Musings from the Oil Patch August 25th 2015

Thanks to a subscriber for this report by Allen Brooks for PPHB. Here is a section:

This analyst made a couple of other interesting observations. He said he questioned E&P management teams about their view of the level for oil prices that would generate returns similar to those earned when crude oil was at $90 a barrel and finding and development costs were much higher than today’s. In his view, the consensus was that $60-$70 a barrel is the “new $90 a barrel” oil given lower well costs and improved corporate efficiencies. He also said that producers acknowledged that returns were “skinny” with crude oil in the low $40s a barrel. We aren’t sure what “skinny” equates to, but we suspect not much profit, if any at all.

We were interested in his other observation, which dealt with how producers are coping with the current environment. He said that producers seemed to be reverting to the “1980’s playbook.” What does that mean? How about drilling within cash flow and attempting to hold production flat. What novel concepts! What someone who didn’t live through the ‘80’s and ‘90’s might not understand is that the playbook resulted from there not being cheap capital and private equity money available then. In fact, following the demise of Continental Illinois Bank in Chicago and Penn Square Bank in Oklahoma City, commercial banks almost outlawed energy lending in the 1980’s as it was considered too speculative, so there was virtually no new capital available. Today, we live in a world driven by easy money policies globally, meaning zero interest rates, which contributed to the high oil prices of 2009-2014 and the surge in capital flowing into private equity funds. A recent quote from economist and money manager Gary Shilling highlights this phenomenon and its damage to the energy industry. He said:“The oil optimists noted that earlier high oil prices, aided by low financing costs, had pushed up production, especially among U.S. frackers. Low prices, they reasoned, would curb production, especially since fracked wells tend to be short-lived and the cost of drilling new ones exceeded the depressed prices. But a funny thing happened on the way to $80 oil: The rally stopped dead in its tracks at about $60 in May and June, then slid to the current $42, a new low. “Me? I'm sticking with my forecast of $10 to $20 a barrel.”

Here is a link to the full report.

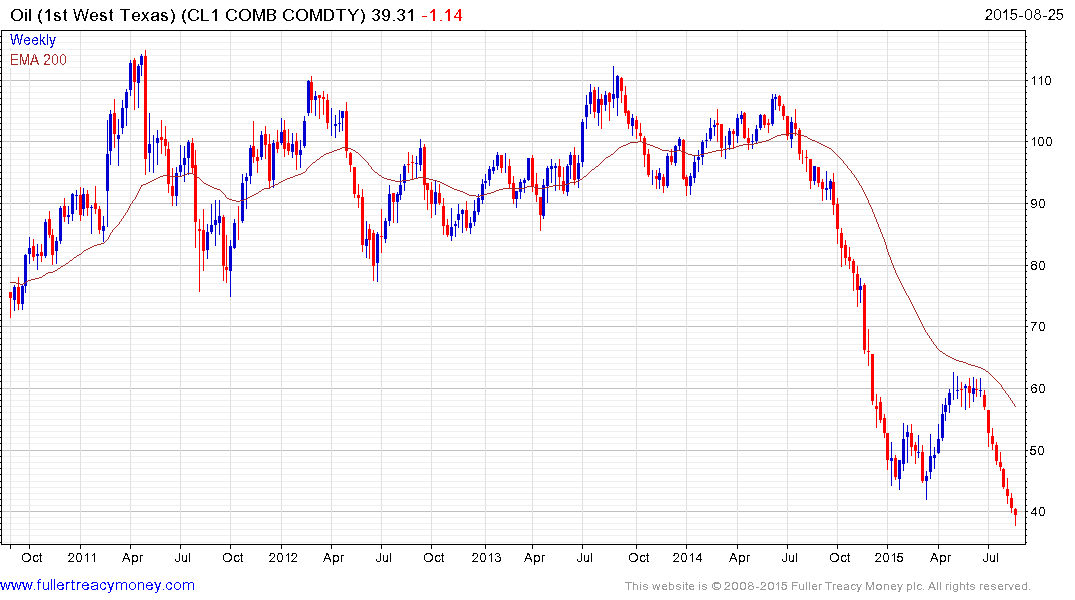

This Service is not bullish of oil prices over the medium-term and we have been vocally proclaiming how much of gamechanger shale oil and gas are for years. However $10 - $20 is an aggressive forecast even in an environment where major producers such as Saudi Arabia and Iran are competing for market share and prices are working on a ninth consecutive week to the downside.

If OPEC could be considered the core of global oil supply, it is reasonable to conclude that US domestic onshore production is the new marginal source of supply. It’s resilience to lower prices, not least due to low interest rates and technological innovation has contributed to the weak price environment.

