short-term range, a sustained move below $57.25 would be required to confirm more than temporary resistance in this area.