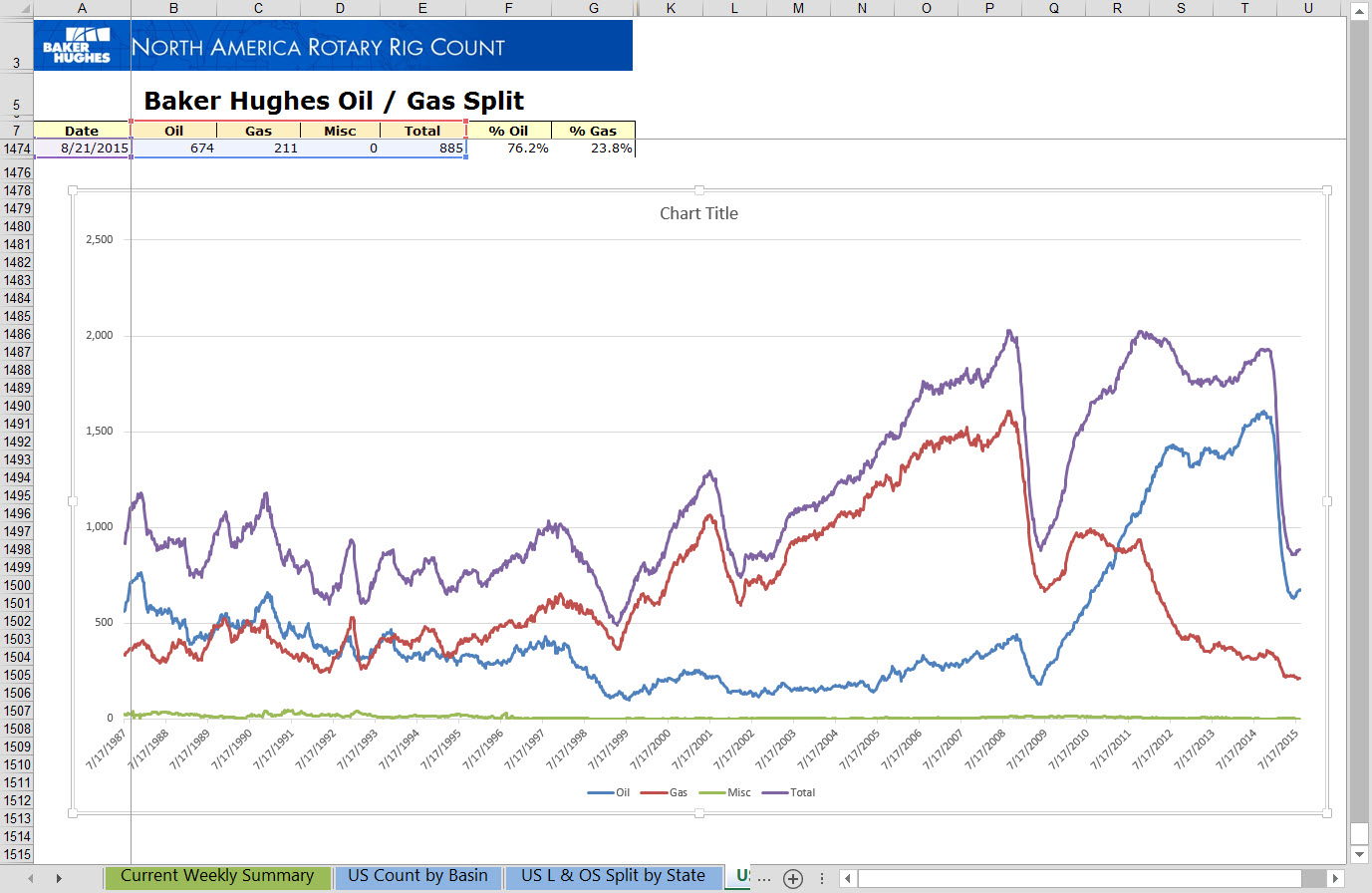

This chart compiled by a subscriber and forwarded in the interests of Empowerment Through Knowledge highlights how the US rig count has found at least near-term support despite the fact oil prices are retesting their lows. Even with this resilience some producers will be under pressure not least as hedges expire and are replaced with contracts at considerably lower prices. We do not yet have evidence of mass consolidation within the sector and it will be hard for prices to sustain a meaningful low until that occurs.

Short-term a deep oversold condition relative the trend mean is evident and the first clear upward dynamic, sustained for more than a session or two, is likely to mark a low of at least near-term significance.